Introduction

With organizations continuously being subjected to both visible and obscure risks, there is a crucial need for comprehensive strategies to ward off potential crises. Unforeseen events can carve a dent in a company's market value, financial health, and reputation in no time.

Against this backdrop, the spotlight on preemptive risk management is brighter than ever, with risk documentation emerging as a strategic necessity for any organization's survival and success.

Key Takeaways

- Risk documentation is the well-defined process of recording potential risks and threats, enabling organizations to assess, monitor, and mitigate them effectively. It transforms abstract concerns into actionable data, crucial for corporate governance and strategic planning.

- Important risk documents include the risk management plan, risk register, risk analysis reports, risk mitigation plans, incident reports, and compliance documentation.

- Common challenges in risk documentation include maintaining relevance, ensuring accessibility, avoiding data overload, integrating with business processes, and securing stakeholder buy-in.

- Risk documents provide clarity, prioritize resource allocation, ensure regulatory compliance, and support informed decision-making. They are vital for avoiding unforeseen crises, financial losses, and reputational damage.

- Effective risk documentation equips organizations to anticipate and manage risks, and gain a competitive edge.

What is Risk Documentation?

Risk documentation is the systematic recording of all potential risks and threats that could detrimentally impact an organization, ranging from financial downturns and legal entanglements to technology breaches and operational hiccups. It’s a key element of corporate governance that ensures a detailed repository is in place, outlining what might go wrong, as well as housing critical analyses and mitigation strategies.

This disciplined approach aids in clarifying the diverse nature of risks, transforming intangible anxieties into structured data that can be actively managed.

