Measure Your Program Outcomes

Source: Based on MetricStream customer responses and GRC Journey Business Value Calculator

-

67 %

67 %improvement in risk reporting visibility and efficiency for the executive management and board

-

87 %

87 %reduction in the time taken to create and review a business impact analysis

-

80 %

80 %increase in risk and control framework-related operational efficiency

Prevent, Respond Faster, and Recover Better from Business Disruptions

The MetricStream Operational Resilience Management software enhances risk visibility across the enterprise, enabling effective mitigation and faster recovery from adverse risk events. MetricStream's operational resilience software supports today’s dynamic business needs with automated workflows, collaboration, and real-time reporting. It brings all aspects of the operational resilience framework on a single unified platform by seamlessly embedding risk management practices into your business continuity planning, allowing preparation for and speedy recovery from potential disruptions. The software gives organizations the ability to break down restrictive silos and ensure integration across various business functions while strengthening resiliency.

Read More product details

How Our Operational Resilience Software Helps You

Identify Critical Processes and Services, Map Dependencies

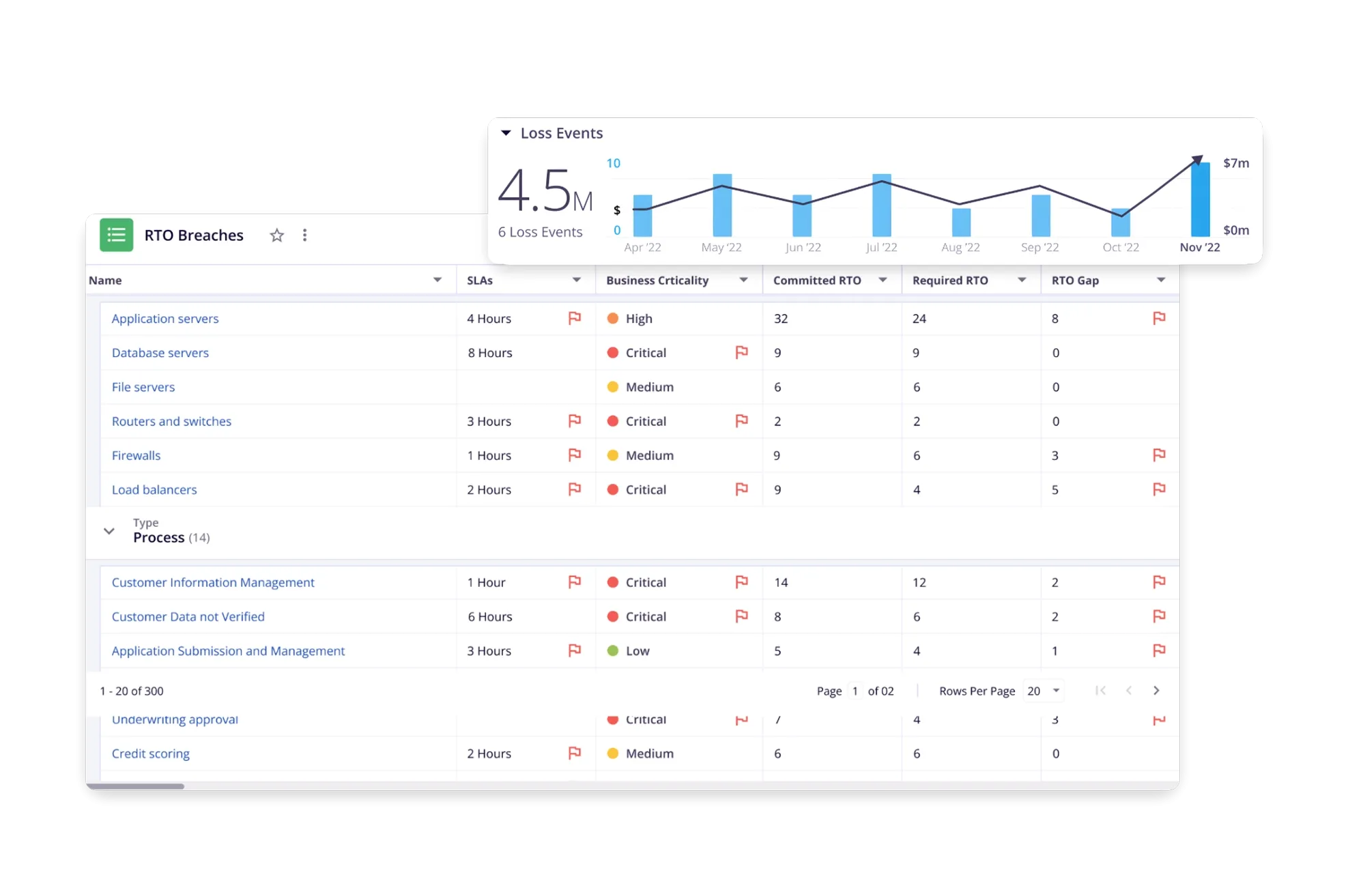

Prepare for recovery from risk events with a complete view of risk information, connections, and dependencies critical to maintaining or restoring systems, data, controls, compliance, and processes. Leverage the software’s centralized library to store and manage risks related to critical business processes, services, assets, data, applications, people, third parties, facilities, threats and vulnerabilities, and more.

