INTRODUCTION

Risks are inherent to every business. Every transaction and every decision made by an organization can be exposed to risks, and in turn, might generate more risks. The key to sustained business performance and success is to rigorously monitor and efficiently manage these risks. This applies, in particular, to the energy and utilities industry, which functions in a highly volatile and price-sensitive global market.

The broad risk areas that energy and utilities organizations are exposed to include cyber risks, stringent compliance and regulatory requirements, like Federal Energy Regulatory Commission (FERC) and North American Electric Reliability Corporation (NERC) regulations, Sarbanes-Oxley Act (SOX), etc., operational risk, market risk, credit risk, environment and sustainability, business continuity risk, extended supplier networks, and operations, among others. In the KPMG’s 2022 Energy CEO Outlook survey, energy CEOs identified regulatory risk and emerging/disruptive technology as two of the top threats to their organizations over the next three years.

Organizations in this sector, which have long-term investment horizons, require a risk-intelligent approach to tackle the complexities of performing real-time risk measurement and mitigation. Enterprise Risk Management (ERM) holds the answer to pressing questions on identifying, evaluating, and mitigating a multitude of risks faced by energy and utilities organizations.

In this eBook, we will delve into the key considerations for an effective ERM program for the energy and utilities industry, the pivotal role played by technology, risk methodology, and more. By the end of this eBook, you will have a good understanding of how you can enhance your ERM program to make it future-ready and forward-looking.

The Enterprise Risk Management Process

ERM is a comprehensive process that enables an organization to efficiently manage the impact of risks on its total return, so that it can achieve its stated business goals and objectives without any major disruptions. An effective ERM program, driven by technology and a farsighted strategy, with a heightened emphasis on the evolving market conditions, can enable energy and utilities organizations to be better prepared for the future. It helps them effortlessly enhance their operational efficiencies and navigate the changing dynamics of investments, competition, regulations, and compliance.

What is ideal is a centralized risk management program that provides contextual risk information for better-informed decision-making. The ERM process comprises certain critical tasks:

Understanding Organizational Goals and Objectives

Energy companies follow varying approaches to ERM, depending upon their scale of operations, existing energy reserves, and the revenue margins they decide to maintain. While companies with more energy reserves might strive to function on a greater scale, look for bigger profit margins, and are ready to take on more risks, other energy plants facing over-exploitation of their energy reserves might want to secure their future and handle less risks, rather than generate revenue margins. A few might also be worried about their fragile energy infrastructure operating under extreme conditions. Hence, it’s important that organizations define and map their risk appetite to their key business objectives and monitor risk exposure against preset thresholds on a regular basis.

Identifying Relevant Risks

Organizations need to identify the various types of risks that they are exposed to, such as market risks, operational risks, counterparty risks, and legal risks. The process involves studying specific elements in the energy value chain, identifying the existing patterns of supply and demand, and evaluating the acceptable levels of risk. A core element here is data mapping which allows organizations to integrate available risk data and establish the appropriate relationships to calculate and measure risk.

One common approach to managing risks in energy and utilities companies is to identify the broad risk areas under various functional units such as production, transportation and storage, refining and processing, and distribution, for various energy commodities including crude oil, refined products, Liquefied Natural Gas (LNG), Liquefied Petroleum Gas (LPG), and electricity. Mapping these to organizational assets, policies, controls, etc. helps to gain contextual risk information.Prioritizing Risks to be Managed

The right techniques and models for risk assessment and evaluation must be given the highest priority. Ideally, an organization would prefer to address and mitigate all the risks it is exposed to. However, with limited resources at disposal, the best approach is to prioritize the risks based on criticality. A combination of both qualitative and quantitative risk assessments can be applied to determine the critical risks that need immediate attention. Effectively prioritizing risks into say, critical, high, medium, and low, categories, or by quantified risk exposure, and contextualizing them with respect to critical assets can help risk teams save time, effort, and resources that would have been otherwise spent in addressing insignificant risks.

Establishing and Documenting Controls

It is mandatory to have adequate and effective controls in place to reduce the exposure to risks or minimize the effect of a risk event. These internal controls are set up in line with the organizational policies, which in turn are guided by relevant laws and regulations, and industry standards. Organizations need to establish and document these controls and continuously monitor and test the control environment for their design as well as operative effectiveness to ensure that there are no weaknesses, gaps, or blind spots. This will enable managers to understand the actual risk exposure and determine ways to address it.