Key Considerations for Building an Effective Risk Documentation Framework

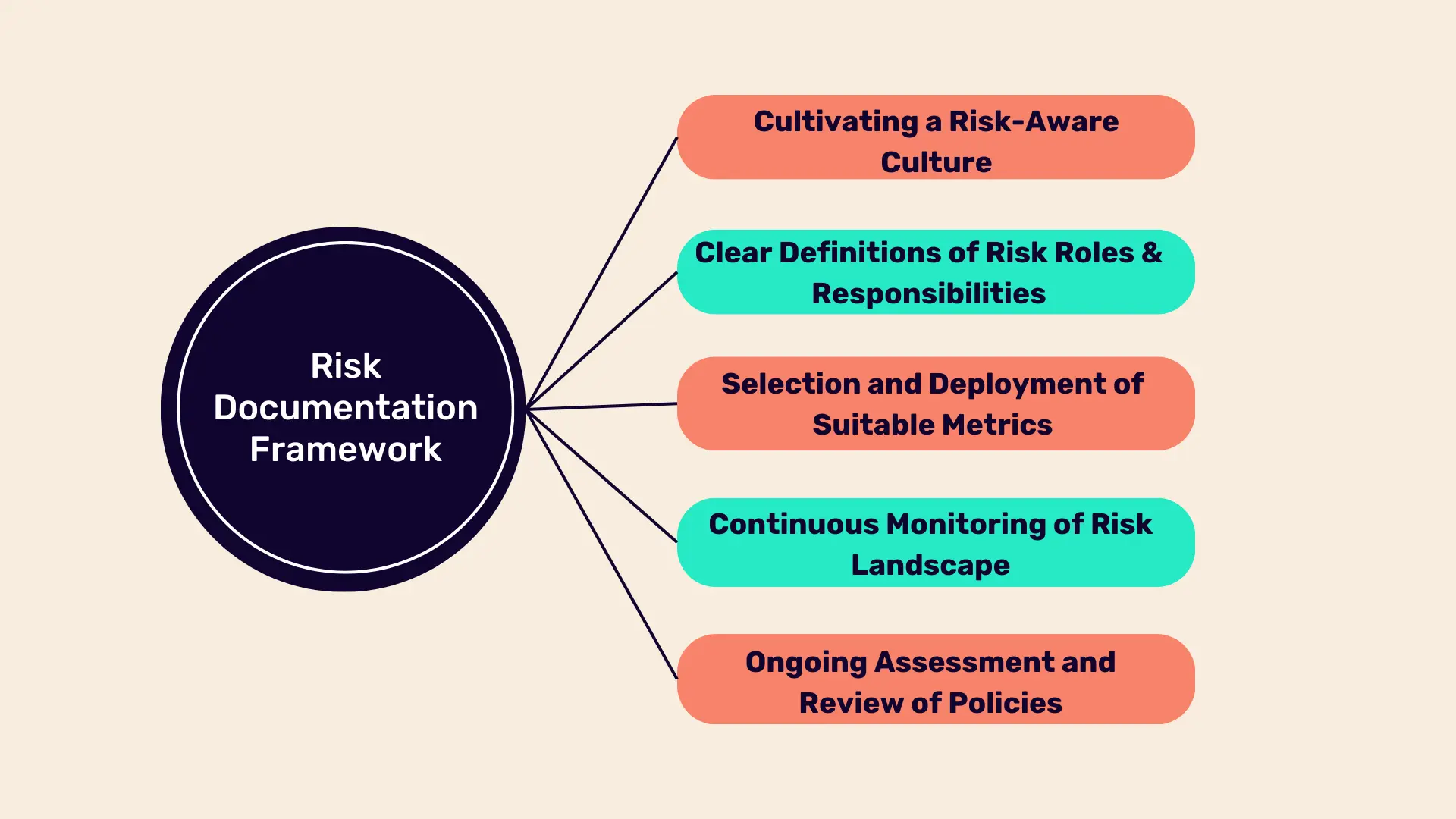

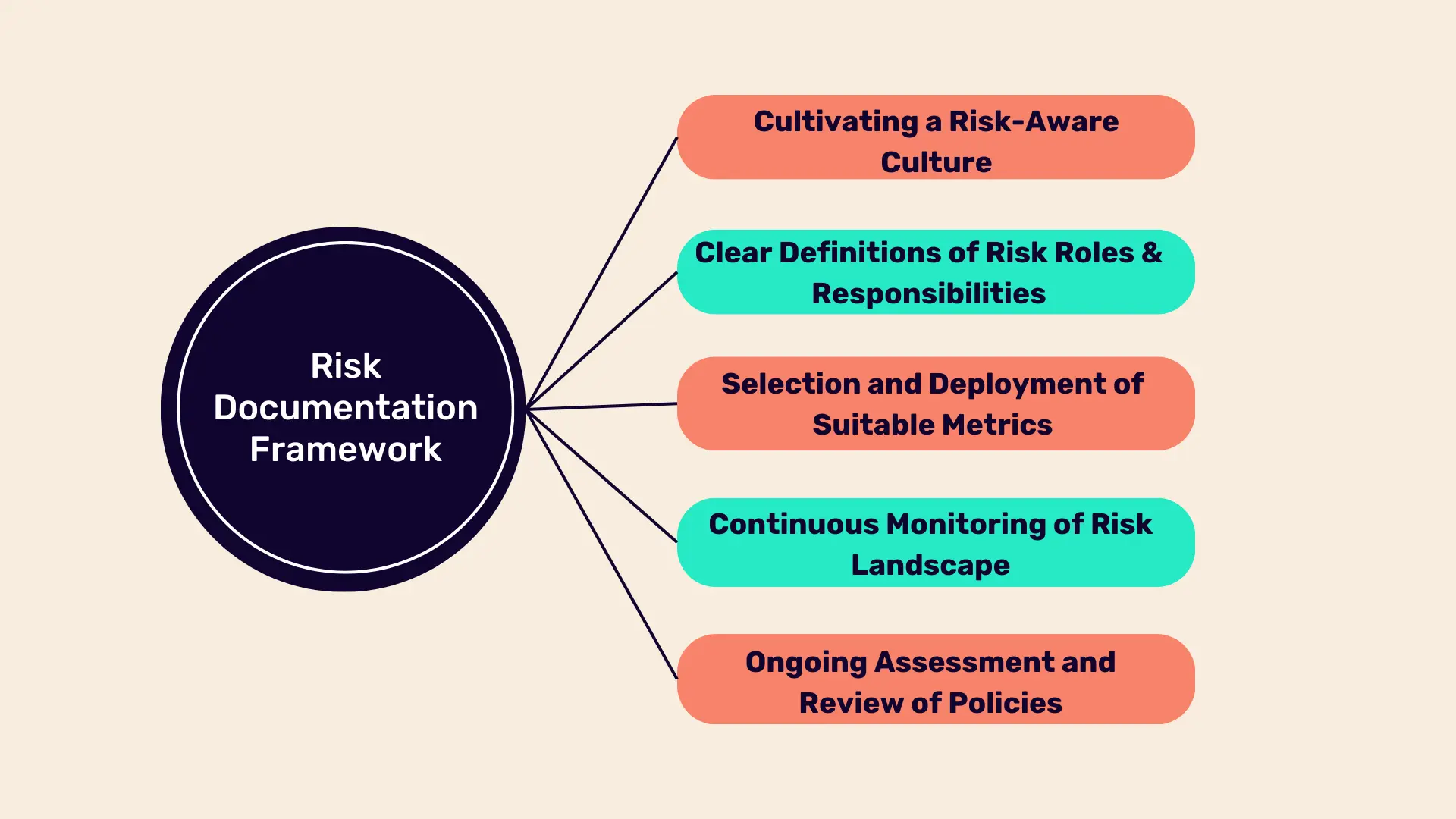

Here are the key considerations for building an effective and robust risk documentation framework:

Cultivating a Risk-Aware Culture:

This cultural groundwork lays the foundation for every subsequent action related to risk management. It involves prioritizing risk awareness at every level of the organization and embedding it into the corporate ethos. By ensuring that every stakeholder, from the board to the frontline employees, recognizes the importance of risk management, organizations can create a proactive stance toward identifying and addressing risks.

Clear Definitions of Risk Roles and Responsibilities:

Establishing crystal-clear risk roles and responsibilities is crucial. By explicitly documenting who owns what aspect of the risk management process, organizations pave the way for efficient and effective governance. This step is instrumental in building a framework where everyone knows their part in contributing to the organization's risk management goals.

Selection and Deployment of Suitable Metrics:

These metrics should be significant and directly related to both the performance and risk indicators that matter most to the organization. Regular assessment of these metrics is necessary to validate whether the risk documentation is serving its intended purpose, allowing for timely adjustments to be made.

Continuous Monitoring of Risk Landscape:

This process ensures that the organization remains agile and responsive to the evolving risk landscape. A well-defined process for identifying and recording emerging and peripheral risks efficiently plays a pivotal role in fine-tuning the risk documentation strategy.

Ongoing Assessment and Review of Policies:

