MetricStream Operational Risk Management software provides a comprehensive set of capabilities to establish risk management discipline. The software embodies a pervasive approach to operational risk management (ORM) and strengthens collaboration across the enterprise—from executives and risk managers to business process owners. By streamlining operational risk management, organizations can make risk-intelligent, real-time business decisions, improve business performance, and reduce losses.

Measure Your Program Outcomes

Source: Based on MetricStream customer responses and GRC Journey Business Value Calculator

-

67 %

67 %improvement in risk visibility through efficient reporting

-

80 %

80 %increase in risk and control framework related operational efficiency

-

15 X

15 Xbetter risk metrics tracking

Streamline Your Operational Risk Management Program to Power Business Performance

MetricStream Operational Risk Management software provides a comprehensive set of capabilities that help you follow robust risk management discipline. Built on the MetricStream Platform, the software enables you to adopt a pervasive approach to operational risk management (ORM) and strengthens collaboration across all business functions—from executives and risk managers to business process owners. A strong and effective ORM tool can help drive risk-intelligent, real-time business decisions to accelerate business performance, and reduce losses.

Learn More product details Download RFP product details

How Our ORM Software Helps You

Centralized Repository and Risk Framework for Smarter Risk Management

Define business objectives, processes, products, risks, and controls, and map the relationships across these data elements. Document organizational hierarchies, and link risk appetites to strategic business objectives. Record and manage operational risks and associated details such as risk description, category, hierarchy, and ownership in a centralized library and risk framework.

