Introduction

Modern enterprises operate in a market disrupted by accelerating climate change, growing inequality, pollution, and conflict. Concerted action to address these challenges is now more critical than ever before. While global leaders have declared their intent to tackle issues like climate change, there is now increasing demand for enterprises to do their part in meeting emission reduction targets, ensuring equality in the workplace, and following through on the promise of corporate governance. Key stakeholders including customers, investors, and regulators are demanding greater action and accountability, and the consequences of failing to do so are severe. In fact, for the first time in modern history, the purpose of an enterprise has expanded from just making profits to including social, environmental, and ethical responsibilities. According to the International Finance Corporation, companies with good ESG practices outperformed those without by 210 points on return on equity and 110 points on return on assets.

There is also a question of risk. Businesses today operate in a heightened risk landscape, and it now includes environmental and social risks as well. Consequently, ESG compliance and reporting is now a regulatory requirement, and managing ESG reporting and disclosures is a critical business imperative. Organizations need comprehensive strategies that encompass ESG best practices and frameworks and robust technology platforms to track and manage regulations. Aligning ESG with the larger GRC practice is an effective strategy that will help businesses keep pace with regulations as they emerge.

This guide has been designed as a ready reckoner for you to understand the significance of ESG, know more about ESG requirements, and learn how to choose one that works for you.

What is ESG?

Environmental, social, and governance factors can have a significant impact on an organization as they are no longer evaluated on the basis of their profits alone, but also on their carbon footprint, diversity, equity, and governance. According to the World Economic Forum's 2023 Global Risk Report, six out of the top ten risks over the next decade are environmental risks. There are increasing number of standards and frameworks being introduced to ensure ESG goals are met and reporting standards adhered to. Non-compliance with these regulations bears serious consequences. Ensuring seamless ESG reporting is now a business imperative and organizations must consider implementing an integrated strategy for ensuring compliance. A comprehensive and robust ESG solution can help the organization meet regulatory requirements, keep track of emerging regulations and changes within frameworks and drive sustainable growth by ensuring environmentally and socially responsible practices.

Key ESG Disclosure Frameworks

There are several regional and international regulations, frameworks, and standards pertaining to ESG. But it is a relatively new area of focus and regulations are still evolving. The four most important ESG reporting standards and regulations are:

Taskforce on Climate-related Financial Disclosures (TCFD)

Created in 2017, TCFD is a framework for organizations to disclose the impact of climate change on their finances and operations. It aims to help consumers understand how organizations assess climate-related risks and opportunities. It covers four categories – governance, strategy, risk management, and targets and measurements. TCFD provides guidelines on the kind of data to be reported but does not specify the exact metrics that companies must adhere to. This framework can be adopted by organizations across all sectors. Other frameworks and standards like GRI and SASB are aligned to the TCFD.

Sustainability Accounting Standards Board (SASB)

These focus on the sustainability risks that may impact a company’s financial health. SASB covers 77 industries with a focus on the environmental, social, and governance factors that can have a bearing on financial performance. These standards are designed to provide investors and capital providers with the information they need for decision-making.

Science Based Targets Initiative (SBTi)

World leaders have committed to cutting down carbon emissions to achieve net zero targets. The SBTi aims to show organizations the path they need to follow to achieve their emission reduction goals. It defines and promotes scientific best practices that companies can use to set their targets. The initiative also evaluates and approves an organization’s emission reduction criteria and targets.

Why Do I Need an ESG Solution?

An organization’s focus on the environmental, social, and governance factors is no longer a nice-to-have practice but a business imperative that is directly linked to its reputation and profits.

ESG is a relatively new concern and regulators across the world are working to address key concerns as they emerge and evolve. As a result, there are a number of frameworks and standards that organizations must adhere to. Also, since these regulations are still evolving, organizations must keep pace with the changes being made.

In Europe, the new Sustainable Financial Disclosure Regulation (SFDR) and the proposed Corporate Sustainability Reporting Directive (CSRD) will make sustainability reporting mandatory. In the UK, large organizations will be required to report on climate risks by 2025. And in the US, the SEC recently announced the creation of a Climate and ESG Taskforce that will proactively identify ESG-related misconduct. ESG Taskforce also recently approved a proposal by Nasdaq that requires listed organizations to show that their board of directors is diverse.

An integrated, comprehensive ESG solution will help your organization ensure compliance and effectively manage ESG-related tasks. Such a solution can help your organization define and manage ESG standards, frameworks, metrics, disclosure requirements, and link standards to different organizational entities. You can automate data collection and aggregation and leverage real-time analytics and comprehensive reports and dashboards. You can use the solution to keep track of regulatory changes and risks for better decision-making.

