ConnectedGRC

Drive a Connected GRC Program for Improved Agility, Performance, and Resilience

-

BusinessGRC

Power Business Performance and Resilience

Discover ConnectedGRC Solutions for Enterprise and Operational Resilience

Explore What Makes MetricStream the Right Choice for Our Customers

Discover How Our Collaborative Partnerships Drive Innovation and Success

- Want to become a Partner?

Find Everything You Need to Build Your GRC Journey and Thrive on Risk

Learn about our mission, vision, and core values

Integrated GRC: The Key to Better Risk Awareness and Better Performance

Overview

The concept of Governance, Risk, and Compliance (GRC) isn’t new. However, the process of implementing GRC in an integrated and federated manner, aligned with business processes and strategic objectives, is something that many organizations continue to struggle with. Integrated GRC demands that a number of roles - including audit, risk management, and compliance - work together to share information, data, assessments, metrics, risks, and losses.

GRC as a discipline is aimed at collaboration and synchronization of information and activities. If implemented effectively, it enables stakeholders to predict risks with greater accuracy, and capitalize on the opportunities that truly matter. However, more often than not, GRC initiatives are fragmented and addressed in an ad hoc manner by different departments working within their limited spheres. This approach prevents senior management from acquiring a clear and expansive view of the risks faced by the organization, along with the measures implemented to deal with those risks.

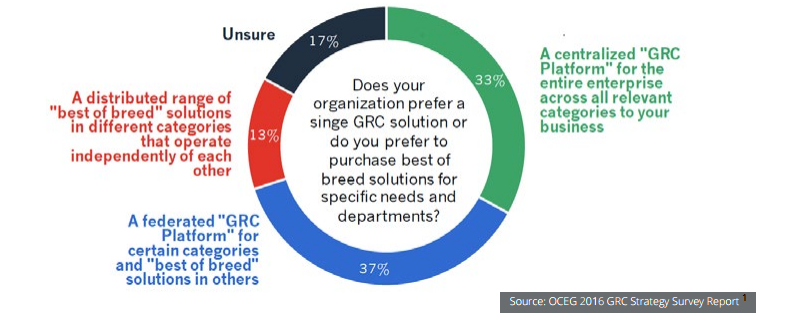

The ideal state is a federated approach to GRC wherein audit, risk, and compliance management activities are integrated, while simultaneously, a centralized view of risk is provided to the executive leadership team to help them understand enterprise-wide risks more clearly. By adopting a federated GRC program, process owners at the business unit level can independently assess and manage their own risks and compliance requirements; at the same time, key risk and compliance metrics can be rolled up to the top of the organization for reporting and analysis.

Why GRC Convergence?

Risk and compliance information in the right format, at the right time, and in the right hands is key to organizational success. It supports quick and informed decision-making which, in turn, can save an organization from financial and reputational loss, data breaches, compliance violations, and more. Stakeholders need to always be cognizant of issues such as ineffective controls, unmitigated risks, and policy conflicts. The path to achieving this objective lies in GRC convergence.

Some of the benefits of GRC convergence include:

- Continuous collaboration across assurance functions which, in turn, helps create a holistic picture of risk

- A “single version of the truth” that is provided to employees, management, auditors and regulatory bodies

- Accuracy of risk and control information that enables stakeholders to make fast, risk-informed business decisions

- Effective compliance programs to address constant changes in regulations, technology, and the business

- Consistency in GRC measures; comprehensive insights into the internal operating environment

- Ability to respond proactively to risks by breaking down restrictive functional, business, and organizational silos

- A unified operating model for the business with the agility needed to manage emerging risks

- Lower cost of assurance.

The World is Moving towards Integrated GRC

70% of organizations state that they have a strategy going forward for GRC integration and collaboration

Practical Steps to Strengthen GRC Convergence or Integration

How do we enable collaboration on GRC across business functions, and instill an effective risk assessment and mitigation discipline? In fact, the question most often asked by organizations is, “How do we simplify GRC, and inculcate a risk-aware culture”? The key is to start small. Implement a phased GRC journey plan with clearly defined roles and priorities for each stage, ensuring that everybody understands what is required. Remember that the three components of governance, risk, and compliance are connected, but at the same time, they are separate disciplines that require their own strategies, steps, and procedures. That level of flexibility must be built into the GRC program while also ensuring that certain elements such as the risk language are consistent across all three disciplines.

When establishing an integrated GRC program, focus first on the foundational elements such as defining and aligning policies, establishing common risk and control taxonomies, consolidating GRC data in a central repository, defining the scope and role of each group in GRC, and establishing points of integration between them. The design of this GRC foundation or framework is critical to driving successful results.

One of the biggest obstacles in cultivating a risk-aware culture is inadequate governance. If the organization does not establish a sound vision and tone at the top, then they cannot expect a culture committed to risk management down the chain. Additionally, a lack of governance and/or leadership in an organization can create difficulty in terms of cross-functional collaboration. It can also result in inadequate allocation of resources for GRC, or even conflicts of interest between assurance functions. The senior management and board of directors must assume the ultimate responsibility for ensuring the efficiency and effectiveness of GRC processes. Another best practice is to develop a set of Key Performance Indicators (KPIs) to measure the effectiveness of GRC activities. The way to do that is to assess the organization needs, culture, and requirements and determine the parameters that make GRC departments effective and successful.

Also, ensure that the data produced in one department can be reused in another one, to maintain consistency.

Many organizations are striving to standardize their GRC processes. This allows them to quickly identify risks and expedite mitigation actions, while also improving GRC efficiency, and minimizing unnecessary costs.

One of the best ways to optimize GRC is to use technology. There are, for instance, tools to automate and streamline audit, risk, and compliance management processes. There are also systems to help import, aggregate, and process GRC information from various sources such as social media, cloud security applications, and transaction systems. This data can then be quickly routed for reporting and visualization.

A comprehensive GRC solution can provide the ability to map GRC data in such a way that users immediately understand the relationships and interactions between various risks, regulations, policies, controls, strategic objectives, and other elements. Such a solution can enable users to harmoniously manage risk, compliance, and audit areas by breaking down restrictive silos, and facilitating robust information sharing and decision making.

GRC Integration: An Intelligent Investment

In the current business environment, where executives are under immense pressure to demonstrate high performance, a strong and integrated GRC program can make all the difference. The market rewards risk takers, but in order to play the high stakes game, the right risk identification and management processes need to be in place. In fact, the cost of not establishing a formidable GRC infrastructure is much higher than the cost of investing in one.

The choice is up to each company to decide whether they want to live with the threat of punitive and legal damages that could go beyond financial stress, or build a preventive mechanism that helps them stay in control, and balance risks and opportunities effectively. In recent years, there has been a perceptible shift toward a cohesive and technology aided approach to enterprise-wide GRC. More risk professionals using this approach are realizing incremental ROI while saving on efforts and resources. A harmonious integration of GRC has proved to be transformational. Are you game?

Subscribe for Latest Updates

Subscribe Now