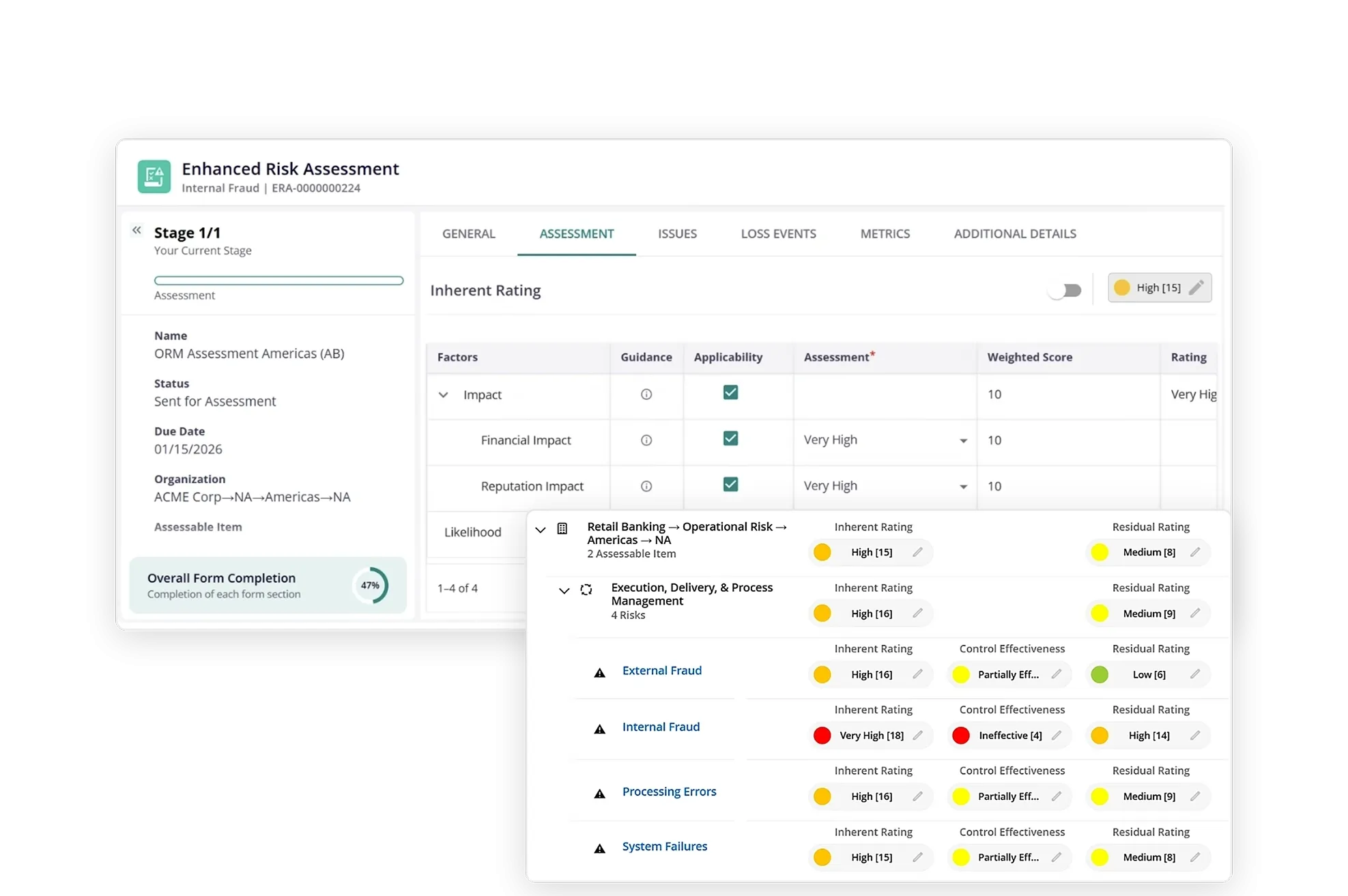

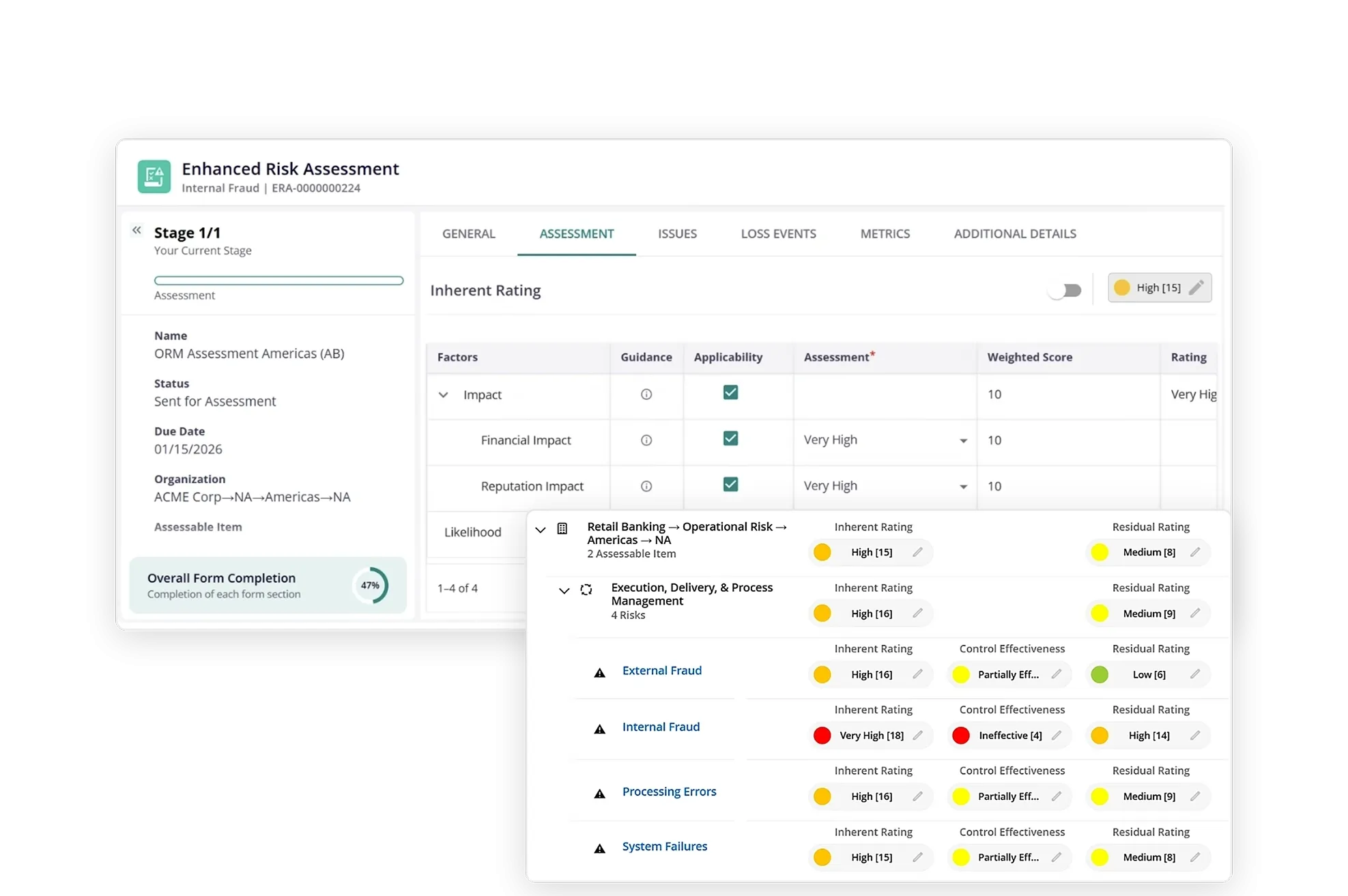

Risk Control Self-Assessment (RCSA) for Accurate Risk Visibility

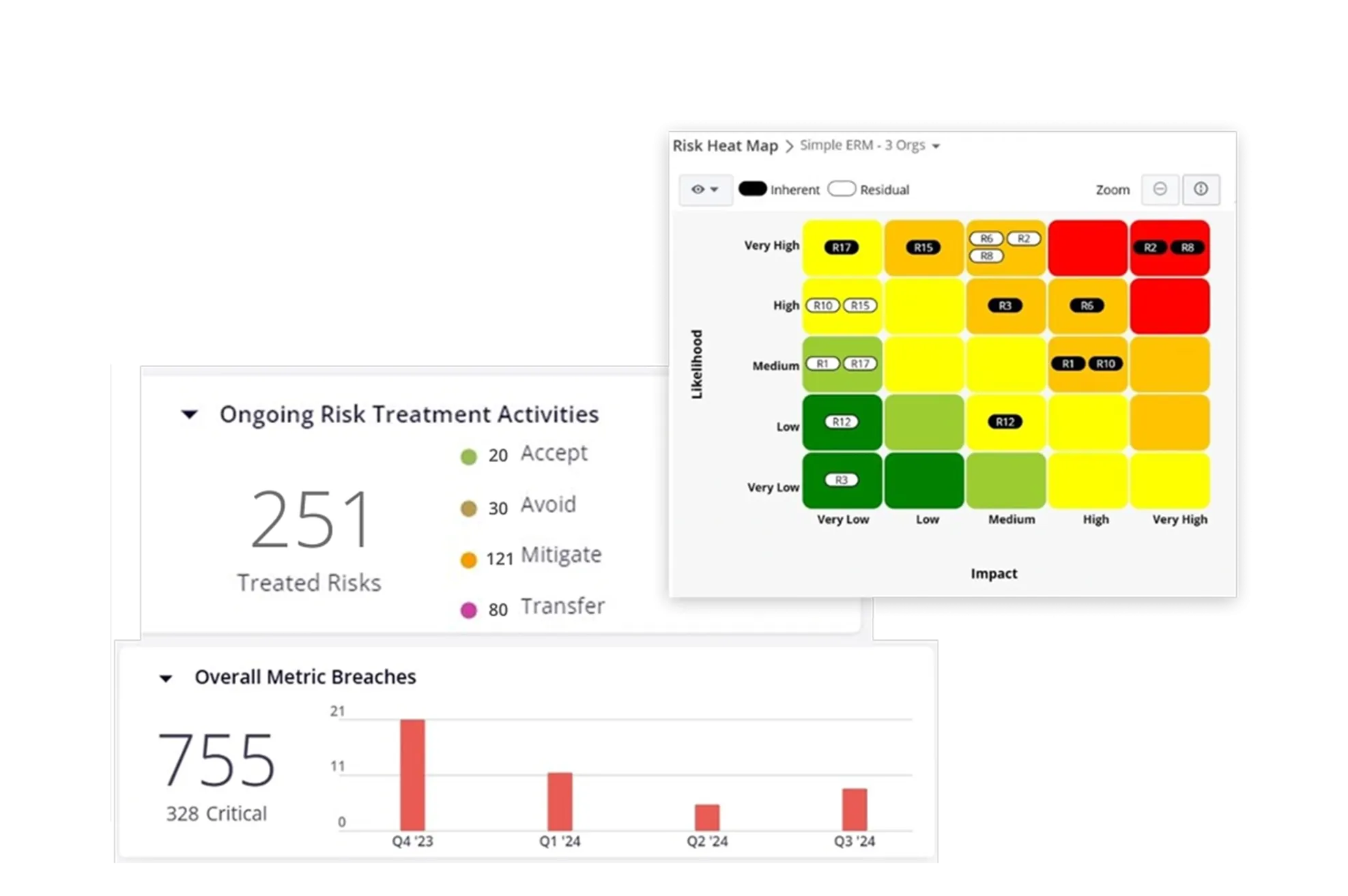

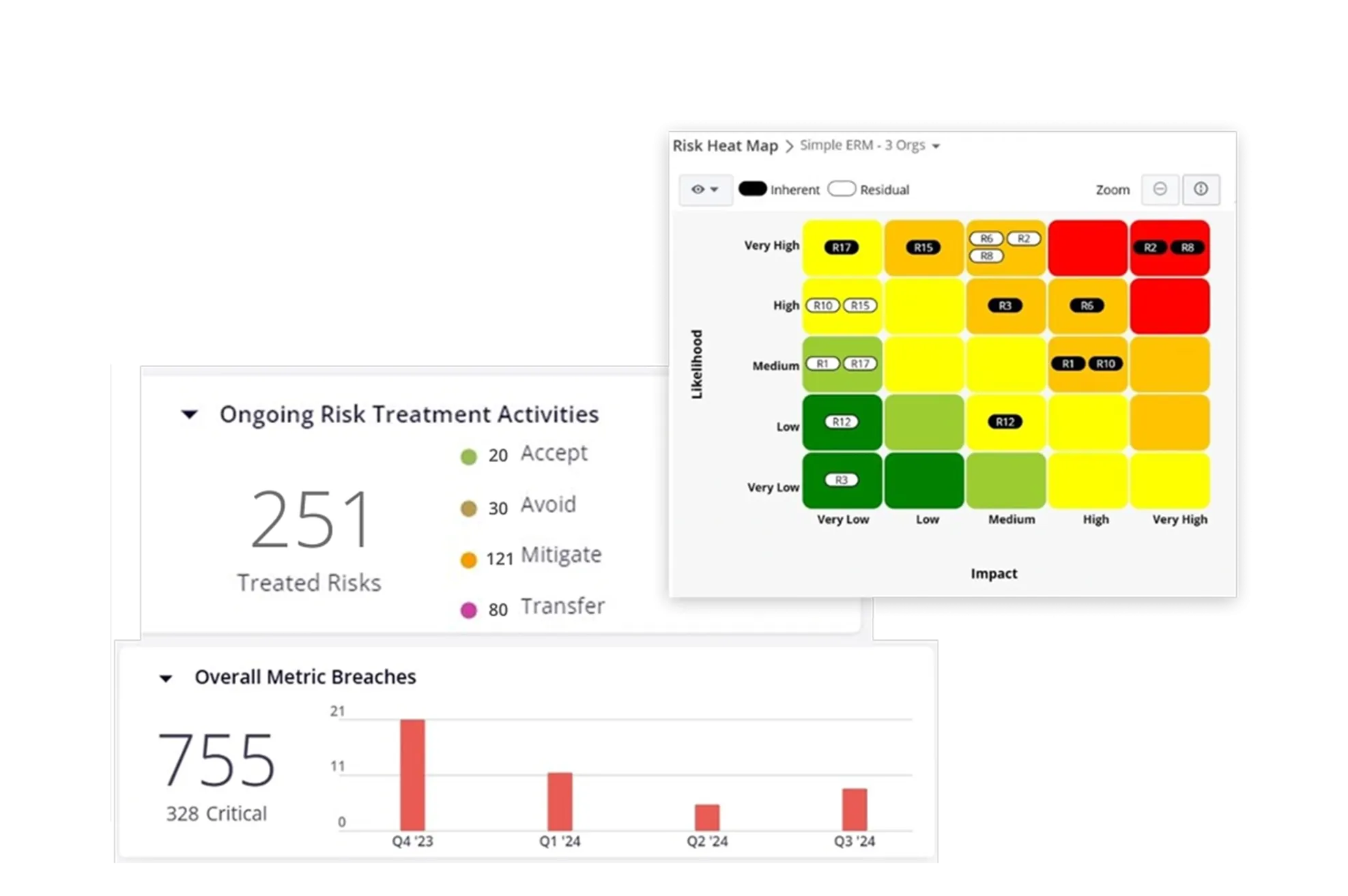

Plan, schedule, manage and perform risk and control assessments easily with our ORM tool. Evaluate inherent and residual risks both quantitatively and qualitatively. Easily aggregate risk scores using weighted average method where weights can be given to multiple dimensions. Define risk treatment plans to accept, avoid, transfer, or optimize risk.