Effectively Managing and Remediating Issues

Organizations need to have well-defined processes in place for the identification, reporting, documentation, and remediation of any issues that are identified in the risk management process. This includes establishing a systematic mechanism to ensure that appropriate personnel are notified in a timely manner to begin investigation and root cause analysis, report findings, and take remedial action. There are various tools available in the market today that enable users to track the status of issues as they automatically move from one stage to the next, providing real-time visibility and improving transparency for all stakeholders.

Risk Methodology

In order to execute their risk strategy, energy and utilities organizations must adopt a sound risk methodology, with the necessary flexibility to enable them to generate more profits. The critical tasks in a well-thought-out risk methodology are as follows:

- Core Strategy: A strategic risk plan must be developed based on important elements such as a dynamic environment to leverage energy assets, the scope of asset control, the physical commodity presence, as well as a focus on market trends. This core strategy must be used as the cornerstone to derive the organizational risk tolerance limits, metric thresholds, risk treatment plan, risk and control assessment frequency, and the capital allocation for recovery in case of an event.

- Risk Components:The various financial, operational, market, and environmental risk components in each operations unit in the energy value chain needs to be clearly identified.

- Risk Measurement: Standard techniques of risk measurement, such as qualitative and quantitative risk assessments based on configurable methodologies, to assess risk exposure against organizational risk appetite and risk strategy

The above three steps will help in identifying critical business functions, processes, systems, and related risks. Following this, the organization has to finalize the policies, the systems and procedures, the valuation methods, the performance measurement criteria, and the capital allocation, for risk management. All these revolve around the key concept of establishing a corporate risk tolerance for the risk appetite as well as market conditions.

Risk Management Governance

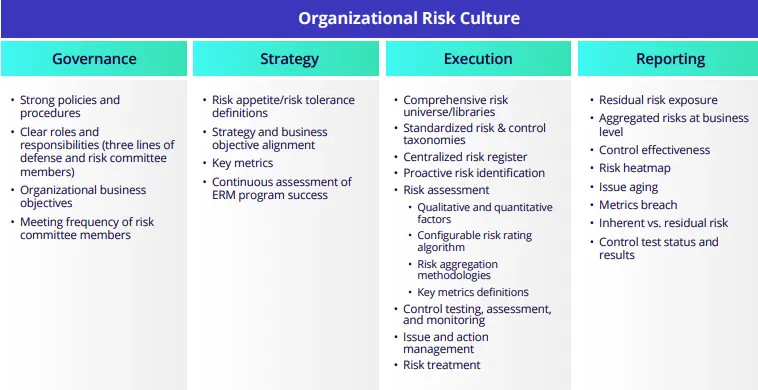

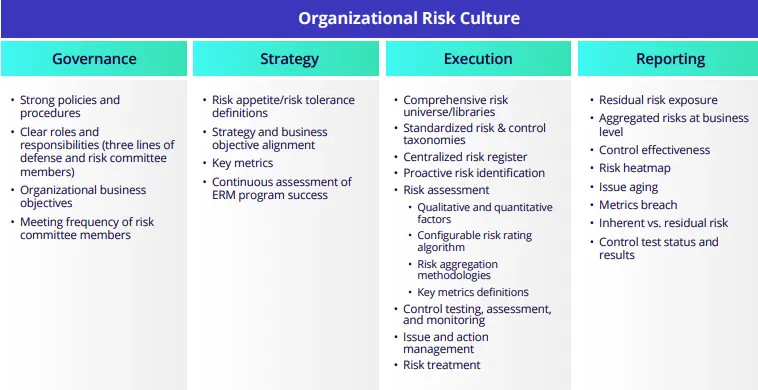

A fine combination of top-down and bottom-up approaches best suits an organization’s risk management governance. The Board of Directors and the audit committee occupy the top position in the governance structure and play a primary role in charting an organization’s risk management plans that is led and managed by the Chief Risk Officer.

An ideal risk management structure in an energy organization is one in which the business management, comprising the heads of various business units, identifies the critical risks, and provides a comprehensive risk inventory. They also set broad risk metrics to monitor continuous business performance.

The senior management provides the overall strategic leadership and guidance on risks and determines the risk policies and processes that control the decision-making throughout the organization.