Case in Point

If an organization does not reduce greenhouse gas emissions, they run the risk of facing several challenges including a drop in credit ratings, share price loss, litigation, higher taxes, and even sanctions. Similarly, an organization that does not improve employee wages may have to contend with low productivity, and high attrition which in the long run will negatively impact shareholder value.

What Software Should I Choose for ESG Management?

When it comes to ESG management, a siloed, fragmented, and manual approach is inefficient and prone to errors. Our research finds that several organizations depend on basic office productivity software and point solutions for their ESG risk and compliance management requirements.

Using basic office productivity tools or even point solutions to manage ESG will only result in blind spots and an incomplete view of the landscape and your organization’s compliance strategy. Such solutions cannot be easily configured to your specific requirements and cannot be scaled up easily to identify new risks. And the deployment of multiple point solutions that address only specific aspects of ESG will lead to an unnecessarily complex and inefficient compliance infrastructure.

A comprehensive, integrated, and connected solution that can collate data from internal and external sources to provide real-time insights into the risk landscape and compliance practices is the best way forward. Such a solution can cut through silos to provide a contextual and collaborative view of the ESG ecosystem via effective visualization tools and dashboards. An integrated solution is critical for empowering the leadership team with real-time insights for data-driven and risk-aware decision-making.

Before deploying an ESG solution check if:

- Your existing solution and strategy are able to meet your ESG goals

- There are persistent challenges that need to be addressed

- The existing solution is delivering the intended results

- Your existing strategy can support future needs

- You are confident about your existing ESG approach

Key Capabilities of a Robust ESG Solution

What Questions Should I Ask Before Buying an ESG Solution?

ESG is a relatively new area of regulatory focus, driven by the escalating climate crisis and social inequities and a sharper focus on corporate action on these fronts. As ESG standards and frameworks emerge and evolve and reporting quickly becomes mandatory, how can CXOs choose a solution that can keep pace with the changes and ensure compliance and reporting?

Any organization starting out on its ESG journey must begin with an in-depth analysis of the organization’s ESG strategy and outline the specific requirements for reporting and compliance and challenges if any. You should also ask some of the questions listed below to identify what you require of an ESG solution:

- How will this solution help me identify, manage, and mitigate ESG risks faster, more so in an increasingly interconnected world?

- How will the solution help me stay ahead of regulatory changes?

- Does it support ESG risk management for third and fourth parties?

- Does the system support automation of ESG risk and compliance?

- Is it intuitive enough to be adopted quickly and easy enough to be configured?

- Can it be integrated with other enterprise systems to provide a more holistic view of risks?

- Does the software come with standard report templates for ESG metrics, risk reports, trend charts, and graphics that I can use to generate board-level reports? What analytics capabilities does the solution provide?

Getting Buy-in From the Decision Makers

Even a decade ago, ESG as a compliance practice was almost nonexistent. Today it is not only vital for growth and profitability but also a highly complex field necessitating constant vigilance to ensure adherence to emerging standards. Consequently, there is some confusion and a lack of understanding of what ESG really means for the organization.

Buying and implementing an integrated ESG solution is only one step towards ensuring enterprise-wide ESG awareness and practice. Building an organizational culture of ESG awareness must start from the top with CXOs understanding and endorsing its importance. Enterprise leaders must appreciate the significance of ESG practices in ensuring profitability and growth while protecting reputation and image. But more importantly, they must understand that the ultimate purpose behind ESG is to ensure the future is sustainable, safe, and equal for the planet and all its people.

An aware and empowered leadership team is the first step in embedding ESG awareness into the organizational culture. Like with all other aspects of risk management, effective ESG management too requires every individual across the organization to be cognizant of the risks, and fallouts of non-compliance with relevant frameworks. Every employee must also know the long-term importance of ESG practices. Education and communication programs are vital for achieving this.

MetricStream ESGRC

Enabling Growth with Purpose

MetricStream’s ESGRC product enables a simplified and streamlined approach toward meeting all organizational requirements relating to Environmental, Social, Governance, Risk and Compliance (ESGRC). Built on the industry-leading MetricStream Platform, the product enables organizations to define and manage ESG standards, frameworks, and disclosure requirements, link standards to organizational entities, automate the collection and aggregation of data, and report through real-time analytics and dashboards. The centralized risk repository helps manage risks related to ESG and carry out essential ESG assessments across business lines and the third-party vendor ecosystem. Real-time visibility into processes and metrics and AI-powered automated identification and correction of related issues, results in seamless, structured, error-free ESG monitoring and reporting across all business lines. The secure and cloud-native product includes business APIs that combine internal and external data to provide contextual intelligence for better decision-making.