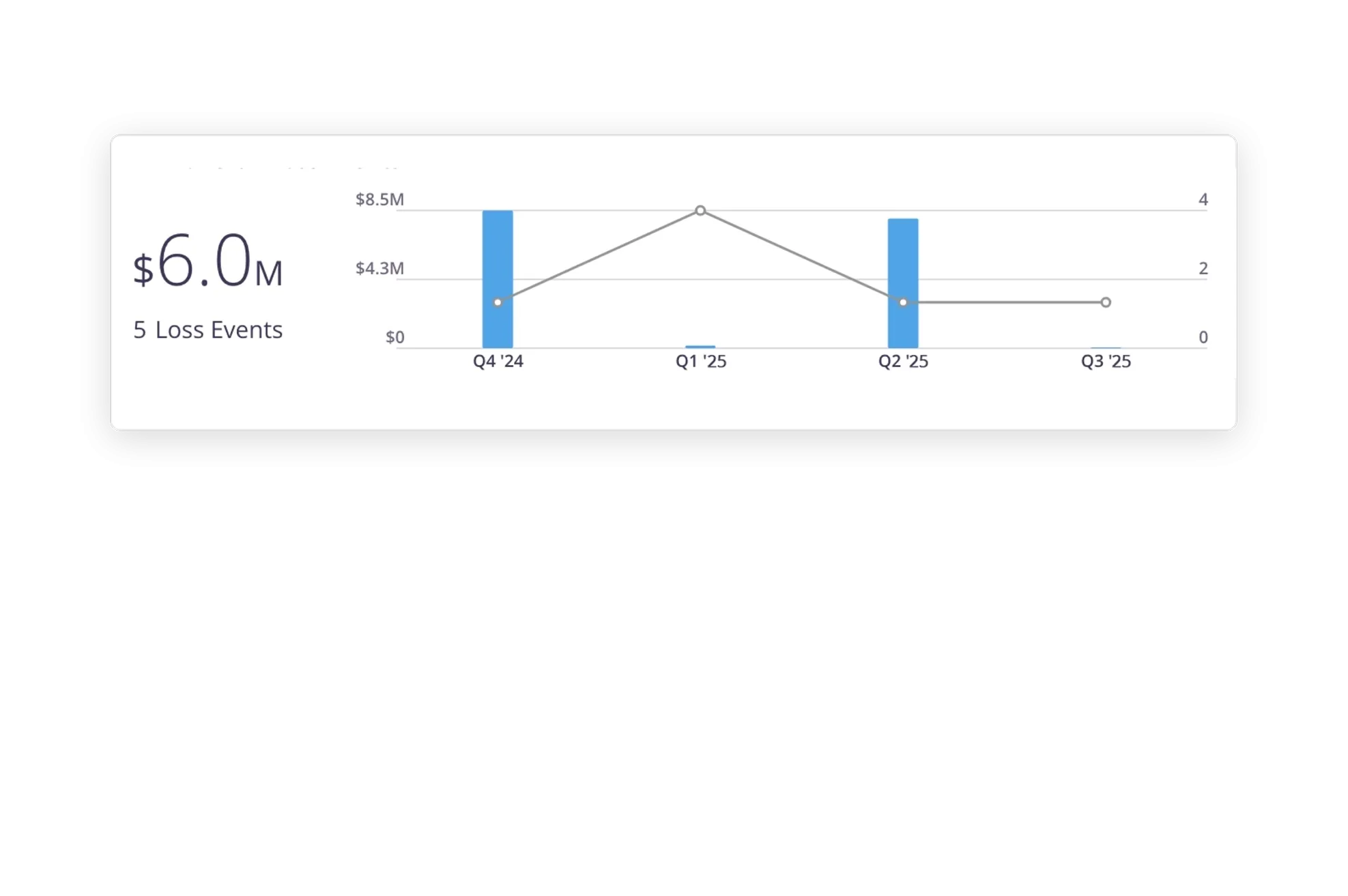

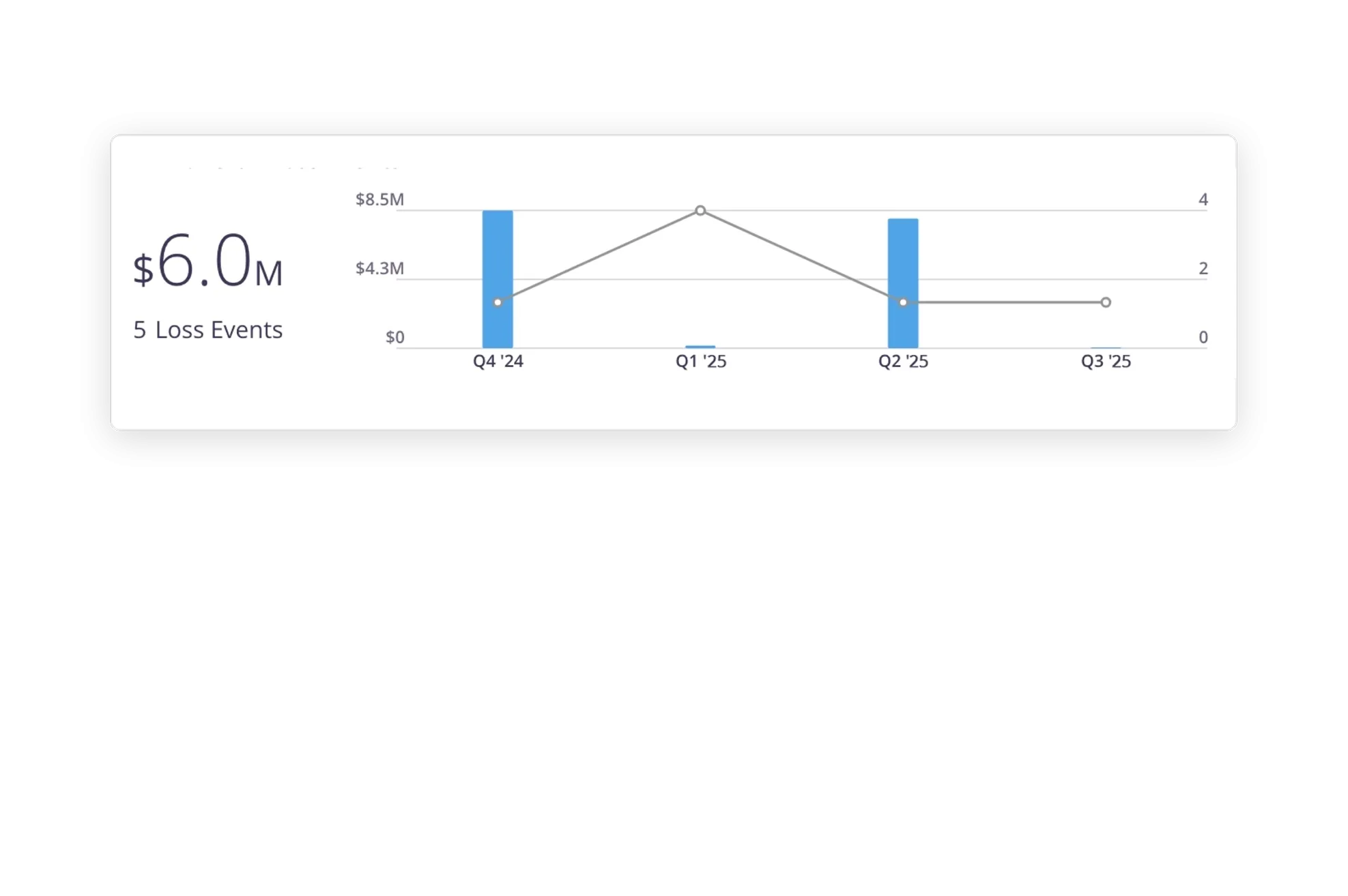

On-Target Operational Loss Event Management

Capture, analyze, categorize, and remediate internal risk events and losses across multiple impacted organizations in compliance with industry regulations like Basel Accords. You can also aggregate multi-currency risk events in a single currency. Define loss thresholds, consolidate data from external loss data exchanges, analyze trends, conduct causal analysis, and initiate corrective actions.

