GRC Simplified.

Outcomes Amplified.

Today’s dynamic world is becoming more complex by the day, as risks, regulations, and audit needs grow, and governance, risk, and compliance (GRC) professionals deal with multiple low-value tasks.

Risk assessors, compliance leaders, cyber risk experts, auditors — your goal is to drive strategic outcomes, yet you're burdened with repetitive work like gathering evidence and completing documentation. Manually filling out multiple forms, templates, and assessments – it all leads to inefficiency and frustration.

It doesn’t have to be this hard!

At MetricStream, our vision is to make GRC easier for the millions of people around the world who participate in it and drive its outcomes.

We simplify GRC in an increasingly complex world, helping organizations navigate audits, mitigate risks, and ensure compliance with our AI-First Risk, Compliance, Audit, Cyber, and Resilience solutions — all on a single, low-code/no-code GRC cloud platform trusted by over 1 million professionals across 35+ countries.

Our Agentic and Generative AI specifically designed for GRC automatically captures risk, compliance, and audit data, performs assessments, conducts testing, generates insights, and personalizes applications.

With MetricStream’s unmatched expertise, powerful AI, and trusted GRC solutions, you can drive better outcomes. Make smarter decisions. And leave more time for what really matters -- protecting and growing your business.

It’s time to simplify how you manage GRC and amplify the impact you deliver.

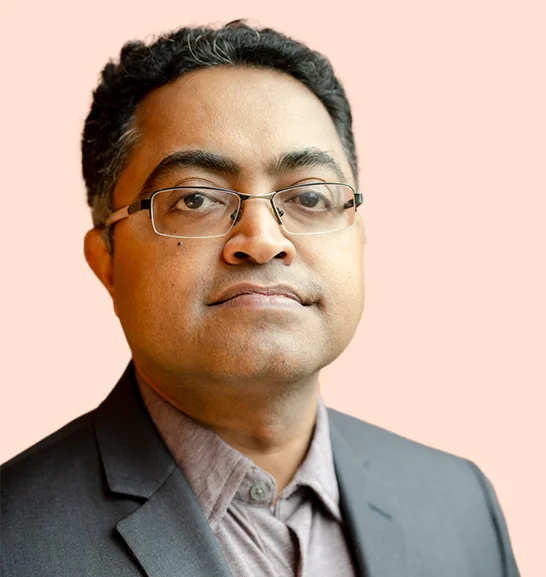

Our Vision

Make GRC easier for the millions of people around the world who participate in and drive its outcomes.

Our Mission

We simplify GRC in an increasingly complex world, driving powerful outcomes through AI.