AI-Powered GRC Solutions Enabling Agility & Resilience

AI Powered Solutions Enabling Agility & Resilience

Accelerate Growth, Drive Risk-Aware Decisions..

Reduce losses and risk events with forward-looking risk visibility. Enable a modern and integrated risk management approach with real-time aggregated risk intelligence and their impact on business objectives and investments.

Recognized as a GRC Leader by Industry Analysts

#12 in Chartis RiskTech 100 Report 2024

MetricStream Ranks #12 in Chartis RiskTech 100 Report 2024 and recognized as Category Leader in Enterprise Governance, Risk, and Compliance

Read more

Leader in Governance, Risk, and Compliance Platforms

MetricStream named a Leader in The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023

Read moreLeader in Chartis Research GRC Solutions

MetricStream named a Leader in Chartis Research GRC Solutions, 2023 Market Update and Vendor Landscape

Read moreRecognized as a GRC Leader by Industry Analysts

Hear From Our Customers

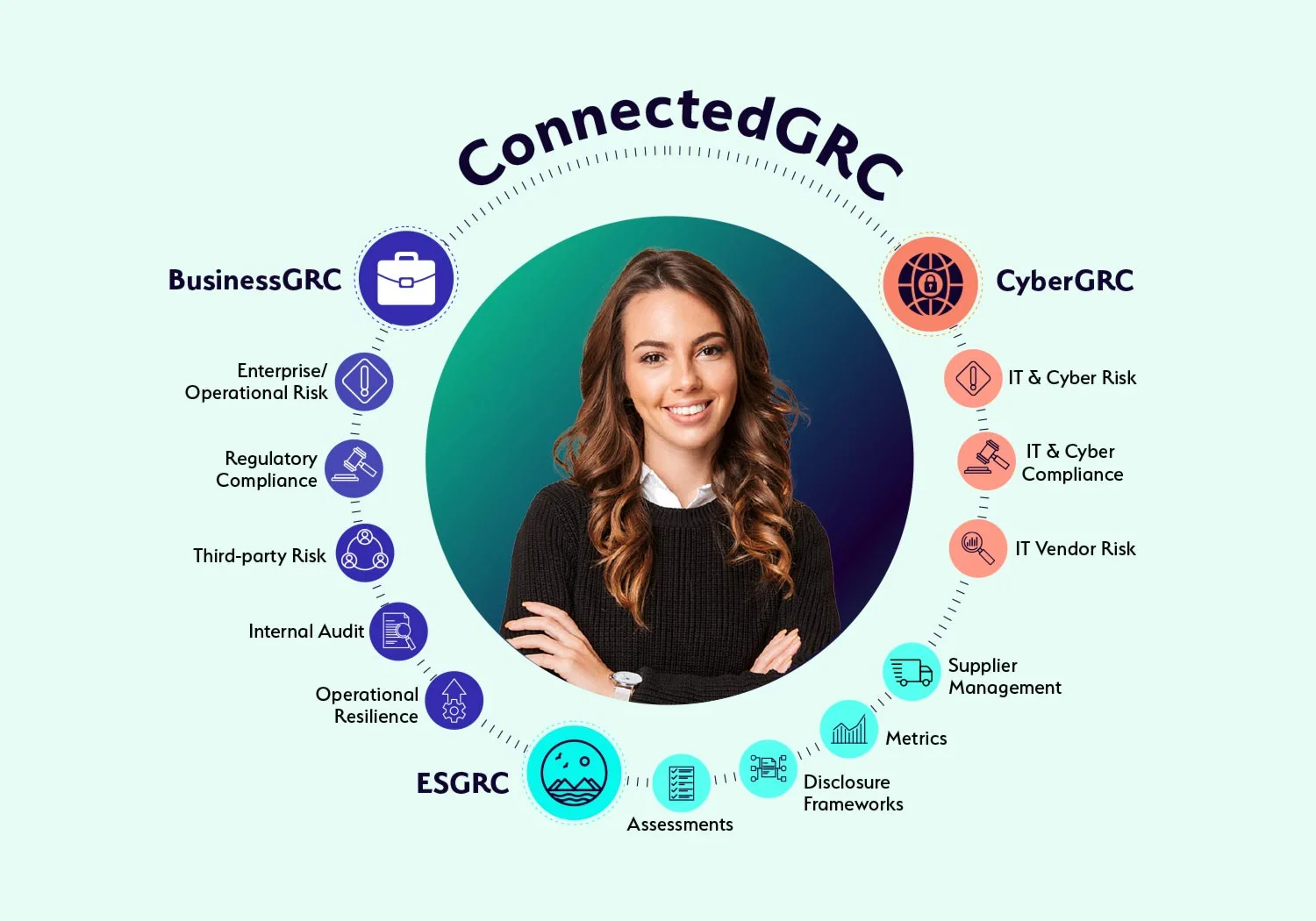

Why Choose a Connected GRC Platform?

Today’s dynamic enterprises require a connected to governance, risk, and compliance to better assess, manage, and mitigate risk across the enterprise. With MetricStream ConnectedGRC, your organization can:

Enhance decision-making with real-time insights into risk and compliance posture

Reduce risk exposure and losses, avoid risk of compliance violations, improve investments in growth, and gain a competitive advantage

Improve risk preparedness with better risk visibility and foresight through a proactive GRC approach