Banking & Financial Services Industry

Measure Your Program Outcomes

- 67%

improvement in risk reporting visibility and efficiency for the executive management and board

- 90%

reduction in the time taken to manage compliance activities

- 80%

decrease in third-party onboarding time

Enable an Integrated Approach to Governance, Risk Management, and Compliance (GRC)

The banking and financial services sector is one of the most highly regulated industries. With the growing call for operational resilience, increasing cyber breaches, stringent regulatory landscape, complex vendor ecosystem, evolving and emerging risks, and growing focus on ESG, there is a greater need for transparency and new technology to meet these demands. MetricStream's products and solutions are designed to solve banking and financial services industry-specific GRC challenges. They support categorizing and classifying business lines and loss events based on Basel standards. They will equip you to better safeguard the well-being of your clients by enabling you to manage, embrace, and ultimately thrive on risk.

How MetricStream Software Solutions Help You

Seamlessly Integrate Risk Workflows

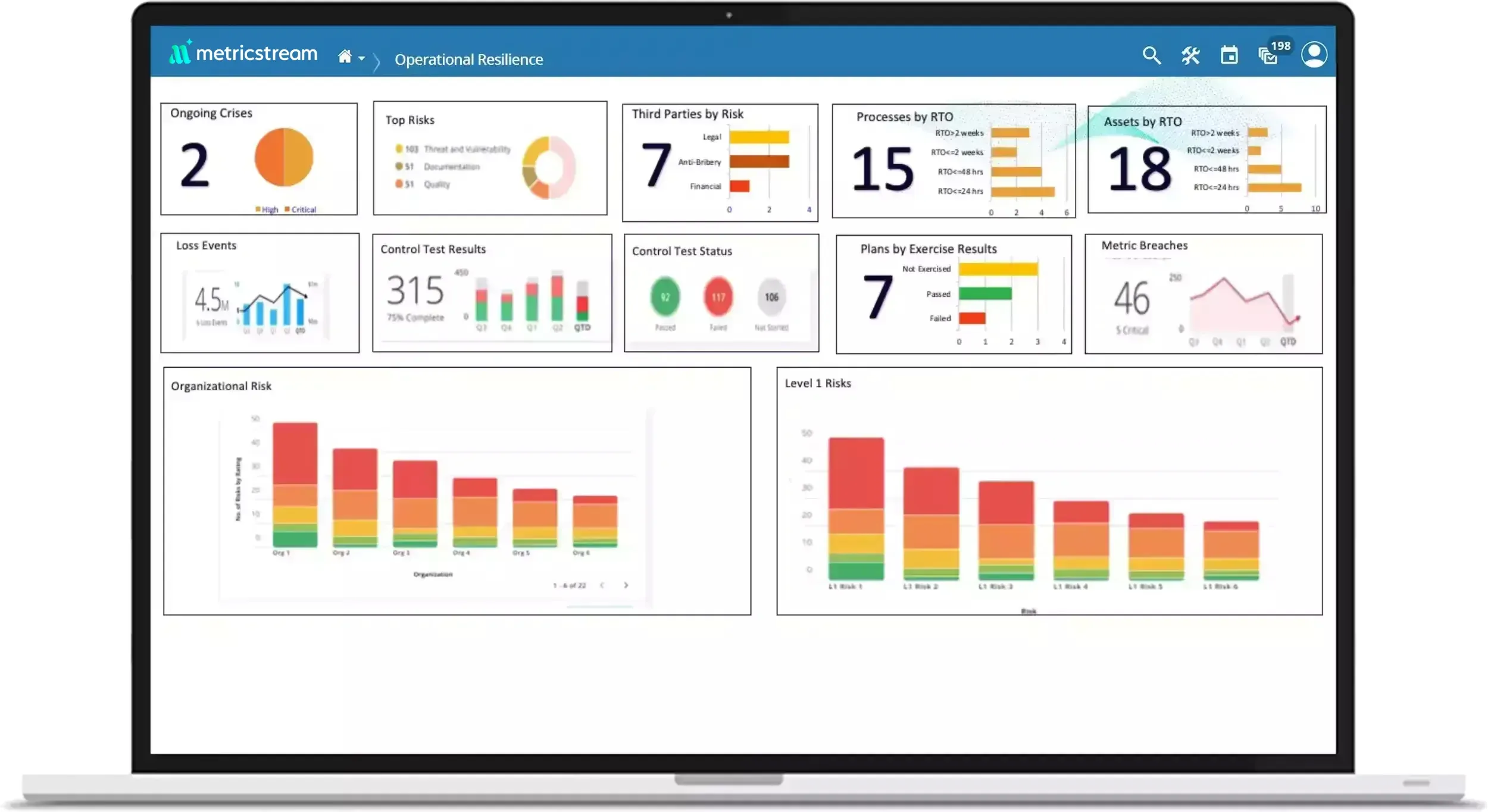

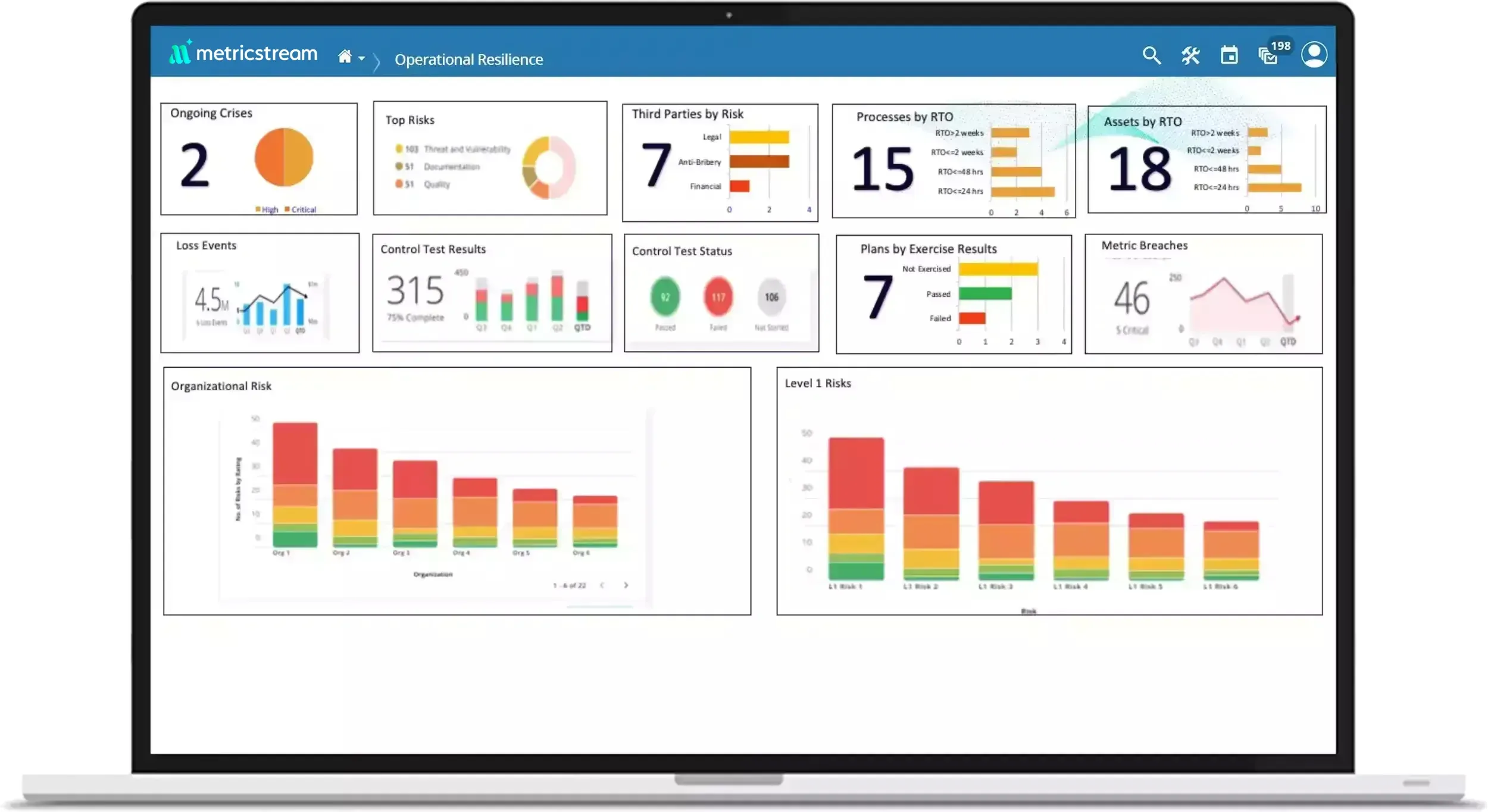

Strengthen operational resilience by providing a unified platform that integrates the workflows for effectively managing operational risk, cyber risk, compliance risk, third-party risk, and business continuity planning. Prepare for and prevent potential disruptions by easily identifying and analyzing critical operations, determining risk appetite, setting risk tolerances, performing scenario analysis and simulations, and more.

Streamline Regulatory Compliance Management Processes