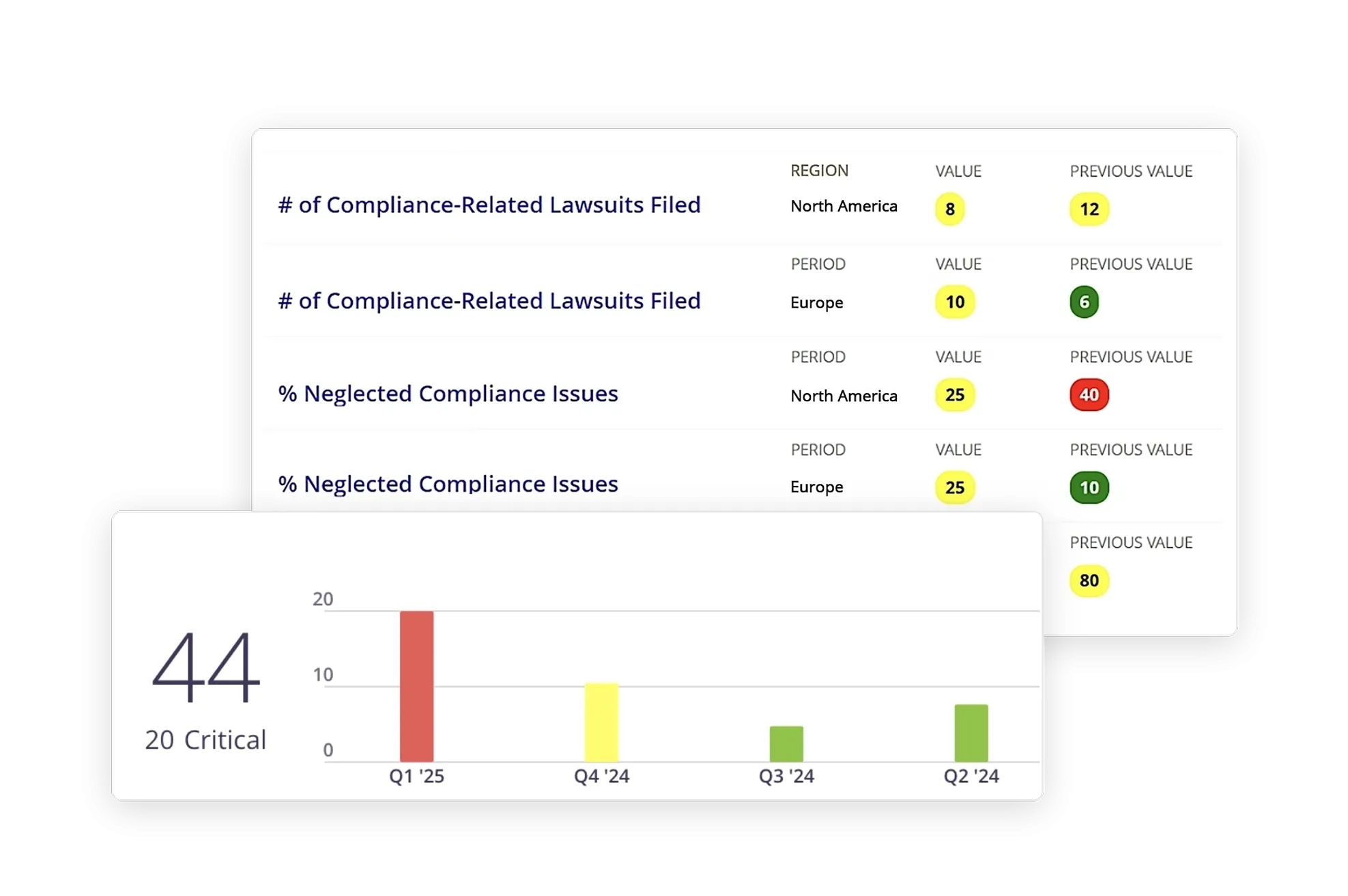

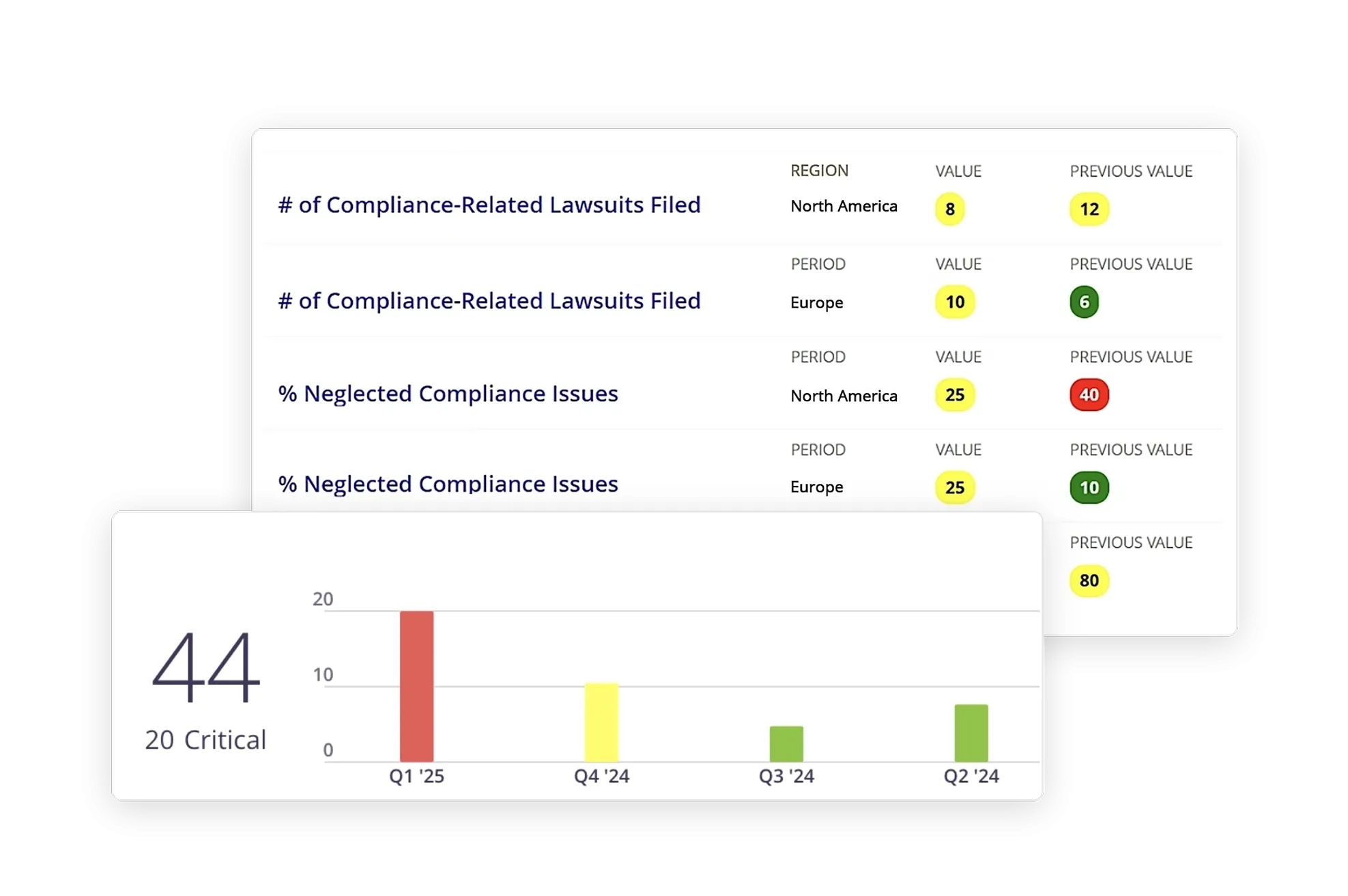

Dynamic Key Metrics (KPI, KRI, and KCI) Monitoring for ORM Optimization

Measure and closely monitor key indicators for risks (KRIs), controls (KCIs), and performance (KPIs). Set thresholds to identify potential threats and mitigate them in advance. Enable correlative analyses between various key metrics. Send alerts and notifications on any breach to relevant personnel and define multiple follow-up actions.

AI-Powered Issue Management to Reduce Redundancies

Leverage AI/ML to quickly identify issues based on relationships and recommend issue classification. Recommend action plans to modify controls or define new controls as part of the issue remediation process. Monitor the status of the implemented actions at every stage and track them to closure.