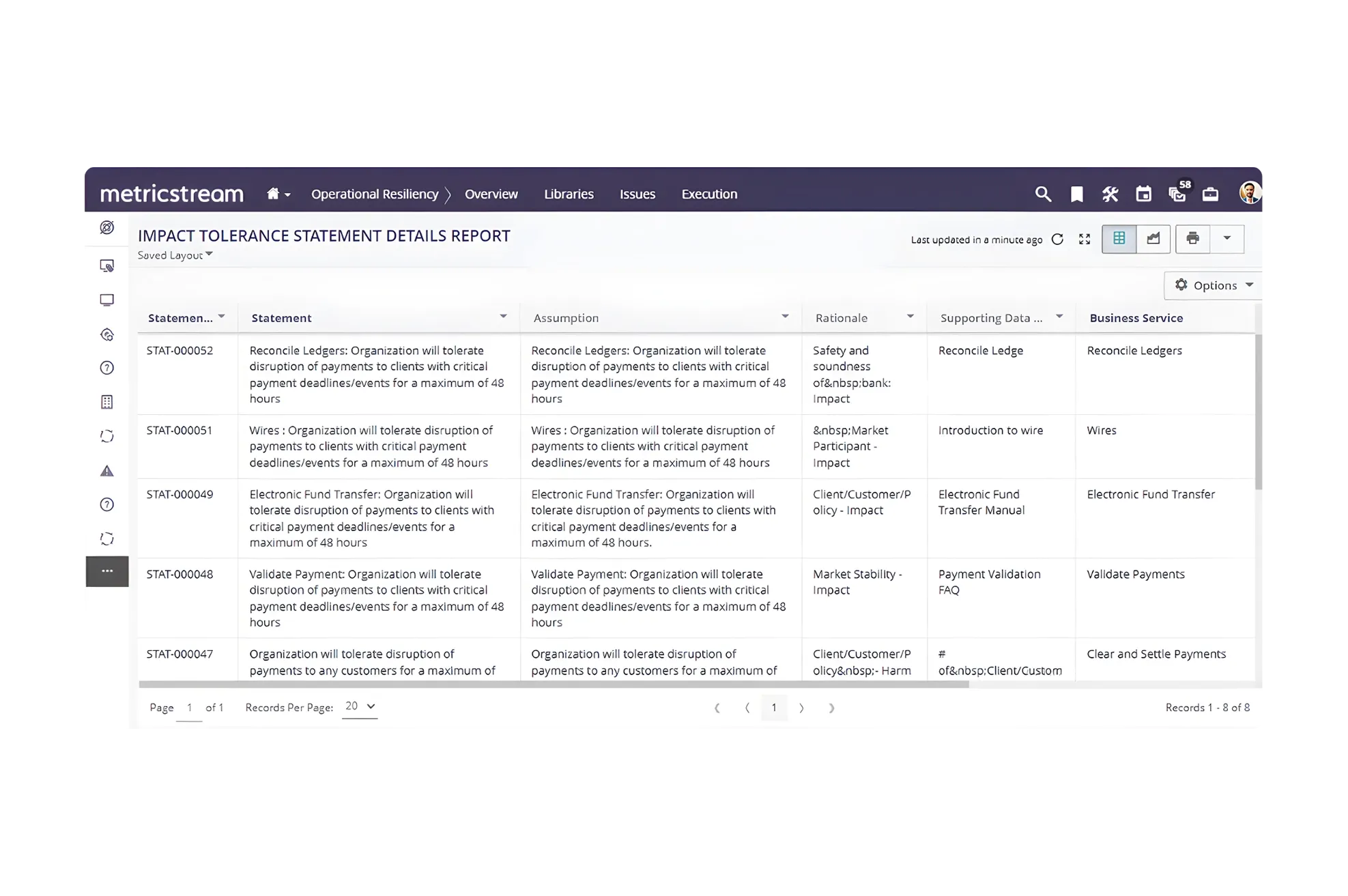

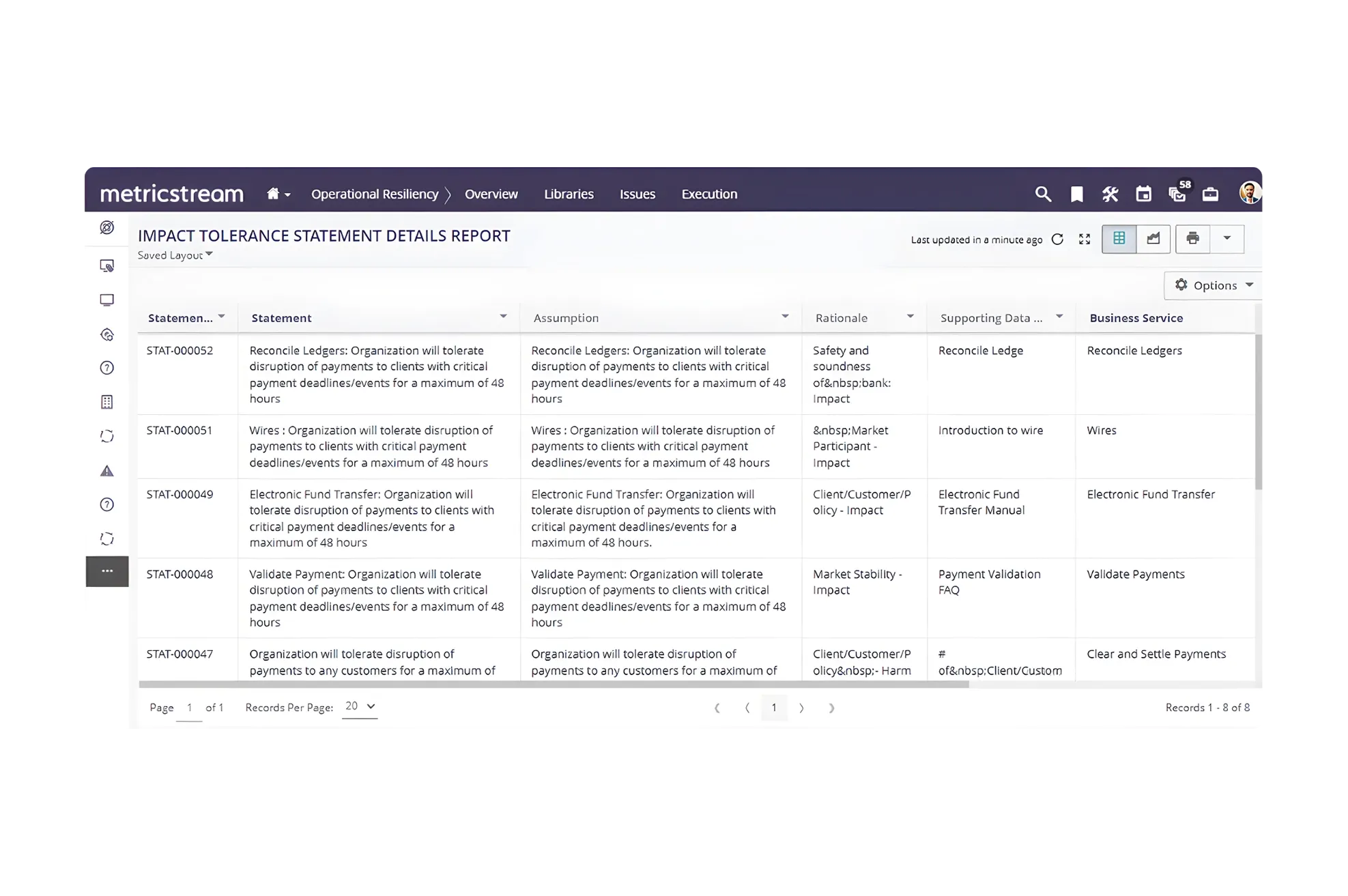

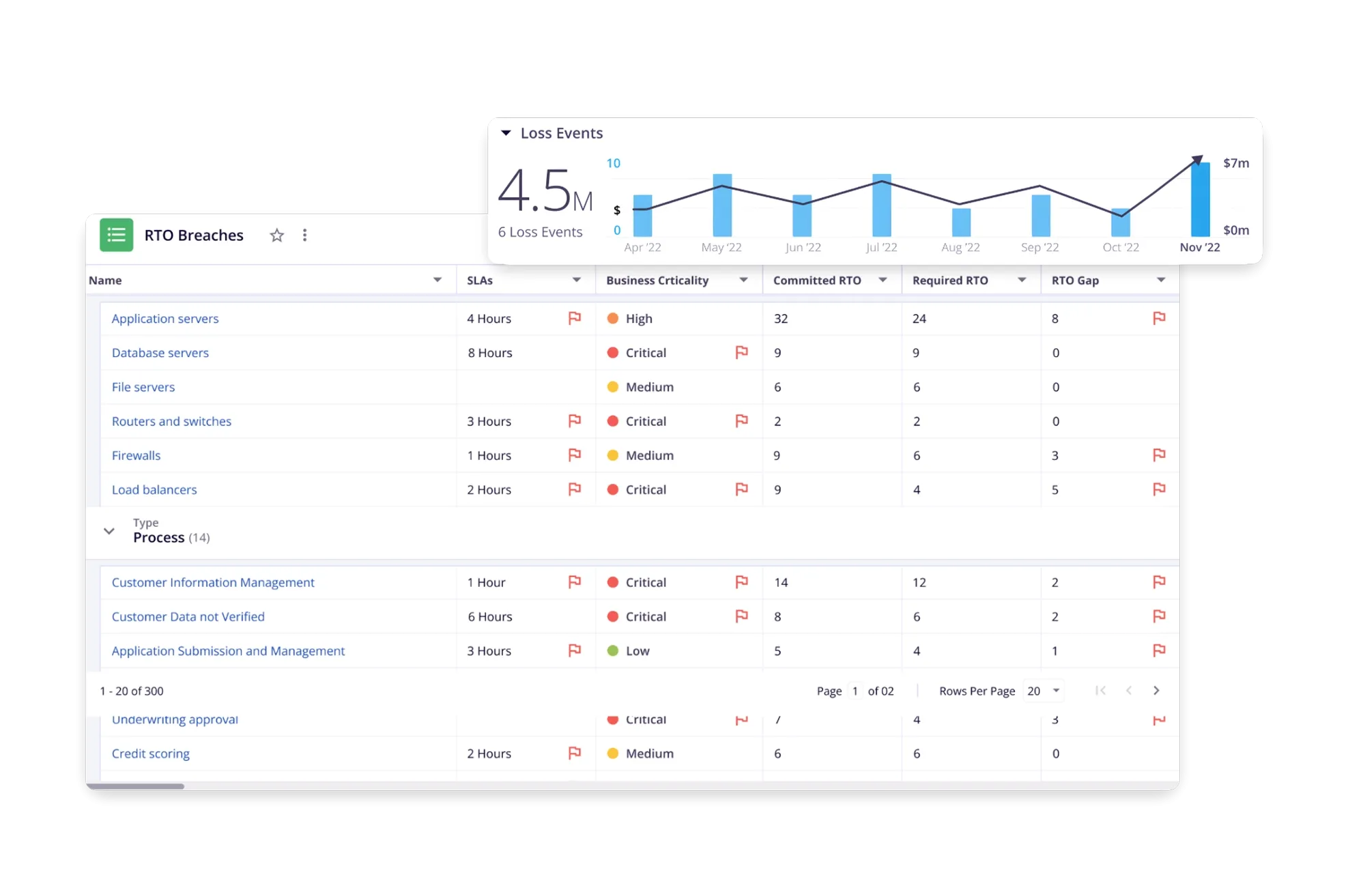

Improved Risk Exposure Calculations with Impact Tolerances

Define impact tolerances, i.e. metrics that specify acceptable levels of disruption, for important business services. Continuously assess and monitor these metrics, both qualitative and quantitative, to keep them within threshold limits, identify potential threats, and mitigate them proactively.