Easily navigate the rapidly evolving regulatory landscape and strengthen compliance. Gain access to a wide array of international, federal, and state regulations, including those from OFAC, SEC, OCC, FINRA, FFIEC, CFPB, FRB, EBA, FCA, BOE, APRA, PRA, and others. Stay on top of regulatory changes and obligations by establishing well-defined compliance management workflows. Easily update and communicate policy changes to employees, manage case and incidents, regulatory exams, and more.

Effectively Manage Third-Party Risk

Proactively identify, manage, and mitigate the risks associated with a rapidly growing third-party ecosystem by providing an integrated, real-time view of the risks across the enterprise. With MetricStream Third-Party Risk Management, perform assessments, scoring, reporting, and risk mitigation across multiple risk domains including operational, data privacy, ethics & corporate compliance, IP, business continuity, cybersecurity, anti-bribery, and anti-corruption, financial, and others.

Gain an Enterprise-Wide View of Cyber Risk

Ensure the effectiveness of cyber security programs with enhanced visibility into the overall IT and cyber risk posture and cybersecurity investment priorities. Leverage built-in best practice frameworks and controls to get IT and cyber risk management programs up and running quickly. Easily adopt leverage industry best practices and advanced cyber risk quantification capabilities, while adhering to industry frameworks such as ISO 27001, NIST CSF, and NIST SP800-53.

Streamline Approach to Internal Audit