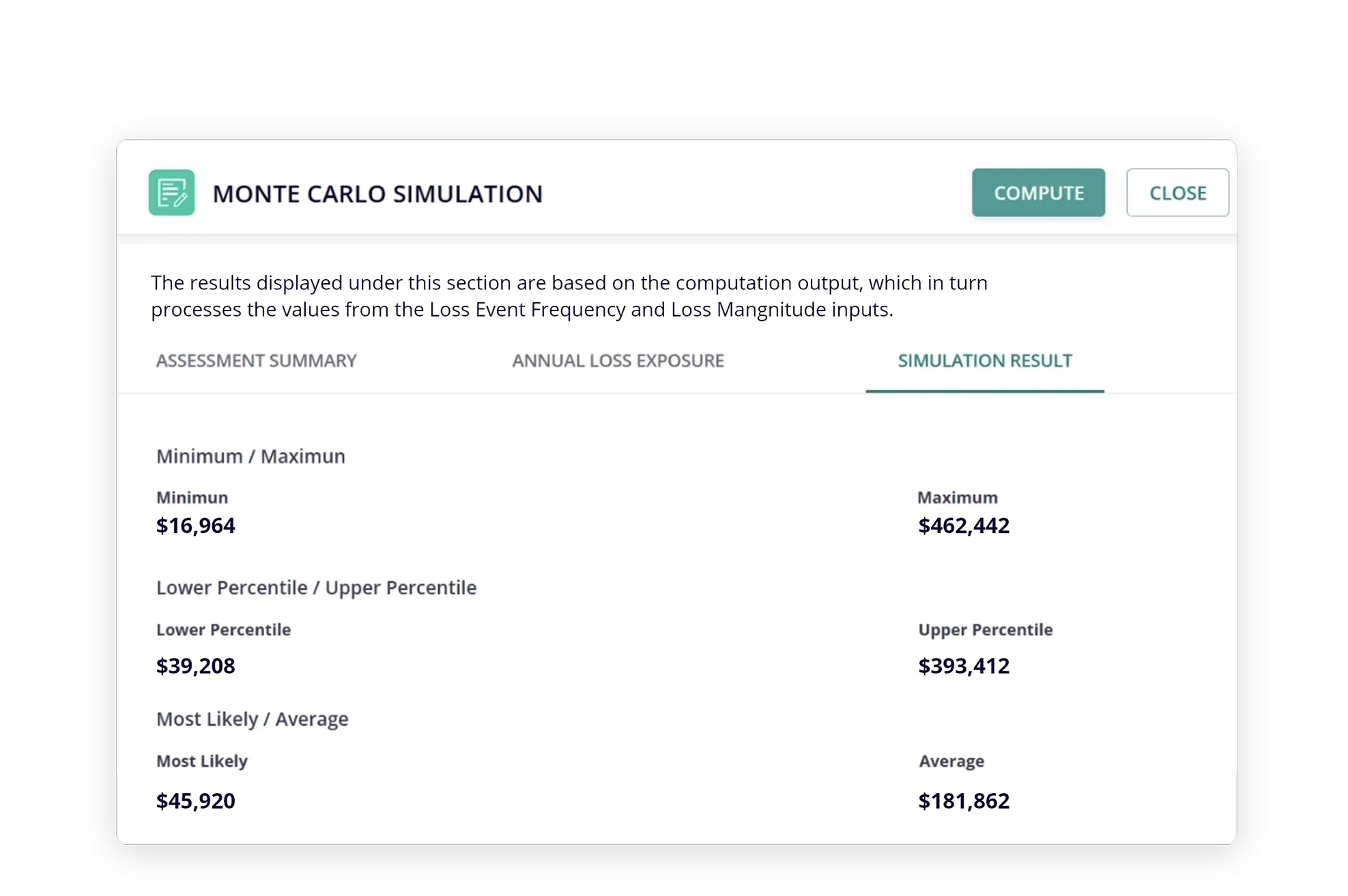

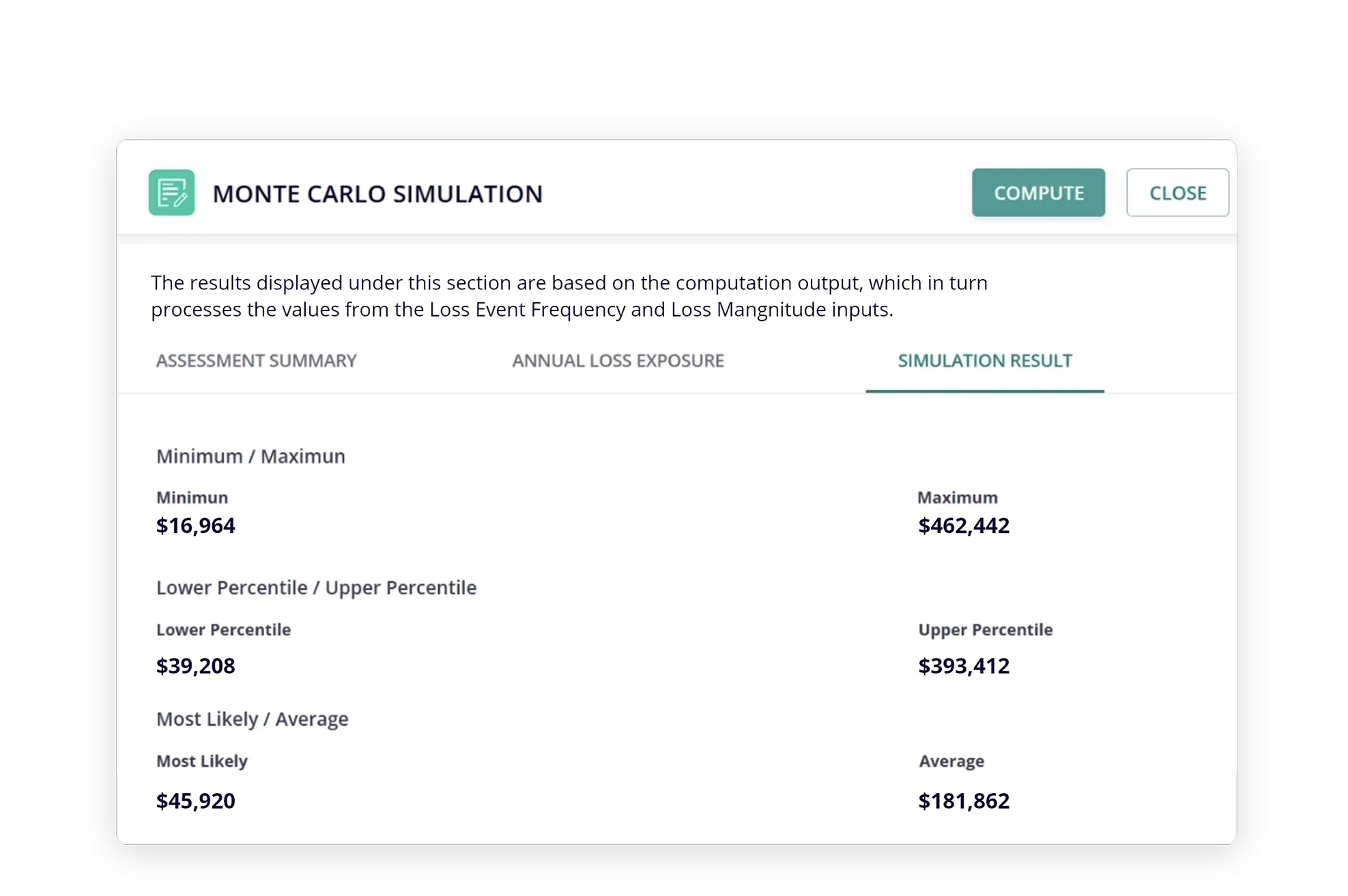

Risk Quantification and Analytics to Safeguard Critical Investments

Define multiple operational risk parameters and calculations rules. Enable advanced risk quantification, analytics, and modelling. Quantify risks into monetary value.