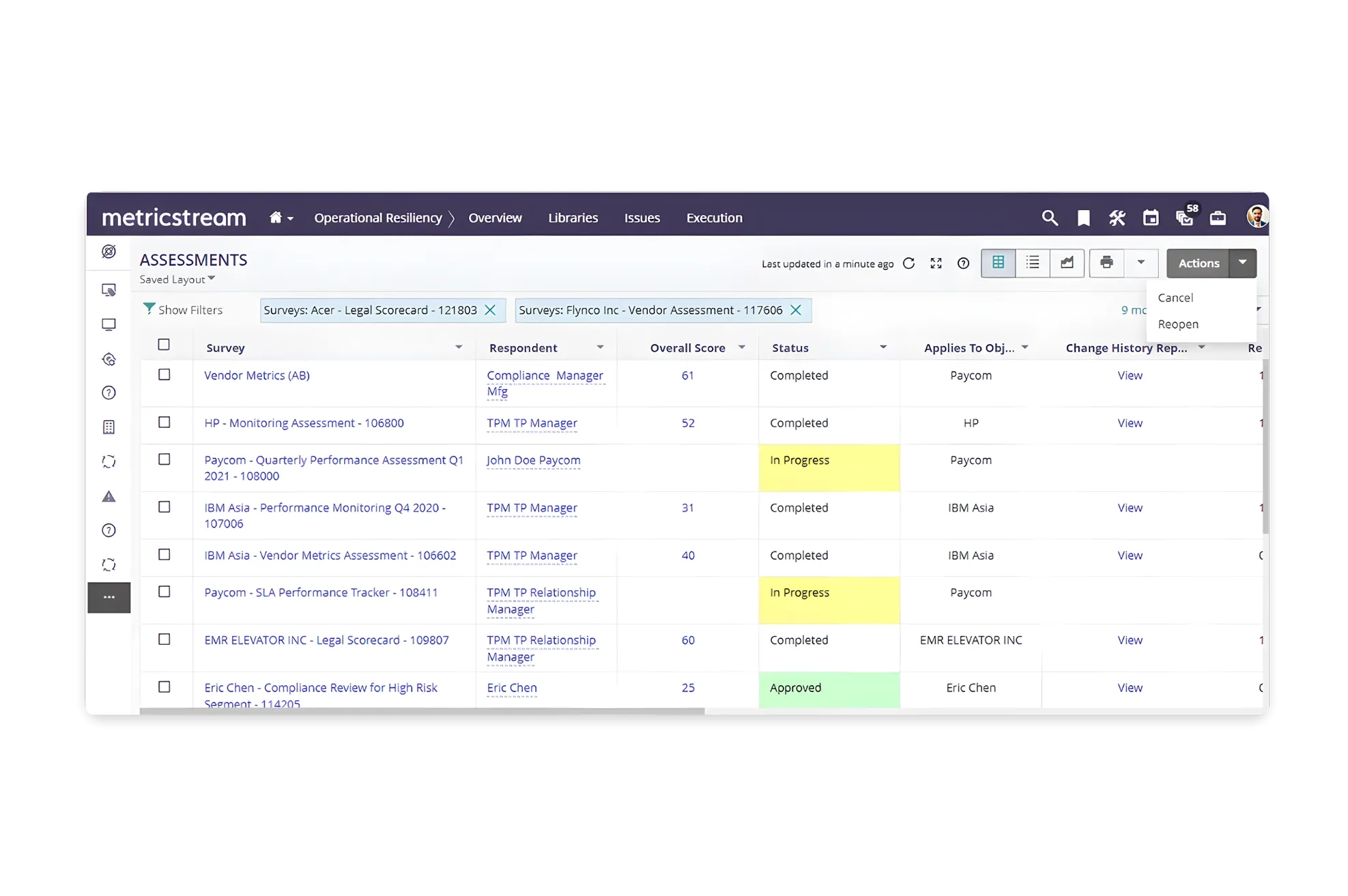

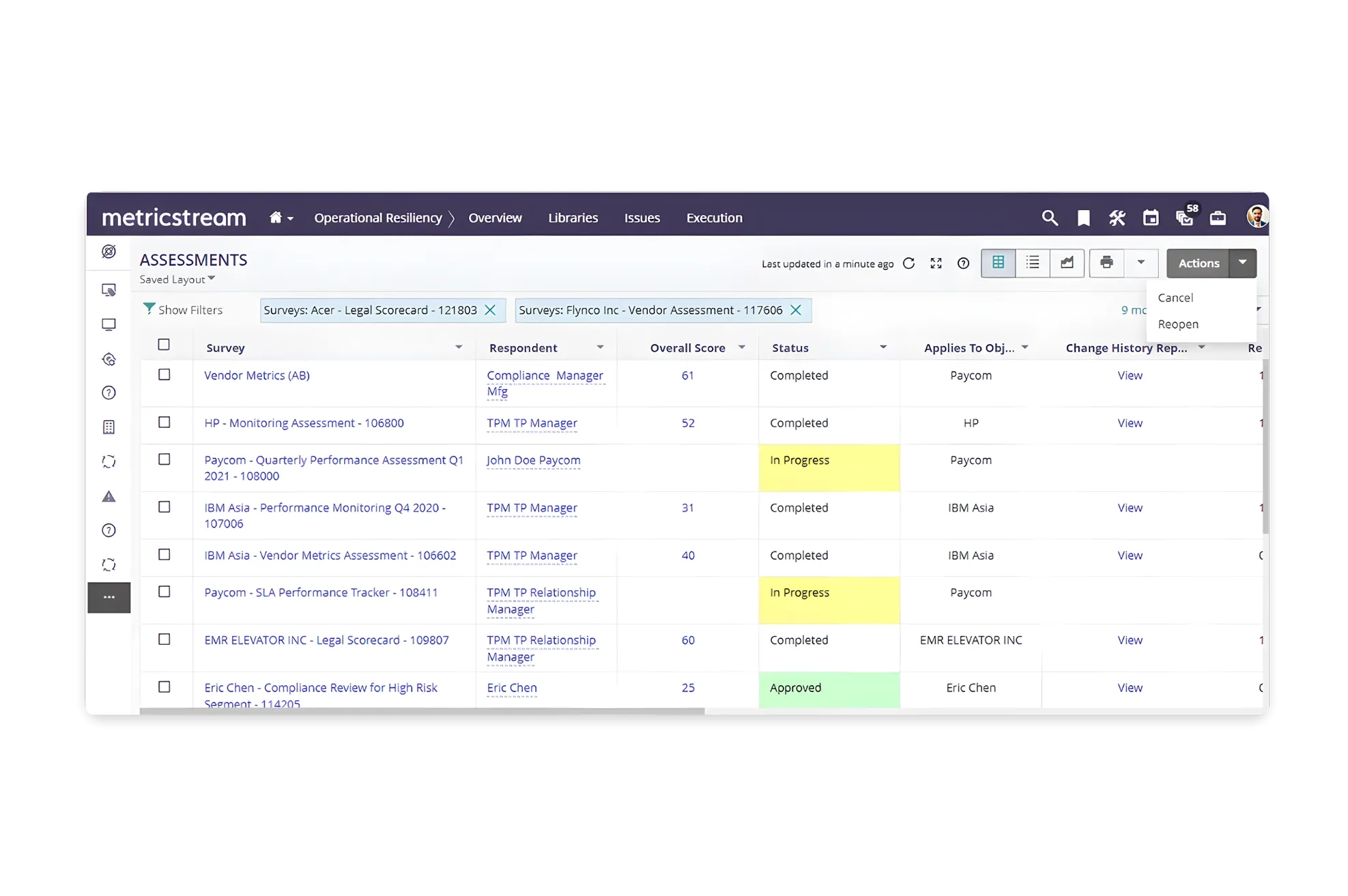

Continuous Risk and Resilience Self-Assessments

Effortlessly plan, schedule, and perform self-assessment surveys and route the results for review and approval. Provide ratings or rankings for each business service for systematic prioritization, assess the organization's tolerance for disruptions or adverse events affecting each business service, and confirm compliance with operational resilience policies and procedures, including regulatory requirements, internal controls, and best practices.

