ConnectedGRC

Drive a Connected GRC Program for Improved Agility, Performance, and Resilience

-

BusinessGRC

Power Business Performance and Resilience

Discover ConnectedGRC Solutions for Enterprise and Operational Resilience

Explore What Makes MetricStream the Right Choice for Our Customers

Discover How Our Collaborative Partnerships Drive Innovation and Success

- Want to become a Partner?

Find Everything You Need to Build Your GRC Journey and Thrive on Risk

Learn about our mission, vision, and core values

Proactive Risk Management - The Key to Business Excellence

Overview

To achieve effective enterprise risk management, organizations must focus on being proactive, rather than merely reactive, and use risk management to both drive competitive advantage and sustain future profitability and growth.

Organizations today are forced to deal with multiple internal and external challenges. Stricter regulations, compliance requirements, and cut-throat competition have only put more pressure on the organizations leaving them with very less space for profit. This brings to the fore a high level of uncertainty, adding to the organization's risk exposure. Organizations need to relook at their approaches and perspectives to be able to manage unavoidable risks in a controlled and effective manner as well as make faster and better business decisions. To achieve this, organizations must focus on being proactive with an ability to look at what the risks of the near future are, rather than being merely reactive. Risk management if implemented effectively can help drive competitive advantage as well as ensure sustainability and growth.

What is Proactive Risk Management?

Proactive risk management is a forward-thinking approach that identifies and anticipates potential risks before they happen and figures out ways to control or eliminate them before they occur. This approach leads to improved resilience and better decision-making.

Proactive risk management improves an organization’s ability to avoid or manage both existing and emerging risks and helps adapt quickly to unwanted events or crisis. It helps build an understanding required to measure and manage emerging risks which give organizations a better view of tomorrow’s risk and how it impacts their business.

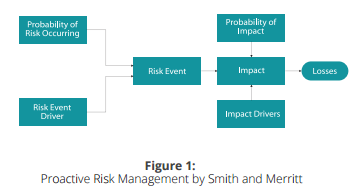

What differentiates proactive risk management approach from a reactive approach is the way risks are assessed, reported and mitigated. It involves carefully analyzing a situation or assessing processes to determine the potential risks, identifying drivers of risks to understand the root cause, assessing probability and impact to prioritize risks and accordingly preparing a contingency plan. To do so, risk managers need to learn to assess the strength of the innovation component of the organization and use that information effectively to combat known and emerging risks. Also, focus on using the expertise of experienced risk managers to engage in strategic risk utilization.

Implementing Proactive Risk Management

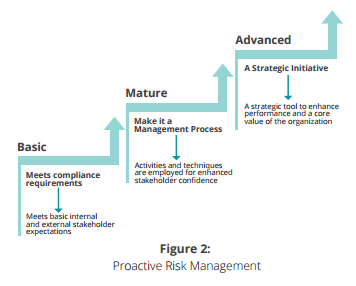

Proactive Risk Management is not a process or an initiative but a discipline that an organization has to practice and make an integral part of the overall business strategy. It cannot be defined in a day and cannot be performed in isolation. It is a continuous process until it becomes an integral part of organization’s risk culture.

Developing and implementing a preventive risk identification and management program helps businesses limit exposure, save costs, and enhance value for stakeholders. However, there are challenges that need to be managed before seeing the results of such approach, for example, lack of clear understanding about the spectrum of risks and consequences, lack of relevant tools and techniques, availability of data in silos, limited resources, and absence of tone-at-the-top.

Delivering effective and proactive Risk Management needs an organization to have more clarity about the breadth of risks facing the business and understand the potential threats and opportunities in alignment with the overall business strategy in order to plan appropriate mitigation action. Also, ensuring proper communication between all stakeholders across functions and harnessing the benefits of technology are crucial elements to create greater business value.

Leveraging Technology to Build a Strong Risk Management Program

Technology plays an intrinsic role in building an effective and proactive risk management and governance approaches at an enterprise level. Many organizations leverage software solutions to minimize risk inconsistencies and silos and to establish a single risk taxonomy and culture across the organization, enabling better understanding with clear roles and responsibilities. While others use sophisticated reporting tools and analytics to manage and transform risk data into valuable business intelligence, which enables risk managers to spend more time on deeper analysis of data turning them to meaningful insights rather than just collecting and managing it. This, in turn, enables organizations to take informed business decisions proactively and act quickly to avoid or control unexpected losses.

Conclusion

For many organizations, risk management is rapidly developing into a more forward-looking, enterprise-wide approach in order to avoid unexpected events and expenses down the line. Companies are making deliberate efforts to improve their risk management programs to meet both business and regulatory demands and to create greater business value as well as ensure sustainability. Having the right tools and capabilities to prepare and respond appropriately to emerging, unforeseen risks too has become crucial.

Subscribe for Latest Updates

Subscribe Now