This structure helps to develop a robust risk management culture across the organization.

Enhance ERM by Leveraging Technology

An enterprise-wide and technology-driven risk management program can steer an organization in the direction of sustained progress. By replacing obsolete manual systems and automating repeatable tasks, technology-based ERM solutions can enable energy and utilities companies to eliminate organizational silos and improve efficiencies.

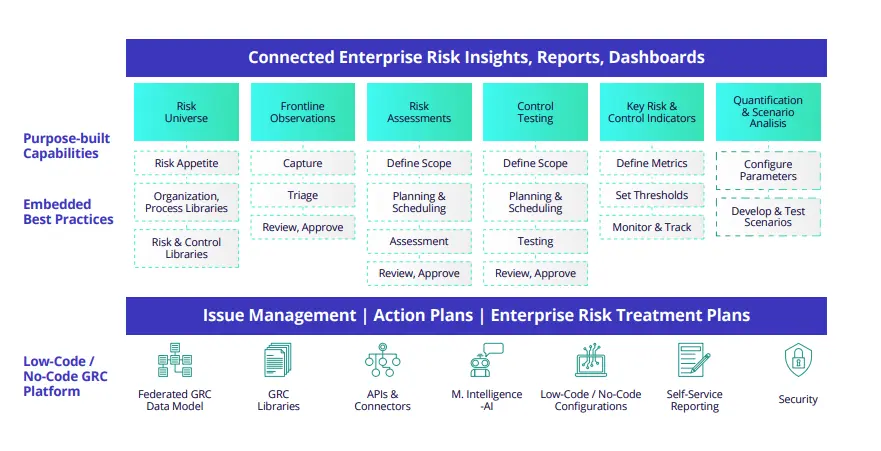

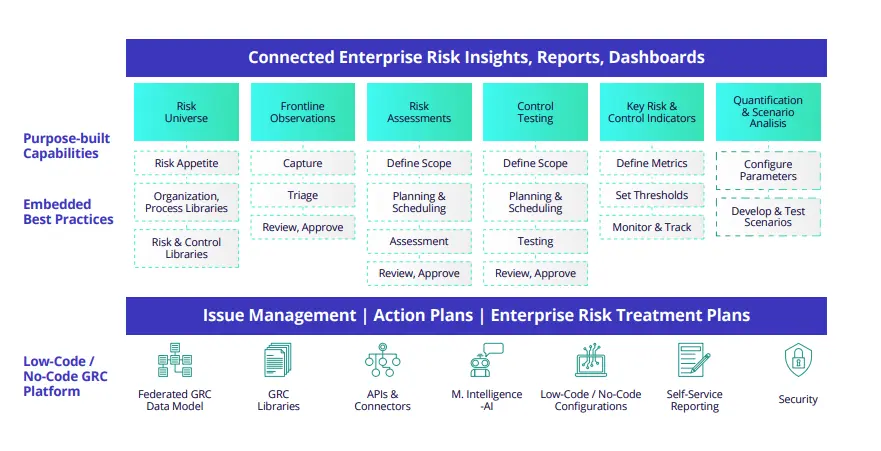

MetricStream Enterprise Risk Management is a single, integrated software that helps organizations simplify and streamline the risk management process and drive risk-aware business decisions. With a federated data model at its core – comprising of standard libraries of risks, controls, processes, and policies – the software helps overcome data silos and provides risk information in the business context. Uniform risk assessment methodologies and standards enable you to accurately understand risk exposure while multi-dimensional risk and control assessments based on qualitative and quantitative parameters help establish the organizational risk profile.

Once the risks are identified, risk assessment and aggregation help in weighing and prioritizing the risks and determining the right risk response. Interactive dashboards, heatmaps – which are effective visualizations with advanced user interactivity, along with flexible reports, provide detailed statistics and exhaustive risk data.

With MetricStream Enterprise Risk Management, you can:

- Gain 360-degree visibility into top organizational risks and prioritize risk response strategy

- Improve agility and risk-based decision-making with predictive risk metrics and indicators to better anticipate and quickly respond to adverse risk events

- Enhance confidence with regulators and the board by establishing a strong risk data governance and reporting framework with clear lines of accountability

Summary

Energy and utilities organizations need to focus on the future for continued financial and operational success. This is possible only when their potential risks and uncertainties are efficiently addressed. Even as they look to responsibly manage the existing oil and gas reserves, these organizations also face immense pressure to scout for alternative and cleaner sources of energy. What this means is increased changes and newer risks powered by an effective strategy and integrated technology.