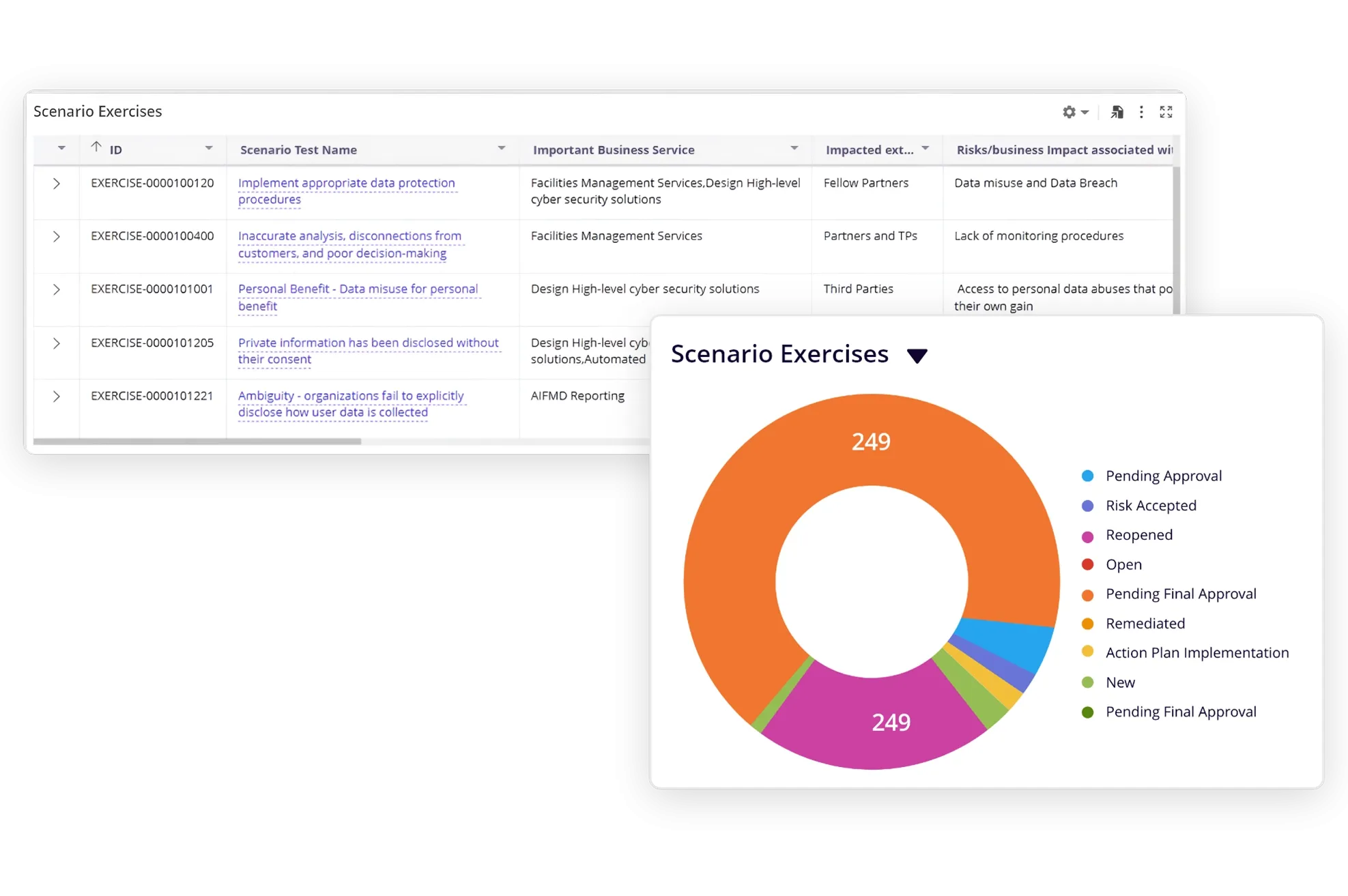

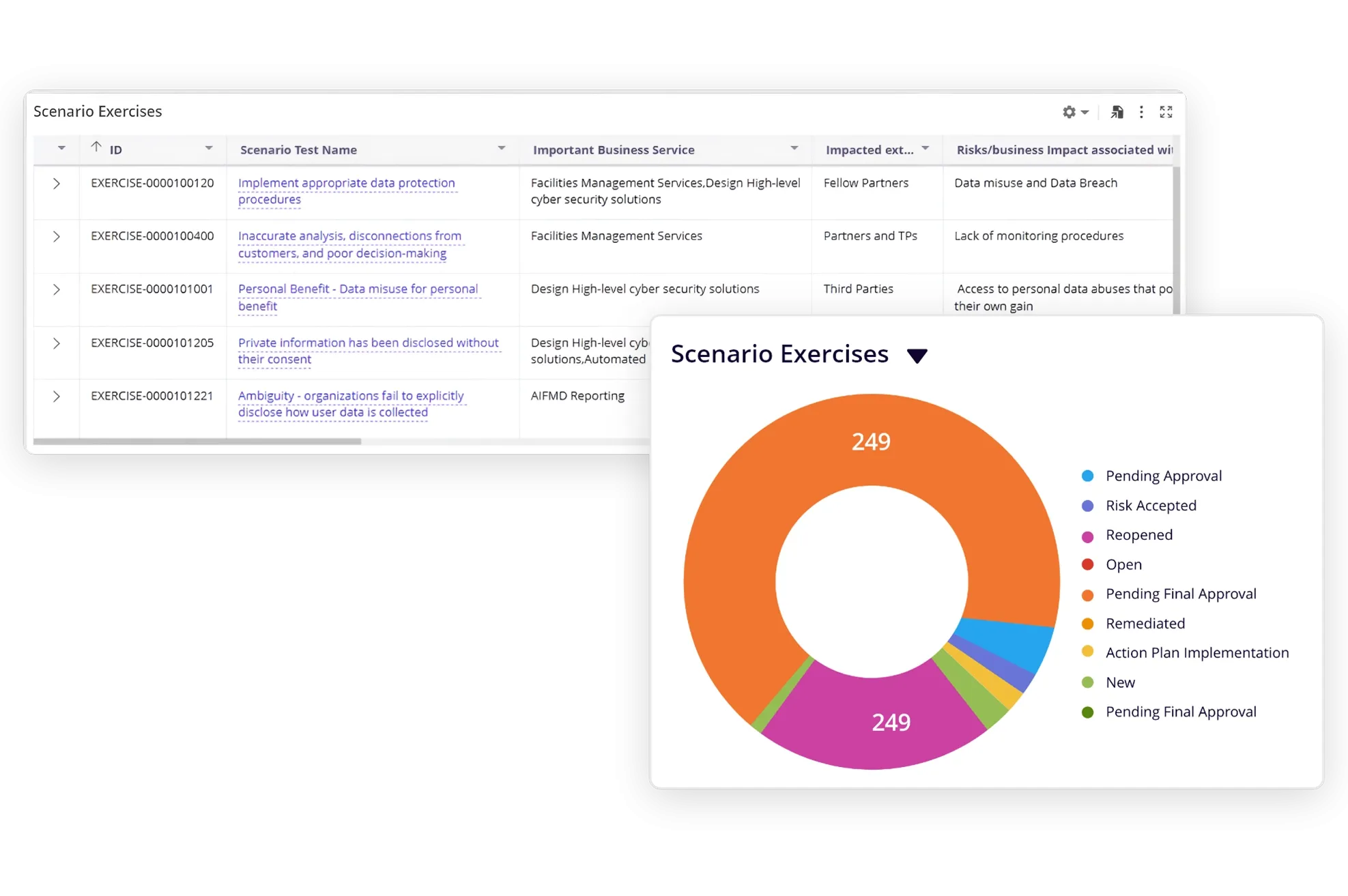

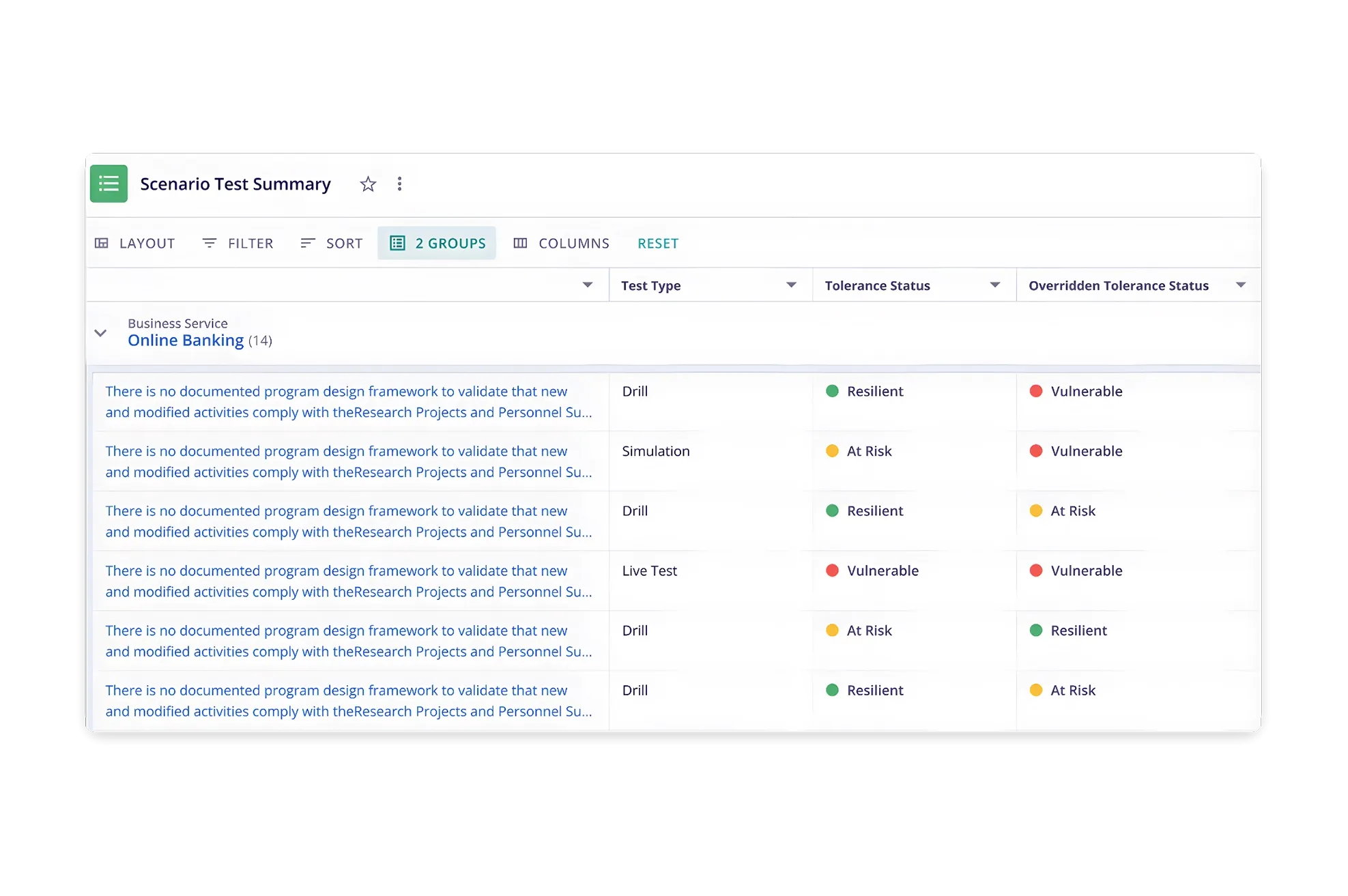

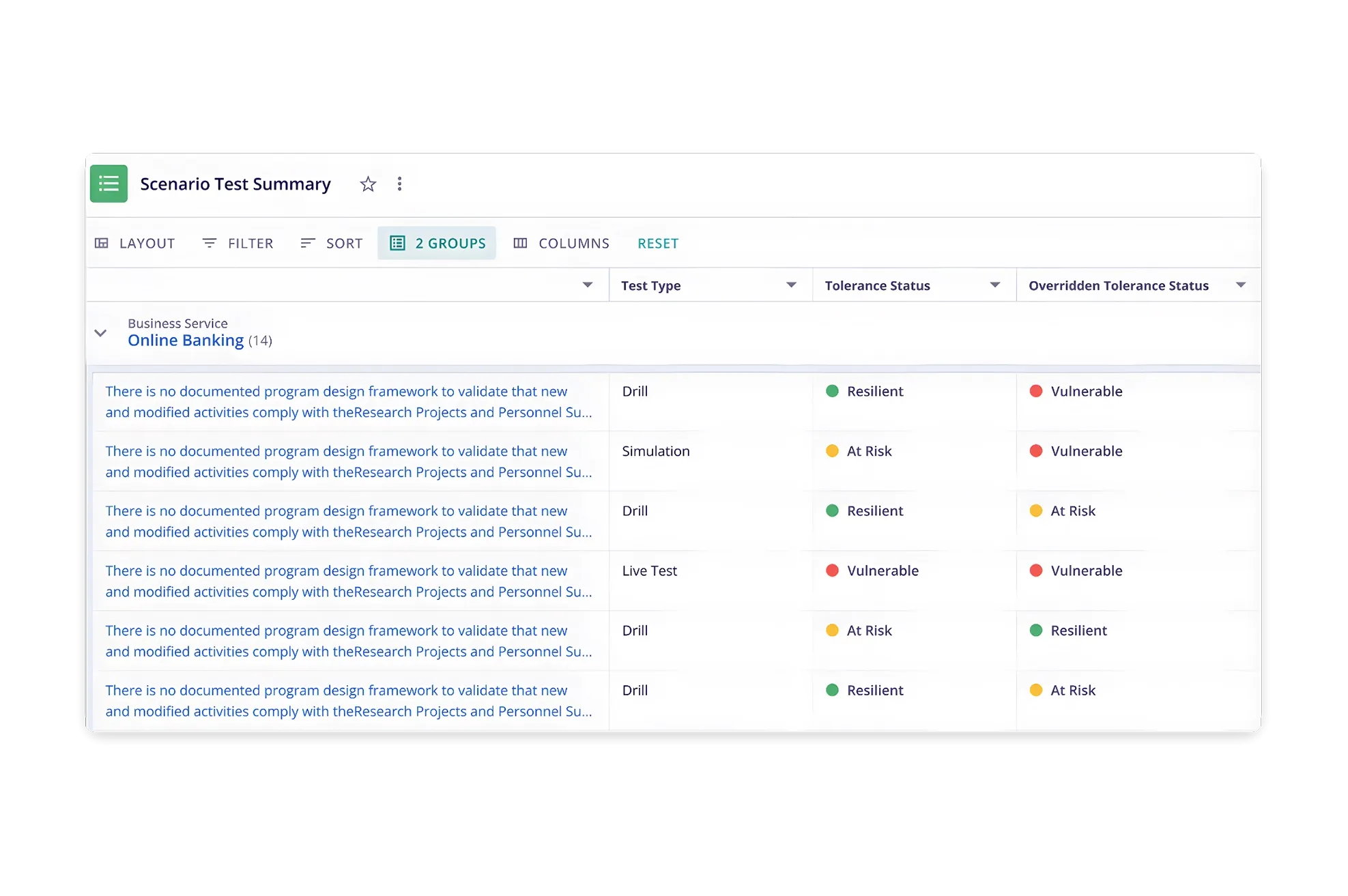

Conduct Scenario Analysis and Testing

Identify and document plausible scenarios that can impact critical business operations. Test each of these scenarios through simulations. Record the learnings from these scenario testing exercises for further review and analysis. Refine and enhance the organization's operational resilience strategy based on these learnings, including updating response plans, improving communication protocols, and strengthening mitigation measures.

Ensure Business Continuity and Manage Crisis Better

Create, maintain, and manage continuity plans from pre-defined templates. Improve visibility by linking these plans to critical IT assets, business processes, locations, controls, and key contacts. Efficiently create and maintain emergency communications trees and distribution lists, as well as emergency notification templates across more than 25 distinct communications channels to ensure business-critical functions continue to operate.