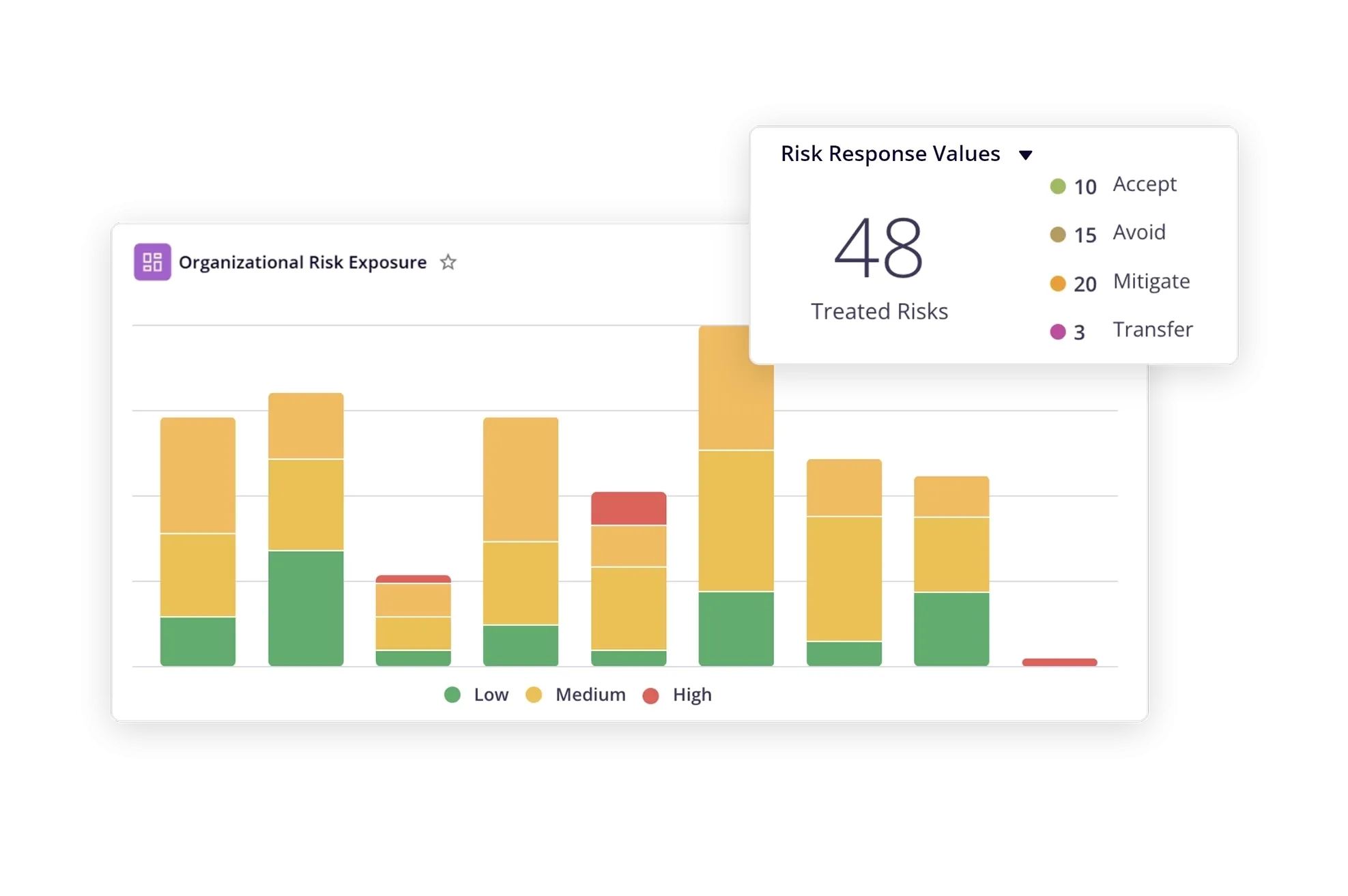

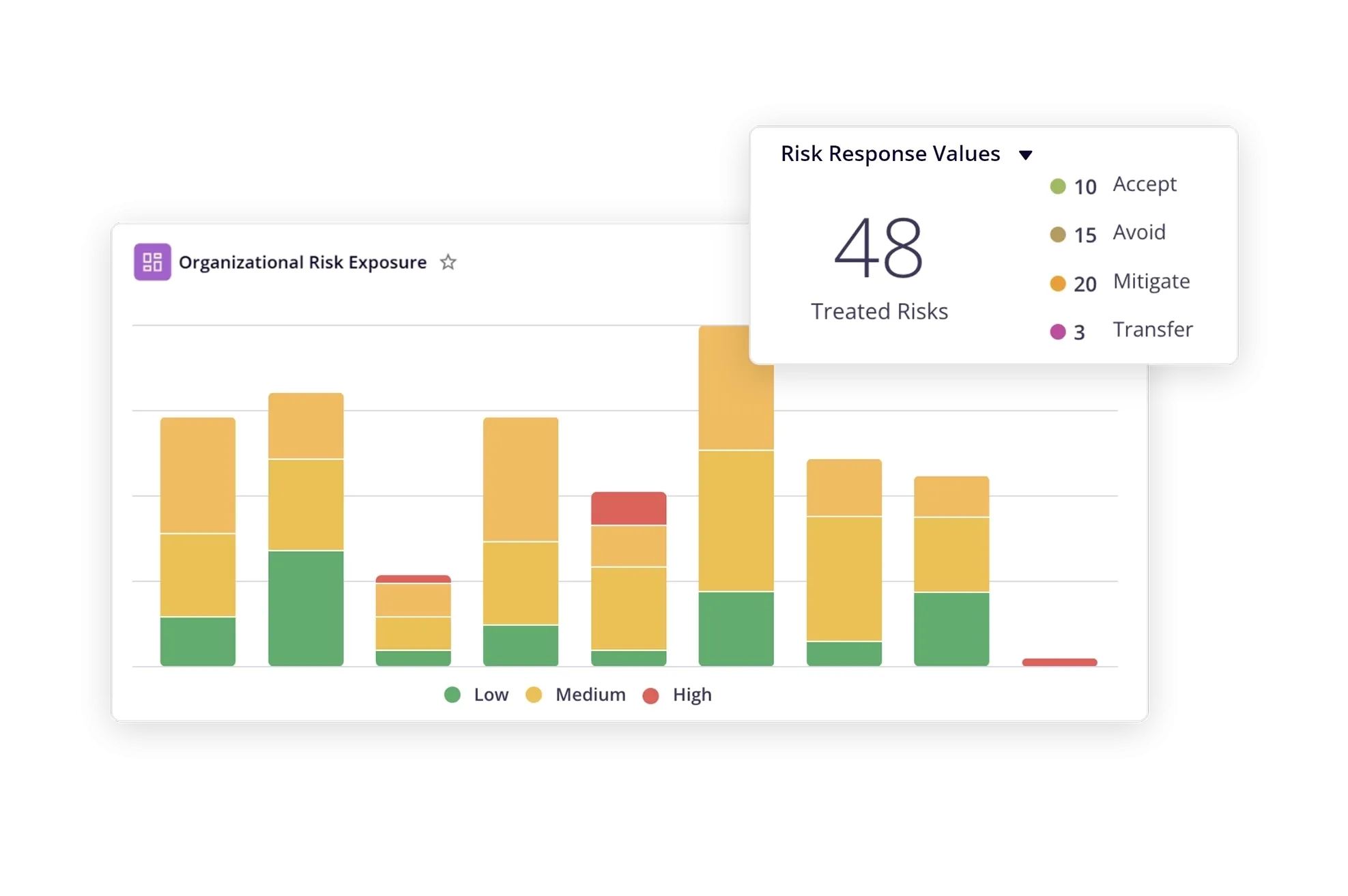

Expansive Risk View with Intuitive Graphical Dashboards and Reports

Gain a 360º view of your ORM program through interactive executive dashboards, heat maps, and advanced data visualization of key metrics. Access real-time information through role-based landing pages with graphical dashboards to stay on top of operational risks. Leverage loss data analytics reports and dashboards to understand root causes, total loss exposure, and optimize your ORM program.

How Our ORM Software Benefits Your Business

- Improve efficiency by reducing risk assessment cycle time and costs, while enhancing resource utilization. Gain a single, forward-looking view of top risks with predictive metrics, enabling agile, risk-based decisions and stronger regulatory confidence through robust governance.

Frequently Asked Questions

Operational risk management (ORM) software is a dedicated solution designed to identify, assess, monitor, and mitigate the risks arising from day-to-day business operations, system failures, human errors, process breakdowns, or external disruptions. Unlike generic risk tools, ORM software offers structured workflows and real-time visibility into the root causes and cascading impacts of operational risks. It enables organizations to connect risk assessments with controls, incidents, and action plans in a centralized platform, helping build a proactive, data-driven risk culture that goes beyond compliance and actively protects performance.

Yes, modern ORM software is designed to work as part of a larger risk and compliance ecosystem. It can easily integrate with systems like ERP, HR, finance, audit, and cybersecurity tools, enabling the free flow of risk data across departments and functions. This integration enhances visibility, reduces data silos, and allows for a more holistic view of operational risk. Whether it's pulling data for risk assessments or triggering alerts based on incidents, connected ORM software empowers organizations to respond faster and smarter by using existing enterprise intelligence.

ORM software works by digitizing the entire operational risk lifecycle, from risk identification and assessment to mitigation and monitoring. It generally starts with capturing potential risks through assessments, loss events, or key risk indicators (KRIs), which are then scored, analyzed, and mapped to relevant processes or controls. The platform automates risk response workflows, assigns ownership, and tracks remediation efforts in real time. Dashboards and reports offer actionable insights for decision-makers, while built-in audit trails ensure transparency and accountability. Ultimately, ORM software transforms risk handling into a continuous, business-aligned discipline.

Yes, the MetricStream ORM software supports categorizing and classifying business lines and loss events based on Basel standards and can be easily configured to define processes and workflows as per various standards such as Basel, Solvency II, PRA, APRA, etc. Additionally, it ensures effective risk management with the capability to integrate with several third-party content providers such as RiskSpotlight, UCF using APIs to pull data into the system.