To learn more about MetricStream Enterprise Risk Management, request a personalized demo today! Click here.

Risks are inherent to every business. Every transaction and every decision made by an organization can be exposed to risks, and in turn, might generate more risks. The key to sustained business performance and success is to rigorously monitor and efficiently manage these risks. This applies, in particular, to the energy and utilities industry, which functions in a highly volatile and price-sensitive global market.

The broad risk areas that energy and utilities organizations are exposed to include cyber risks, stringent compliance and regulatory requirements, like Federal Energy Regulatory Commission (FERC) and North American Electric Reliability Corporation (NERC) regulations, Sarbanes-Oxley Act (SOX), etc., operational risk, market risk, credit risk, environment and sustainability, business continuity risk, extended supplier networks, and operations, among others. In the KPMG’s 2022 Energy CEO Outlook survey, energy CEOs identified regulatory risk and emerging/disruptive technology as two of the top threats to their organizations over the next three years.

Organizations in this sector, which have long-term investment horizons, require a risk-intelligent approach to tackle the complexities of performing real-time risk measurement and mitigation. Enterprise Risk Management (ERM) holds the answer to pressing questions on identifying, evaluating, and mitigating a multitude of risks faced by energy and utilities organizations.

In this eBook, we will delve into the key considerations for an effective ERM program for the energy and utilities industry, the pivotal role played by technology, risk methodology, and more. By the end of this eBook, you will have a good understanding of how you can enhance your ERM program to make it future-ready and forward-looking.

ERM is a comprehensive process that enables an organization to efficiently manage the impact of risks on its total return, so that it can achieve its stated business goals and objectives without any major disruptions. An effective ERM program, driven by technology and a farsighted strategy, with a heightened emphasis on the evolving market conditions, can enable energy and utilities organizations to be better prepared for the future. It helps them effortlessly enhance their operational efficiencies and navigate the changing dynamics of investments, competition, regulations, and compliance.

What is ideal is a centralized risk management program that provides contextual risk information for better-informed decision-making. The ERM process comprises certain critical tasks:

Understanding Organizational Goals and Objectives

Energy companies follow varying approaches to ERM, depending upon their scale of operations, existing energy reserves, and the revenue margins they decide to maintain. While companies with more energy reserves might strive to function on a greater scale, look for bigger profit margins, and are ready to take on more risks, other energy plants facing over-exploitation of their energy reserves might want to secure their future and handle less risks, rather than generate revenue margins. A few might also be worried about their fragile energy infrastructure operating under extreme conditions. Hence, it’s important that organizations define and map their risk appetite to their key business objectives and monitor risk exposure against preset thresholds on a regular basis.

Identifying Relevant Risks

Organizations need to identify the various types of risks that they are exposed to, such as market risks, operational risks, counterparty risks, and legal risks. The process involves studying specific elements in the energy value chain, identifying the existing patterns of supply and demand, and evaluating the acceptable levels of risk. A core element here is data mapping which allows organizations to integrate available risk data and establish the appropriate relationships to calculate and measure risk.

One common approach to managing risks in energy and utilities companies is to identify the broad risk areas under various functional units such as production, transportation and storage, refining and processing, and distribution, for various energy commodities including crude oil, refined products, Liquefied Natural Gas (LNG), Liquefied Petroleum Gas (LPG), and electricity. Mapping these to organizational assets, policies, controls, etc. helps to gain contextual risk information.Prioritizing Risks to be Managed

The right techniques and models for risk assessment and evaluation must be given the highest priority. Ideally, an organization would prefer to address and mitigate all the risks it is exposed to. However, with limited resources at disposal, the best approach is to prioritize the risks based on criticality. A combination of both qualitative and quantitative risk assessments can be applied to determine the critical risks that need immediate attention. Effectively prioritizing risks into say, critical, high, medium, and low, categories, or by quantified risk exposure, and contextualizing them with respect to critical assets can help risk teams save time, effort, and resources that would have been otherwise spent in addressing insignificant risks.