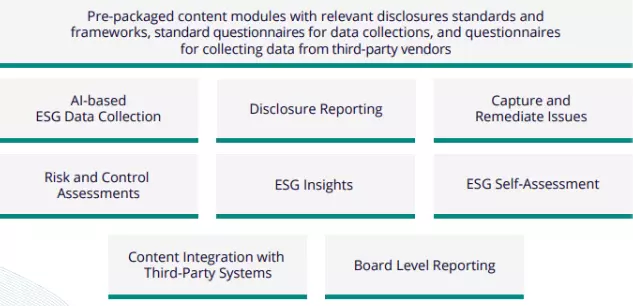

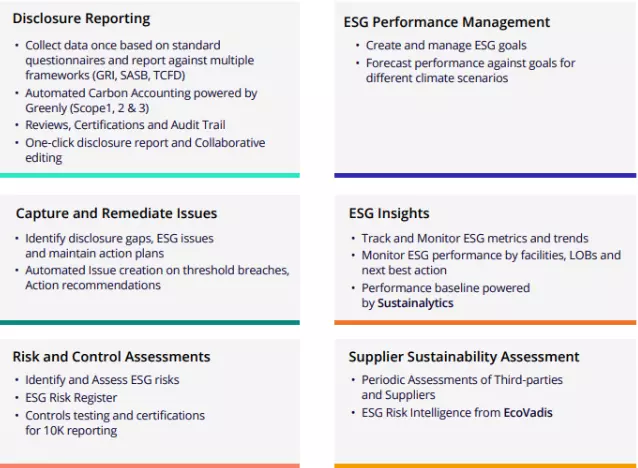

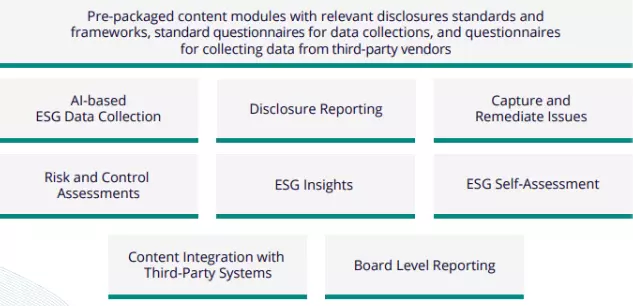

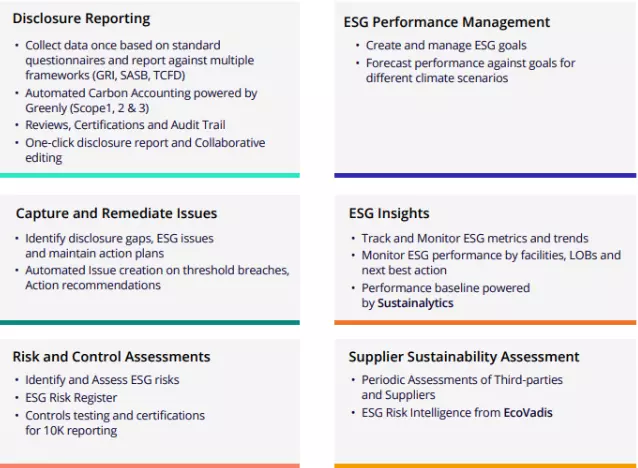

MetricStream ESGRC Capabilities

Summary

The world is running out of time to address the escalating climate crisis and social inequities.

And understandably there is now greater scrutiny and demand for corporate responsibility and accountability on these matters. A sharper focus on ESG is now a critical requirement and organizations must quickly implement an integrated ESG strategy to keep pace with the rapidly evolving and complex regulatory landscape. We hope this buyer’s guide will help you establish a comprehensive ESG strategy with a robust solution that can help meet your organization’s compliance requirements.

MetricStream has been a leader in the risk management and compliance space for over two decades. We would be happy to answer any questions you may have about strengthening your ESG strategy, preparing for upcoming regulations, and ensuring seamless reporting.

Modern enterprises operate in a market disrupted by accelerating climate change, growing inequality, pollution, and conflict. Concerted action to address these challenges is now more critical than ever before. While global leaders have declared their intent to tackle issues like climate change, there is now increasing demand for enterprises to do their part in meeting emission reduction targets, ensuring equality in the workplace, and following through on the promise of corporate governance. Key stakeholders including customers, investors, and regulators are demanding greater action and accountability, and the consequences of failing to do so are severe. In fact, for the first time in modern history, the purpose of an enterprise has expanded from just making profits to including social, environmental, and ethical responsibilities. According to the International Finance Corporation, companies with good ESG practices outperformed those without by 210 points on return on equity and 110 points on return on assets.