Regular review of policies and procedures provides insights into the effectiveness and relevance of the current documentation. This includes reviewing incidents and loss data, analyzing escalations, and exceptions, performing root cause analysis, and more. Adjustments based on these reviews ensure that the organization’s risk mitigation strategies are deeply ingrained and reflective of its operational realities.

Types of Risk Documents

Here are the different types of risk documents that can come in handy for an organization:

Risk Management Plan:

This foundational document outlines your organization's risk management process, from risk identification and analysis to mitigation and monitoring strategies. It serves as a roadmap for managing risks throughout the project or business operation lifecycle.Risk Register:

Perhaps the most crucial of all risk documents, the risk register is a comprehensive log of identified risks, their severity, mitigation measures, and the current status of each risk. It's a living document that evolves as new risks emerge and existing risks are resolved.Risk Analysis Reports:

These detailed reports break down the potential impact and likelihood of identified risks. Risk analysis reports help prioritize risks and are essential for informed decision-making regarding resource allocation for risk mitigation.Risk Mitigation Plans:

Once risks are identified and prioritized, risk mitigation plans detail the specific steps and measures taken to reduce or eliminate the impacts of those risks. These plans are tailored to each identified risk and include timelines, responsible parties, and budget considerations.Incident Reports:

If a risk materializes into an event, incident reports provide a retrospective analysis of what happened, why it happened, and how similar incidents can be prevented in the future. These documents are vital for learning from past mistakes and fortifying risk management strategies.Compliance Documentation:

Compliance documents prove adherence to regulatory requirements and internal policies. They provide evidence of the organization's commitment to meeting legal, ethical, and regulatory standards, reducing the risk of non-compliance penalties and reputational damage.