MetricStream’s ORM software tool lets you plan, schedule, and perform both top-down and bottom-up risk and control self-assessments. It enables simple risk analysis and assessments by rating risks, and advanced assessments using multiple parameters and risk scoring to meet variations in risk assessment methodologies across business units, regions, and products. Also, the operational risk management framework helps you assess the overall control environment based on multiple factors. You can aggregate risk scores using a weighted average method where weights can be given to multiple dimensions including organization, objective, product, process, assessable item, or risk hierarchy for improved and accurate risk visibility.

Risk analysis and computations are based on configurable methodologies and algorithms for inherent impact and likelihood. Risk assessment criteria include impact, likelihood, controllability, and other determinants as well as weight-based assessments of risk criteria values for use in combined valuations.

MetricStream ORM software supports the collection of loss data for effective risk management in multiple ways:

- Internal loss data- when the data collection is carried out through a manual/automated approach from forms and bulk upload of multiple loss events from spreadsheets.

- External loss data- when the data collection from libraries/contortions is enabled through APIs and spreadsheets uploads.

- In compliance with the Basel Accords, the operational risk management framework helps you can capture and categorize internal risk events and losses across multiple impacted organizations. Faster loss data recording with a simplified and easy-to-use interface is enabled for frontline users to record basic details of a loss event. Multi-currency risk events can be aggregated in a single currency. You can analyze trends, conduct a causal analysis, and initiate corrective actions across your organization. You can also define loss thresholds, consolidate data from external loss data exchanges, and conduct a loss data analysis.

- Business users or frontline workers can easily report an issue or a loss using a simple interface with minimal information. The reviewer can triage these loss events or issues based on AI-powered recommendations.

With our ORM software system, you can record findings stemming from risk assessments and control tests. AI/ML can be leveraged to quickly identify semantically similar issues, classify issues, and recommend action plans. You can drive action plans to modify internal controls or define new internal controls as part of the issue remediation process. Implemented actions can be monitored at every stage and tracked to closure.

You can explore the MetricStream Operational Resilience solution that brings all aspects of the operational resilience framework on to a single unified platform by seamlessly embedding risk management practices into compliance, cybersecurity, vendor risk management and business continuity planning to prepare for and prevent potential disruptions. To request a demo, click here. get a demo

Also, you can visit our Learn section to dive deeper into the GRC universe and the Insight section to explore our customer stories, webinars, thought leadership, and more.