Establishing and Documenting Controls

It is mandatory to have adequate and effective controls in place to reduce the exposure to risks or minimize the effect of a risk event. These internal controls are set up in line with the organizational policies, which in turn are guided by relevant laws and regulations, and industry standards. Organizations need to establish and document these controls and continuously monitor and test the control environment for their design as well as operative effectiveness to ensure that there are no weaknesses, gaps, or blind spots. This will enable managers to understand the actual risk exposure and determine ways to address it.

Effectively Managing and Remediating Issues

Organizations need to have well-defined processes in place for the identification, reporting, documentation, and remediation of any issues that are identified in the risk management process. This includes establishing a systematic mechanism to ensure that appropriate personnel are notified in a timely manner to begin investigation and root cause analysis, report findings, and take remedial action. There are various tools available in the market today that enable users to track the status of issues as they automatically move from one stage to the next, providing real-time visibility and improving transparency for all stakeholders.

In order to execute their risk strategy, energy and utilities organizations must adopt a sound risk methodology, with the necessary flexibility to enable them to generate more profits. The critical tasks in a well-thought-out risk methodology are as follows:

- Core Strategy: A strategic risk plan must be developed based on important elements such as a dynamic environment to leverage energy assets, the scope of asset control, the physical commodity presence, as well as a focus on market trends. This core strategy must be used as the cornerstone to derive the organizational risk tolerance limits, metric thresholds, risk treatment plan, risk and control assessment frequency, and the capital allocation for recovery in case of an event.

- Risk Components:The various financial, operational, market, and environmental risk components in each operations unit in the energy value chain needs to be clearly identified.

- Risk Measurement: Standard techniques of risk measurement, such as qualitative and quantitative risk assessments based on configurable methodologies, to assess risk exposure against organizational risk appetite and risk strategy

The above three steps will help in identifying critical business functions, processes, systems, and related risks. Following this, the organization has to finalize the policies, the systems and procedures, the valuation methods, the performance measurement criteria, and the capital allocation, for risk management. All these revolve around the key concept of establishing a corporate risk tolerance for the risk appetite as well as market conditions.

A fine combination of top-down and bottom-up approaches best suits an organization’s risk management governance. The Board of Directors and the audit committee occupy the top position in the governance structure and play a primary role in charting an organization’s risk management plans that is led and managed by the Chief Risk Officer.

An ideal risk management structure in an energy organization is one in which the business management, comprising the heads of various business units, identifies the critical risks, and provides a comprehensive risk inventory. They also set broad risk metrics to monitor continuous business performance.

The senior management provides the overall strategic leadership and guidance on risks and determines the risk policies and processes that control the decision-making throughout the organization.

This structure helps to develop a robust risk management culture across the organization.

An enterprise-wide and technology-driven risk management program can steer an organization in the direction of sustained progress. By replacing obsolete manual systems and automating repeatable tasks, technology-based ERM solutions can enable energy and utilities companies to eliminate organizational silos and improve efficiencies.

MetricStream Enterprise Risk Management is a single, integrated software that helps organizations simplify and streamline the risk management process and drive risk-aware business decisions. With a federated data model at its core – comprising of standard libraries of risks, controls, processes, and policies – the software helps overcome data silos and provides risk information in the business context. Uniform risk assessment methodologies and standards enable you to accurately understand risk exposure while multi-dimensional risk and control assessments based on qualitative and quantitative parameters help establish the organizational risk profile.

Once the risks are identified, risk assessment and aggregation help in weighing and prioritizing the risks and determining the right risk response. Interactive dashboards, heatmaps – which are effective visualizations with advanced user interactivity, along with flexible reports, provide detailed statistics and exhaustive risk data.

With MetricStream Enterprise Risk Management, you can:

- Gain 360-degree visibility into top organizational risks and prioritize risk response strategy

- Improve agility and risk-based decision-making with predictive risk metrics and indicators to better anticipate and quickly respond to adverse risk events

- Enhance confidence with regulators and the board by establishing a strong risk data governance and reporting framework with clear lines of accountability

Energy and utilities organizations need to focus on the future for continued financial and operational success. This is possible only when their potential risks and uncertainties are efficiently addressed. Even as they look to responsibly manage the existing oil and gas reserves, these organizations also face immense pressure to scout for alternative and cleaner sources of energy. What this means is increased changes and newer risks powered by an effective strategy and integrated technology.

To learn more about MetricStream Enterprise Risk Management, request a personalized demo today! Click here.