Measure Your Program Outcomes

Source: Based on MetricStream customer responses and GRC Journey Business Value Calculator

0

improvement in risk reporting visibility and efficiency for the executive management and board

0

cost savings in risk assessment and related processes

0

improvement in risk and control framework related operational efficiency

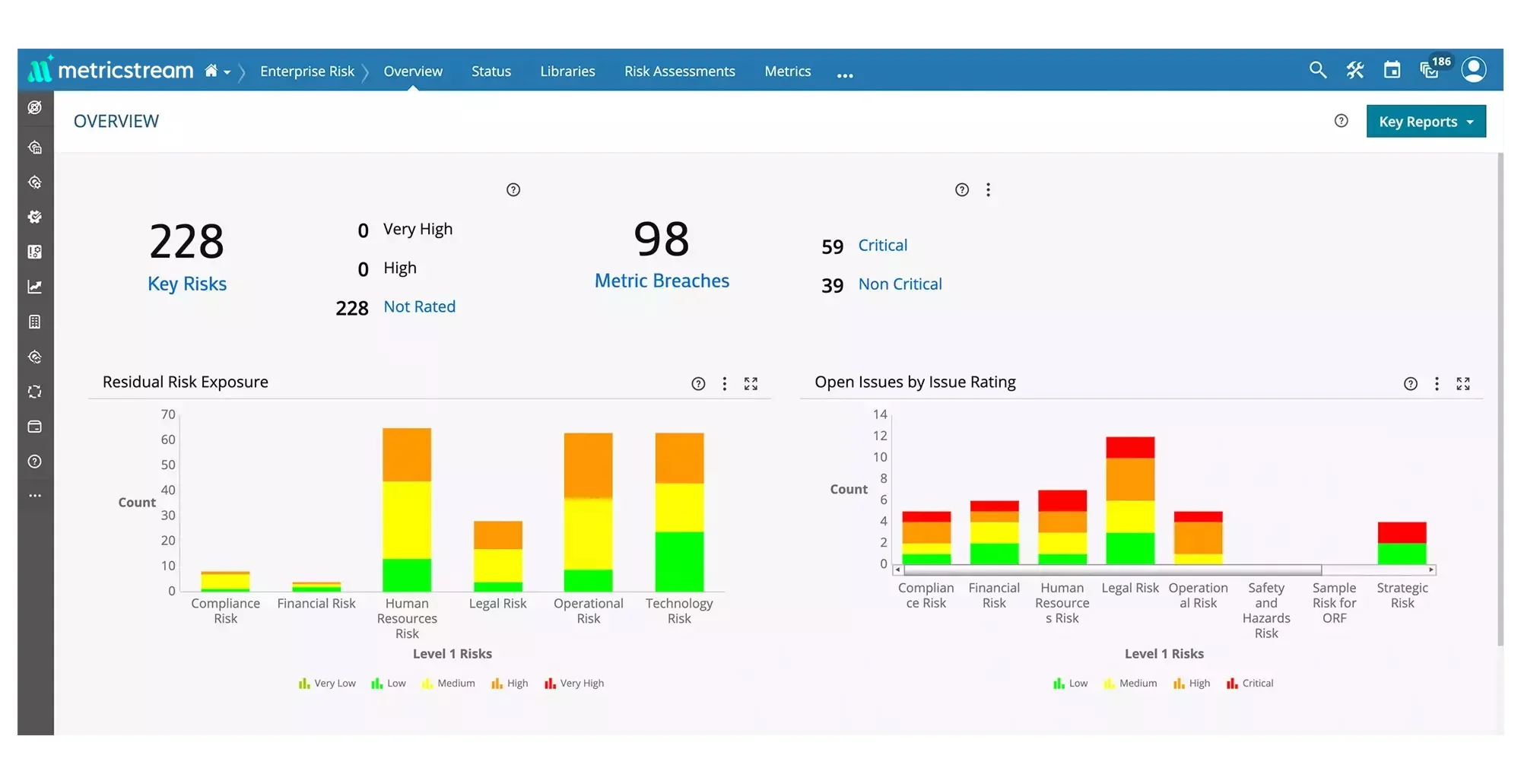

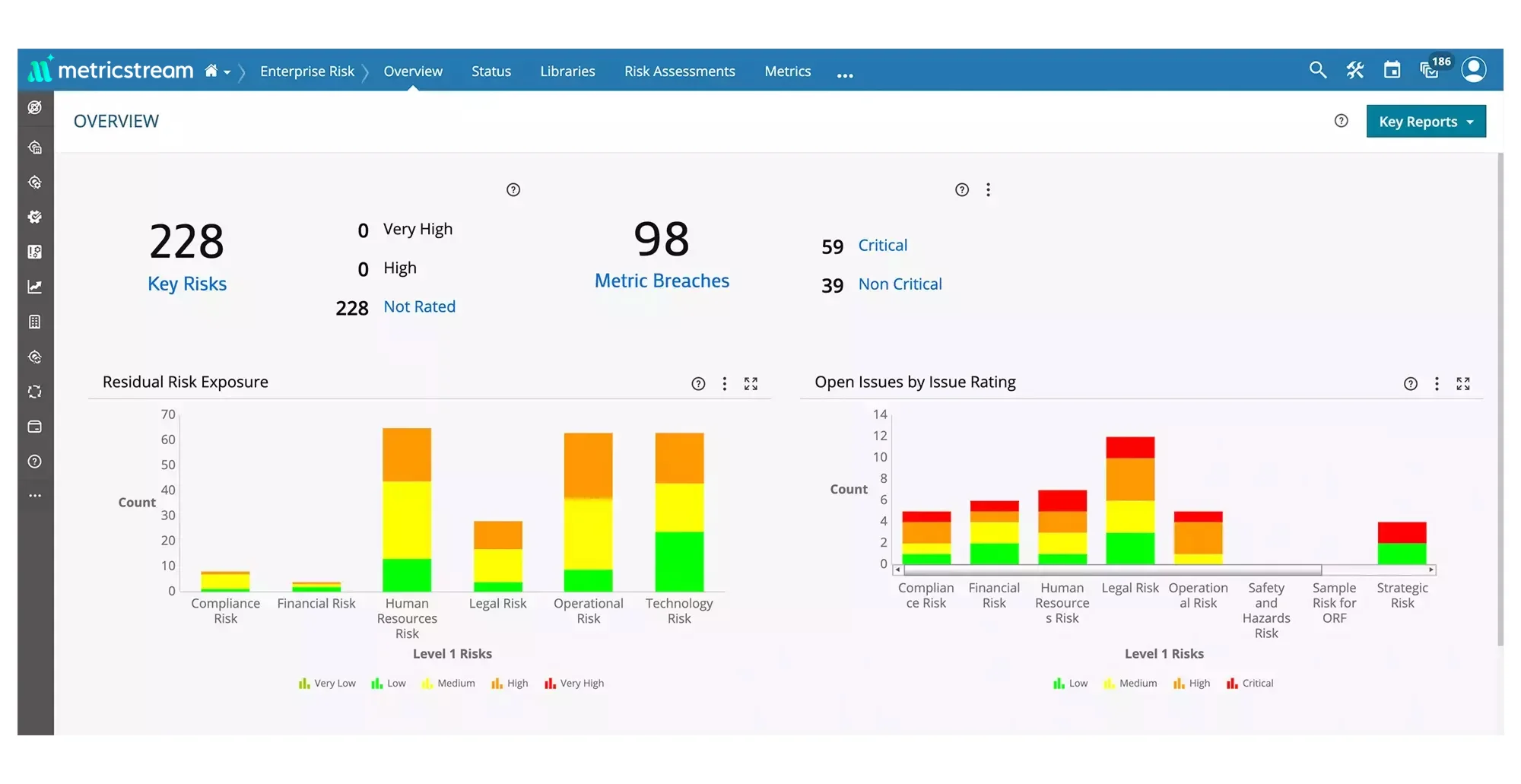

Gain Forward-Looking Risk Insights with Predictive Risk Metrics and Indicators

The MetricStream Integrated Risk Management solution empowers your organization to manage both current and emerging risks across multiple risk categories, including geopolitical, digital, strategic, third-party, cybersecurity, and compliance. Built on the MetricStream Platform, the solution cuts across organizational silos by standardizing risk and control taxonomies, centralizing risk libraries, and enabling stakeholders to effectively coordinate and unify risk management activities across all business functions. Effectively align your assurance programs and gain comprehensive visibility into both risk exposure and relationships. Deliver deeper visibility and understanding of risk inter-linkages, interdependencies, and their impact on business performance, strengthen resilience, enhance agility, and empower risk-aware decision making in an increasingly interconnected risk landscape.