There is also a question of risk. Businesses today operate in a heightened risk landscape, and it now includes environmental and social risks as well. Consequently, ESG compliance and reporting is now a regulatory requirement, and managing ESG reporting and disclosures is a critical business imperative. Organizations need comprehensive strategies that encompass ESG best practices and frameworks and robust technology platforms to track and manage regulations. Aligning ESG with the larger GRC practice is an effective strategy that will help businesses keep pace with regulations as they emerge.

This guide has been designed as a ready reckoner for you to understand the significance of ESG, know more about ESG requirements, and learn how to choose one that works for you.

Environmental, social, and governance factors can have a significant impact on an organization as they are no longer evaluated on the basis of their profits alone, but also on their carbon footprint, diversity, equity, and governance. According to the World Economic Forum's 2023 Global Risk Report, six out of the top ten risks over the next decade are environmental risks. There are increasing number of standards and frameworks being introduced to ensure ESG goals are met and reporting standards adhered to. Non-compliance with these regulations bears serious consequences. Ensuring seamless ESG reporting is now a business imperative and organizations must consider implementing an integrated strategy for ensuring compliance. A comprehensive and robust ESG solution can help the organization meet regulatory requirements, keep track of emerging regulations and changes within frameworks and drive sustainable growth by ensuring environmentally and socially responsible practices.

There are several regional and international regulations, frameworks, and standards pertaining to ESG. But it is a relatively new area of focus and regulations are still evolving. The four most important ESG reporting standards and regulations are:

Taskforce on Climate-related Financial Disclosures (TCFD)

Created in 2017, TCFD is a framework for organizations to disclose the impact of climate change on their finances and operations. It aims to help consumers understand how organizations assess climate-related risks and opportunities. It covers four categories – governance, strategy, risk management, and targets and measurements. TCFD provides guidelines on the kind of data to be reported but does not specify the exact metrics that companies must adhere to. This framework can be adopted by organizations across all sectors. Other frameworks and standards like GRI and SASB are aligned to the TCFD.

Sustainability Accounting Standards Board (SASB)

These focus on the sustainability risks that may impact a company’s financial health. SASB covers 77 industries with a focus on the environmental, social, and governance factors that can have a bearing on financial performance. These standards are designed to provide investors and capital providers with the information they need for decision-making.

Science Based Targets Initiative (SBTi)

World leaders have committed to cutting down carbon emissions to achieve net zero targets. The SBTi aims to show organizations the path they need to follow to achieve their emission reduction goals. It defines and promotes scientific best practices that companies can use to set their targets. The initiative also evaluates and approves an organization’s emission reduction criteria and targets.

An organization’s focus on the environmental, social, and governance factors is no longer a nice-to-have practice but a business imperative that is directly linked to its reputation and profits.

ESG is a relatively new concern and regulators across the world are working to address key concerns as they emerge and evolve. As a result, there are a number of frameworks and standards that organizations must adhere to. Also, since these regulations are still evolving, organizations must keep pace with the changes being made.

In Europe, the new Sustainable Financial Disclosure Regulation (SFDR) and the proposed Corporate Sustainability Reporting Directive (CSRD) will make sustainability reporting mandatory. In the UK, large organizations will be required to report on climate risks by 2025. And in the US, the SEC recently announced the creation of a Climate and ESG Taskforce that will proactively identify ESG-related misconduct. ESG Taskforce also recently approved a proposal by Nasdaq that requires listed organizations to show that their board of directors is diverse.

An integrated, comprehensive ESG solution will help your organization ensure compliance and effectively manage ESG-related tasks. Such a solution can help your organization define and manage ESG standards, frameworks, metrics, disclosure requirements, and link standards to different organizational entities. You can automate data collection and aggregation and leverage real-time analytics and comprehensive reports and dashboards. You can use the solution to keep track of regulatory changes and risks for better decision-making.

Case in Point

If an organization does not reduce greenhouse gas emissions, they run the risk of facing several challenges including a drop in credit ratings, share price loss, litigation, higher taxes, and even sanctions. Similarly, an organization that does not improve employee wages may have to contend with low productivity, and high attrition which in the long run will negatively impact shareholder value.

When it comes to ESG management, a siloed, fragmented, and manual approach is inefficient and prone to errors. Our research finds that several organizations depend on basic office productivity software and point solutions for their ESG risk and compliance management requirements.