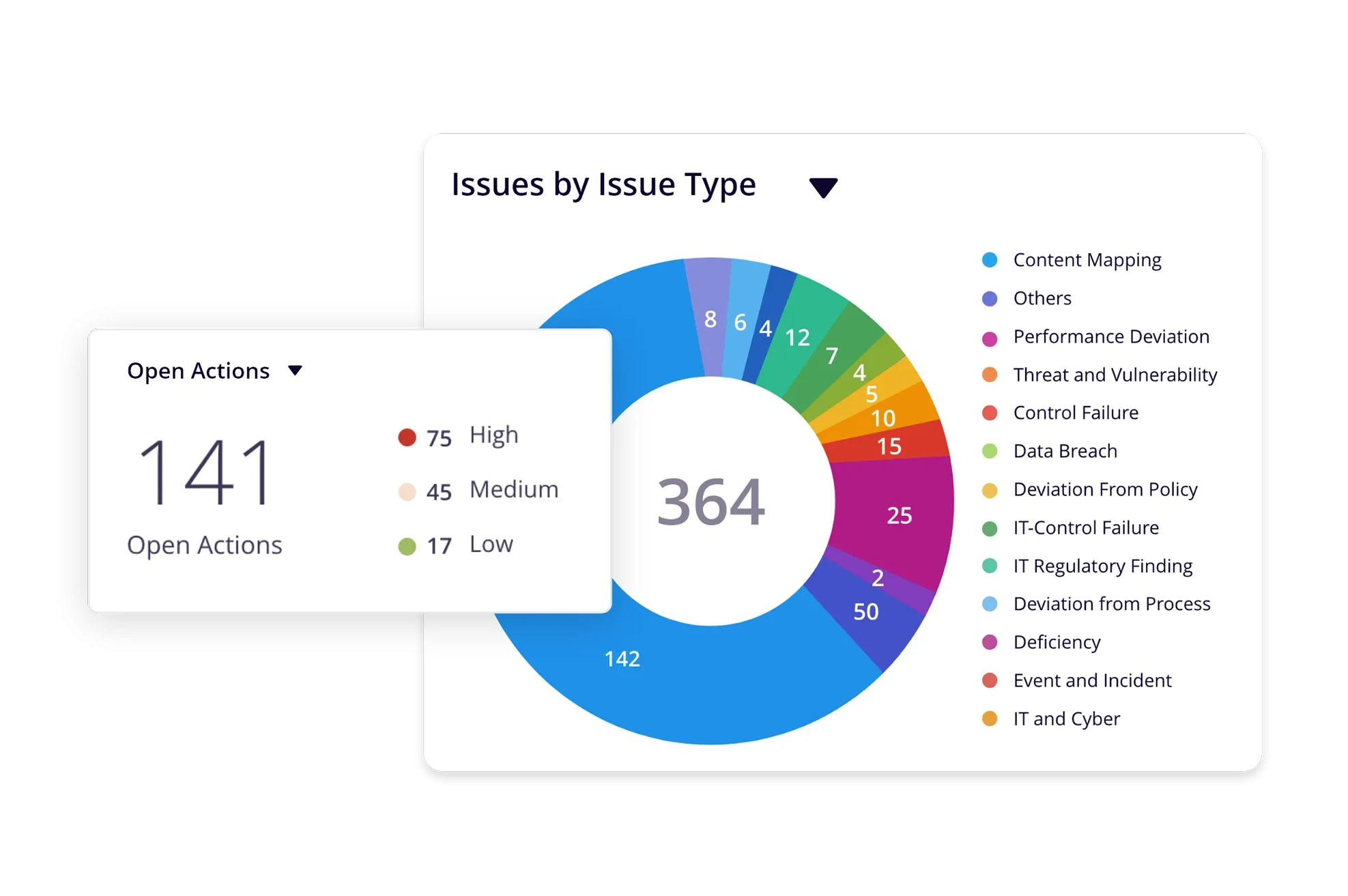

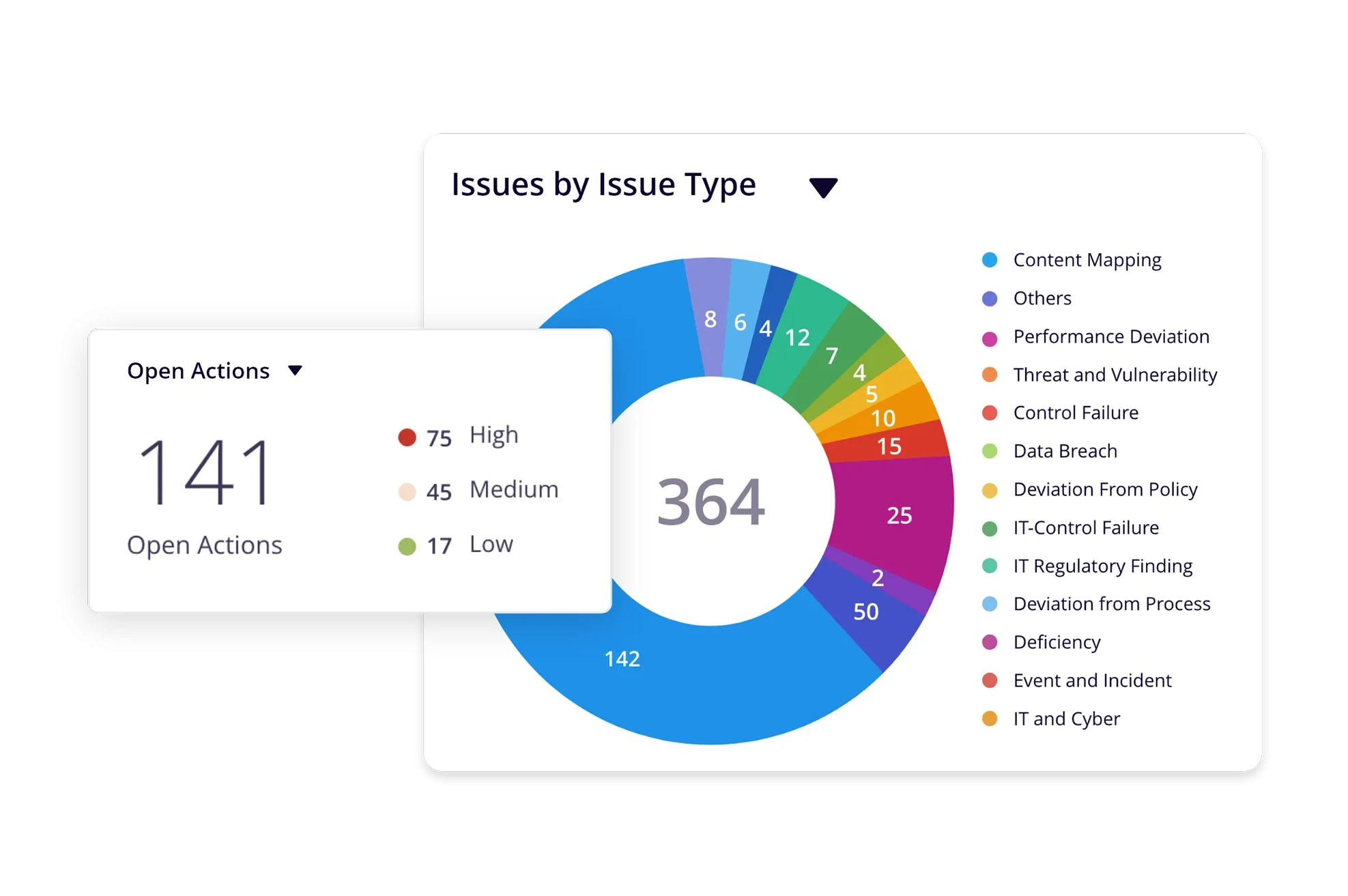

Leverage AI-Powered Issue and Action Management

Report and manage issues and action plans triggered by risk and resilience assessments, scenario testing, and business impact analysis. Leverage AI capabilities to eliminate duplication of issues and expedite issue remediation across operational risk, cyber risk, business continuity, and third-party risk management programs. Define and track the sequence of events to ensure business recovery and program performance accountability.

How Our Operational Resilience Software Benefits You

- Reduce time in creating IT and cyber policies and aligning them with regulations. Ensure compliance through timely communication, attestations, and evidence collection, while efficiently managing exceptions and proactively identifying potential policy violations across the organization.

Frequently Asked Questions

Operational Resilience Management Software helps organizations prepare for, respond to, and recover from disruptions- whether they’re caused by cyber incidents, supply chain issues, system outages, or even natural disasters. Instead of treating these events as one-off emergencies, the software allows you to build resilience into your business model. This way, you're not just reacting when things go wrong - you’re identifying vulnerabilities and strengthening your ability to adapt under pressure. With visibility, structure, and automation, it becomes easier to ensure that your operations stay on track, even when the unexpected happens.

Operational resilience eventually boils down to ensuring your business can continue to deliver critical services no matter what comes your way. Whether it's a cyberattack, a vendor failure, or a market shock, disruptions today are more frequent and far-reaching than ever before. Being resilient means you can absorb these hits, recover faster, and continue to serve customers with minimal interruption. It also protects your brand reputation, boosts stakeholder confidence, and strengthens internal decision-making. In a world where trust and continuity matter more than ever, operational resilience gives you a stark competitive edge. It shifts your mindset from short-term firefighting to long-term preparedness - and that makes all the difference.