READ MORE Product Description

How Our Integrated Risk Management Solution Helps You

Enhance Risk Visibility with an Integrated Approach to Risk Management

Implement an integrated approach that cuts across siloes and delivers risk insights to make better business decisions. Gain foresight of risks across functions including compliance, IT, audit, legal, finance, and operations. Address enterprise and operational risk with a structured and collaborative approach that enables risk-informed business decisions.

Keep Compliance Risks and Fines at Bay

Reduce the cost of compliance by proactively assessing and managing compliance risks. Stay on top of regulatory requirements with strong policy governance to build regulators’ and the board’s trust. Proactively manage all issues, incidents and cases related to compliance.

Safeguard Your Business from Cyber Risks

Automate and enhance cyber governance with real-time visibility into your overall IT and cyber risk posture, ensure compliance with cyber regulations, and monitor vendors for cybersecurity risks.

Strengthen Extended Ecosystem by Effectively Managing Third and Fourth-Party Risks

Prevent and respond better to third-party risk incidents and enable business continuity through quick and intelligent risk insights. Gain a comprehensive visibility into third and fourth-party risks throughout their lifecycle - from onboarding to offboarding.

Streamline Your Assurance Program with Risk-Based Internal Audits

Drive an agile and risk-based internal audit and financial controls management program that is aligned with your overarching risk management framework and business strategy. Leverage AI capabilities to quickly sift through data to mine insights.

Effectively Manage Environmental, Social, and Governance (ESG) Risks

Centrally manage ESG disclosure requirements of multiple ESG frameworks, including SASB, and TCFB with standard questionnaires that equip you to collect data only once. Identify disclosure gaps and ESG issues and automate issue creation on threshold breaches. Track and monitor ESG metrics and trends and enable periodic assessments of third -parties and suppliers.

How Our Integrated Risk Management (IRM) Software Solution Benefits You

- Drive agility in risk-based decision-making by providing a single view of the top risks faced across the three lines of defense

- Enhance operational efficiency by reducing the cycle time and costs of risk assessments

- Improve the maturity of the risk management program by establishing consistent risk processes, methods, and classifications across the three lines of defense

- Accelerate business performance and growth by aligning risk metrics to performance indicators based on key strategic initiatives

Frequently Asked Questions

Integrated Risk Management (IRM) software is a solution that brings all your risk-related activities into one connected space. Instead of managing risks in silos, where each department has its own version of risk, IRM software gives you a single source of truth. It helps you identify, assess, monitor, and respond to different types of risks across your entire organization, from operational and cyber risks to strategic and compliance risks. Think of it as a framework that helps you see the full picture, so you’re not just reacting to problems, but actively anticipating and preparing for them with confidence and clarity.

IRM software helps organizations break down barriers between teams, turning fragmented risk efforts into a coordinated strategy. With real-time visibility into risks across business units, it enables smarter, faster decision-making and strengthens enterprise-wide accountability. It also helps you move from a compliance-driven mindset to a risk-informed culture, where people understand how their work contributes to broader goals and resilience. Ultimately, the biggest benefit is peace of mind: knowing that you're not just managing risks, but staying one step ahead of them. As risks evolve, so does your ability to respond quickly, without losing sight of long-term priorities.

IRM software is designed to handle a wide range of risks, both traditional and emerging. These include operational risks like process failures or human error, financial risks, IT and cyber threats, third-party and vendor risks, compliance and regulatory risks, as well as strategic and reputational risks. Because all these risks are interconnected, the software helps you understand how one issue might impact another, so you can manage risks holistically, rather than in isolation. Industries are becoming more interconnected and globalized, so managing these overlaps becomes essential to staying competitive and compliant. IRM software gives you the tools to stay resilient in an increasingly uncertain world.

Look for features that help you connect the dots between risks, controls, incidents, and business outcomes. Core capabilities should include risk identification and assessment tools, real-time dashboards, control libraries, workflow automation, and robust reporting. Integration is key - the software should work well with your existing systems so you’re not duplicating efforts. It’s also important to have flexibility: your risk landscape will evolve, so your software should adapt easily to new risks, regulations, and business needs. And above all, it should be intuitive and user-friendly, because risk management works best when it’s embedded into everyday decision-making across the organization. Features like AI-driven insights, mobile access, and configurable workflows can make a big difference in how well the system is adopted and used.