Key Components of Risk Documentation

Effective risk documentation is foundational to any risk management program. It ensures that risks are consistently tracked, evaluated, and addressed, while also providing a clear record for accountability, audits, and continuous improvement. Proper documentation supports decision-making by making risk information transparent, structured, and easily accessible to stakeholders. Below are the key components every comprehensive risk document should include:

Risk Identification

This section clearly outlines each identified risk, including a unique ID or code, a brief description, and the category of risk (e.g., financial, operational, cybersecurity, regulatory). It provides a clear reference point for tracking and management.

Example: "Risk ID: CYB-001 – Unauthorized access to customer data via phishing attacks."Risk Source and Trigger

Detailing the origin of the risk — whether internal (e.g., outdated systems, human error) or external (e.g., market volatility, natural disasters) — helps in understanding its context. Including possible triggers highlights scenarios that could cause the risk to materialize.

Risk Likelihood and Impact Assessment

Documenting the probability of the risk occurring and its potential consequences is crucial. This may include:

- Qualitative ratings (e.g., High, Medium, Low)

- Quantitative scores or financial estimates

- Descriptions of the impact on operations, reputation, compliance, or financial performance

Risk Rating or Score

A risk score, often calculated using a matrix that considers both likelihood and impact, helps prioritize risks. This scoring helps teams quickly identify which risks require immediate action.

Example: Likelihood (High) x Impact (High) = Risk Score: 9 (Critical)Risk Owner

Identifying the person or department responsible for managing the risk ensures accountability. Risk owners are tasked with overseeing response plans and reporting on the risk’s status.

Risk Response Strategy

This component outlines the chosen mitigation approach, such as:

- Avoidance

- Reduction

- Transfer (e.g., insurance, outsourcing)

- Acceptance

Each strategy should include a rationale and be tied to the organization's risk appetite.

Mitigation Actions and Controls

Document the specific controls or activities being implemented to address the risk. This includes preventive, detective, and corrective controls, along with deadlines, resource allocation, and responsible parties.

Monitoring and Review Plan

Risks evolve over time, so the documentation should include how and when the risk will be reviewed. This might involve:

- Key Risk Indicators (KRIs)

- Review frequency (e.g., quarterly)

- Metrics or performance benchmarks

Residual Risk Assessment

After mitigation measures are in place, it’s important to document the residual risk — the level of risk that remains. This helps determine if further action is needed or if the risk falls within acceptable levels.

Supporting Evidence and Attachments

Include references to reports, audit results, compliance logs, or other documents that support the assessment and decisions. This strengthens the credibility of the documentation and facilitates audits.

Status and History

A log of status updates, changes in risk profile, and historical actions taken provides an audit trail. It also helps new stakeholders quickly understand the risk’s journey and current position.

By thoroughly documenting each of these components, organizations can ensure they have a clear, consistent, and actionable view of their risk landscape — one that enables timely decisions and improves enterprise-wide resilience.

Challenges of Risk Documentation

Below are some of the challenges companies face when dealing with the mammoth process of risk documentation:

Maintaining Relevance:

With the business landscape and external environment continuously changing, keeping risk documents up-to-date is a daunting task.

Solution: Implementing regular review cycles and assigning specific ownership for updates can ensure that documents remain relevant and reflective of the current risk landscape.

Ensuring Accessibility and Usability:

Often, risk documentation is stored in formats or locations that are not readily accessible or understandable to all stakeholders.

Solution: Leveraging centralized and user-friendly GRC platforms like MetricStream can enhance accessibility, making it easier for stakeholders to engage with risk documentation meaningfully.

Data Overload:

With vast amounts of data available, there's a risk of including too much detail in risk documents, making it challenging to distill actionable insights.

Solution: Prioritizing data and focusing on key metrics can streamline documentation, ensuring clarity and usability.

Integration with Business Processes:

Often, risk management processes and documentation are siloed from the core business operations.

Solution: Ensuring that risk management is integrated into the DNA of organizational processes through clear procedures and workflows can enhance the relevance and impact of risk documentation.

Securing Stakeholder Buy-in:

Engaging stakeholders and securing their buy-in for risk management initiatives can be challenging.