Using basic office productivity tools or even point solutions to manage ESG will only result in blind spots and an incomplete view of the landscape and your organization’s compliance strategy. Such solutions cannot be easily configured to your specific requirements and cannot be scaled up easily to identify new risks. And the deployment of multiple point solutions that address only specific aspects of ESG will lead to an unnecessarily complex and inefficient compliance infrastructure.

A comprehensive, integrated, and connected solution that can collate data from internal and external sources to provide real-time insights into the risk landscape and compliance practices is the best way forward. Such a solution can cut through silos to provide a contextual and collaborative view of the ESG ecosystem via effective visualization tools and dashboards. An integrated solution is critical for empowering the leadership team with real-time insights for data-driven and risk-aware decision-making.

Before deploying an ESG solution check if:

- Your existing solution and strategy are able to meet your ESG goals

- There are persistent challenges that need to be addressed

- The existing solution is delivering the intended results

- Your existing strategy can support future needs

- You are confident about your existing ESG approach

Key Capabilities of a Robust ESG Solution

ESG is a relatively new area of regulatory focus, driven by the escalating climate crisis and social inequities and a sharper focus on corporate action on these fronts. As ESG standards and frameworks emerge and evolve and reporting quickly becomes mandatory, how can CXOs choose a solution that can keep pace with the changes and ensure compliance and reporting?

Any organization starting out on its ESG journey must begin with an in-depth analysis of the organization’s ESG strategy and outline the specific requirements for reporting and compliance and challenges if any. You should also ask some of the questions listed below to identify what you require of an ESG solution:

- How will this solution help me identify, manage, and mitigate ESG risks faster, more so in an increasingly interconnected world?

- How will the solution help me stay ahead of regulatory changes?

- Does it support ESG risk management for third and fourth parties?

- Does the system support automation of ESG risk and compliance?

- Is it intuitive enough to be adopted quickly and easy enough to be configured?

- Can it be integrated with other enterprise systems to provide a more holistic view of risks?

- Does the software come with standard report templates for ESG metrics, risk reports, trend charts, and graphics that I can use to generate board-level reports? What analytics capabilities does the solution provide?

Even a decade ago, ESG as a compliance practice was almost nonexistent. Today it is not only vital for growth and profitability but also a highly complex field necessitating constant vigilance to ensure adherence to emerging standards. Consequently, there is some confusion and a lack of understanding of what ESG really means for the organization.

Buying and implementing an integrated ESG solution is only one step towards ensuring enterprise-wide ESG awareness and practice. Building an organizational culture of ESG awareness must start from the top with CXOs understanding and endorsing its importance. Enterprise leaders must appreciate the significance of ESG practices in ensuring profitability and growth while protecting reputation and image. But more importantly, they must understand that the ultimate purpose behind ESG is to ensure the future is sustainable, safe, and equal for the planet and all its people.

An aware and empowered leadership team is the first step in embedding ESG awareness into the organizational culture. Like with all other aspects of risk management, effective ESG management too requires every individual across the organization to be cognizant of the risks, and fallouts of non-compliance with relevant frameworks. Every employee must also know the long-term importance of ESG practices. Education and communication programs are vital for achieving this.

Enabling Growth with Purpose

MetricStream’s ESGRC product enables a simplified and streamlined approach toward meeting all organizational requirements relating to Environmental, Social, Governance, Risk and Compliance (ESGRC). Built on the industry-leading MetricStream Platform, the product enables organizations to define and manage ESG standards, frameworks, and disclosure requirements, link standards to organizational entities, automate the collection and aggregation of data, and report through real-time analytics and dashboards. The centralized risk repository helps manage risks related to ESG and carry out essential ESG assessments across business lines and the third-party vendor ecosystem. Real-time visibility into processes and metrics and AI-powered automated identification and correction of related issues, results in seamless, structured, error-free ESG monitoring and reporting across all business lines. The secure and cloud-native product includes business APIs that combine internal and external data to provide contextual intelligence for better decision-making.

MetricStream ESGRC Capabilities

The world is running out of time to address the escalating climate crisis and social inequities.

And understandably there is now greater scrutiny and demand for corporate responsibility and accountability on these matters. A sharper focus on ESG is now a critical requirement and organizations must quickly implement an integrated ESG strategy to keep pace with the rapidly evolving and complex regulatory landscape. We hope this buyer’s guide will help you establish a comprehensive ESG strategy with a robust solution that can help meet your organization’s compliance requirements.

MetricStream has been a leader in the risk management and compliance space for over two decades. We would be happy to answer any questions you may have about strengthening your ESG strategy, preparing for upcoming regulations, and ensuring seamless reporting.