Operational Resilience Software plays a critical role in helping you stay compliant with growing regulatory expectations across industries. Frameworks like DORA, PRA, FFIEC, and others increasingly require organizations to map critical business services, assess impact tolerances, and prove they can recover within acceptable timeframes. This software gives you the tools to do exactly that - with automated mapping, scenario testing, impact analysis, and detailed audit trails. It streamlines evidence collection and reporting so you're always ready for scrutiny, whether from regulators, auditors, or internal stakeholders. And because it keeps your resilience activities centralized and transparent, it not only supports compliance but helps turn it into a driver of broader operational improvement.

Operational resilience software is a technology solution that assists organizations in managing and strengthening their operational resilience programs. By bringing all aspects of the operational resilience framework on a single unified platform, it enhances enterprise-wide risk visibility, and enables effective mitigation and faster recovery from adverse risk events.

Operational resilience software should include features for risk assessment and management, incident tracking and response, business continuity planning, resilience testing, compliance management, data analytics, and reporting. It should offer integration capabilities, a user-friendly interface, and scalability to meet the needs of organizations. With these features, operational resilience software empowers organizations to manage and enhance their resilience capabilities, ensuring business continuity and safeguarding critical assets and operations.

Operational resilience management is a broader approach aimed at building resilience and ensuring continuity of operations in the face of disruptions, while Operational Risk Management (ORM) focuses on managing specific risks to prevent disruptions. While ORM deals with risk mitigation, Operational Resilience Management deals with resilience-building and continuity planning.

Operational resilience software is essential due to the growing complexity of business environment and increasing disruptions. It offers centralized management for risk assessment, incident response, and business continuity planning and automates repeatable tasks providing better efficiency. By enhancing risk visibility, facilitating efficient incident management, and supporting compliance, it ensures organizations can adapt and recover swiftly, maintaining business continuity and safeguarding critical operations.