Solution: Clear communication of the value of risk management and how it aligns with broader organizational objectives can foster a culture of proactive risk management.

Why are Risk Documents Crucial For Any Organization?

Risk documents are crucial for any organization because they provide clarity on potential pitfalls, enable the prioritization of resources, ensure compliance with regulatory requirements, and support informed decision-making. By documenting risks, organizations can avoid unanticipated crises and financial losses, steering toward sustainable growth and success.

Let's delve into the pivotal reasons why risk documents hold importance for any entity:

Clarity and Understanding:

Risk documents clarify what might go wrong, providing a clear view of potential pitfalls. This understanding is critical in ensuring that all members of the organization are on the same page and can work towards common mitigation strategies.

Prioritization of Resources:

By documenting risks, organizations can prioritize resources, focusing on mitigating the risks with the highest probability of occurrence and the most severe potential impact. This efficient allocation of resources is indispensable for any business aiming to thrive.

Compliance and Regulatory Adherence:

Many industries are governed by strict regulatory requirements that mandate risk assessments and documentation. Failure to comply can result in severe penalties, making risk documentation not just prudent but obligatory.

Informed Decision-Making:

Equipped with a comprehensive risk document, decision-makers can make informed choices, weighing the potential risks against the anticipated rewards. This foresight is crucial for steering the organization towards sustainable growth and success.

A Consequence of Lacking Proper Documentation:

With adequate risk documentation, organizations are more likely to avoid unanticipated crises, financial losses, and damage to their reputation, which could have been mitigated or avoided with proper foresight and planning.

Risk Documentation Best Practices

Effective risk documentation is more than just record-keeping — it's a strategic tool that helps organizations track, assess, and respond to risks in a structured and consistent manner. Following best practices ensures that risk records are accurate, useful, and actionable, especially during audits, compliance reviews, or crisis response. Here are the key best practices to follow:

Use a Standardized Template

A consistent format across all risk documentation improves readability, simplifies reporting, and helps ensure that no critical information is overlooked. Include predefined fields such as risk description, owner, likelihood, impact, response strategy, and status.

Align With Your Risk Framework

Ensure your documentation is aligned with your organization’s broader risk management framework (such as ISO 31000 or COSO). This alignment helps maintain consistency in terminology, methodology, and assessment criteria across departments.

Define Clear Ownership

Assign each risk to a dedicated owner responsible for tracking, managing, and updating it. This encourages accountability and ensures timely follow-up on mitigation activities.

Include Quantitative and Qualitative Data

Use a mix of numerical risk scores (e.g., likelihood x impact) and narrative descriptions to provide a well-rounded view of each risk. This approach helps both data-driven decision-makers and executive stakeholders interpret the information effectively.

Keep It Up to Date

Risks evolve, so stale documentation can lead to poor decisions. Schedule periodic reviews (monthly, quarterly, or annually) to reassess risks, update controls, and reflect any new developments or residual risks.

Ensure Version Control and Audit Trails

Track changes over time by maintaining version histories. This is crucial during audits and compliance checks, where traceability and documentation integrity are key.

Integrate With Risk Management Tools

Use digital tools or risk management platforms that centralize documentation, enable real-time updates, and allow for easy reporting. This minimizes human error and increases collaboration across teams.

Focus on Actionability

Risk documentation should not just record the risk—it should clearly outline next steps, deadlines, and resources required. Ensure that each entry leads to tangible follow-up or monitoring activities.

Secure Confidential Information

Some risks may involve sensitive data or internal vulnerabilities. Always apply appropriate access controls and encryption protocols to keep documentation secure and in compliance with data privacy regulations.

Make it Accessible and Clear

Ensure documentation is easy to understand for both technical and non-technical stakeholders. Avoid jargon, use clear language, and provide visual aids (like risk matrices or dashboards) where helpful.

By following these best practices, organizations can ensure that their risk documentation serves as a reliable foundation for informed decision-making, continuous improvement, and regulatory compliance.

Conclusion

Organizations that prioritize an all-encompassing risk management strategy find themselves better equipped to anticipate risks, make informed decisions, and maintain a competitive edge. Risk documentation is an essential and reliable investment in the company's future stability and success.