Centrally manage all audit projects, risks, and execute a risk-based approach to internal audit that ensures prioritization of audit tasks and resources based on risk criticality. With MetricStream Internal Audit, simplify audit planning, scheduling, and execution to improve auditor productivity and enable better collaboration across audit teams. AI capabilities and real-time access to audit data through intuitive graphical dashboards provide a comprehensive picture of audit across the business.

Implement an Integrated Approach to Risk Management

Gain deeper insights into risk and control data by identifying gaps, missing linkages, and redundancies through AI-powered data mapping. Rationalize controls with ML-driven cognitive insights that sense deficiencies and overlaps, ensuring greater efficiency and effectiveness. Automatically generate consistent and comprehensive risk and control descriptions to streamline documentation. Leverage AI-infused issue and action workflows that use semantic analytics to identify, flag, and recommend actions for issues. Access real-time audit insights with intelligent summarization and self-service reporting to drive faster, data-backed decisions. Manage internal risk events and losses in compliance with industry regulations like Basel Accords.

How MetricStream Benefits Your Business

- Strengthen operational resilience and risk preparedness across operations, compliance, cyber risk, and third parties

- Increase visibility into top organizational risks with real-time aggregated view of quantified risks and contextual information across processes and business objectives

- Agile and better-informed decision-making with real-time monitoring of compliance risks, assessment, controls, and compliance violations

- Prevent cyber attacks by identifying, managing and mitigating cyber risks across the enterprise