Don’t let the lack of proper risk documentation be your organization’s Achilles' heel.

Adopting MetricStream’s Enterprise Risk Management software can be a game-changer for organizations looking to fortify their risk management strategies. Embrace the strategic advantage and transform your approach to risk management, turning potential risks into tangible opportunities for growth and innovation.

Frequently Asked Questions

How does a risk register help in risk management?

A risk register helps in risk management by providing a centralized repository of all identified risks, their potential impacts, likelihood, and the strategies for mitigating them. It facilitates tracking and ensures that risks are systematically monitored and managed throughout the project or organizational lifecycle.

How often should risk documents be updated?

Risk documents should be updated regularly, typically at key milestones, during major changes in project scope, or whenever new risks are identified. Continuous monitoring and updating ensure that the risk management process remains relevant and effective.

Why is risk documentation important?

Risk documentation is essential for tracking, analyzing, and responding to potential threats, ensuring consistency, accountability, and regulatory compliance across the organization.

What is the meaning of risk documentation?

Risk documentation refers to the structured recording of identified risks, their potential impact, mitigation strategies, and ongoing status within an organization.

What are the key aspects of risk documentation?

Key aspects include risk identification, ownership, assessment of impact and likelihood, mitigation plans, monitoring processes, and regular updates.

What are the elements of a good risk document?

A good risk document includes a clear risk description, assessment details, responsible owners, mitigation strategies, timelines, monitoring plans, and evidence of review or updates.

With organizations continuously being subjected to both visible and obscure risks, there is a crucial need for comprehensive strategies to ward off potential crises. Unforeseen events can carve a dent in a company's market value, financial health, and reputation in no time.

Against this backdrop, the spotlight on preemptive risk management is brighter than ever, with risk documentation emerging as a strategic necessity for any organization's survival and success.

- Risk documentation is the well-defined process of recording potential risks and threats, enabling organizations to assess, monitor, and mitigate them effectively. It transforms abstract concerns into actionable data, crucial for corporate governance and strategic planning.

- Important risk documents include the risk management plan, risk register, risk analysis reports, risk mitigation plans, incident reports, and compliance documentation.

- Common challenges in risk documentation include maintaining relevance, ensuring accessibility, avoiding data overload, integrating with business processes, and securing stakeholder buy-in.

- Risk documents provide clarity, prioritize resource allocation, ensure regulatory compliance, and support informed decision-making. They are vital for avoiding unforeseen crises, financial losses, and reputational damage.

- Effective risk documentation equips organizations to anticipate and manage risks, and gain a competitive edge.

Risk documentation is the systematic recording of all potential risks and threats that could detrimentally impact an organization, ranging from financial downturns and legal entanglements to technology breaches and operational hiccups. It’s a key element of corporate governance that ensures a detailed repository is in place, outlining what might go wrong, as well as housing critical analyses and mitigation strategies.

This disciplined approach aids in clarifying the diverse nature of risks, transforming intangible anxieties into structured data that can be actively managed.

Here are the key considerations for building an effective and robust risk documentation framework:

Cultivating a Risk-Aware Culture:

This cultural groundwork lays the foundation for every subsequent action related to risk management. It involves prioritizing risk awareness at every level of the organization and embedding it into the corporate ethos. By ensuring that every stakeholder, from the board to the frontline employees, recognizes the importance of risk management, organizations can create a proactive stance toward identifying and addressing risks.

Clear Definitions of Risk Roles and Responsibilities:

Establishing crystal-clear risk roles and responsibilities is crucial. By explicitly documenting who owns what aspect of the risk management process, organizations pave the way for efficient and effective governance. This step is instrumental in building a framework where everyone knows their part in contributing to the organization's risk management goals.

Selection and Deployment of Suitable Metrics:

These metrics should be significant and directly related to both the performance and risk indicators that matter most to the organization. Regular assessment of these metrics is necessary to validate whether the risk documentation is serving its intended purpose, allowing for timely adjustments to be made.

Continuous Monitoring of Risk Landscape:

This process ensures that the organization remains agile and responsive to the evolving risk landscape. A well-defined process for identifying and recording emerging and peripheral risks efficiently plays a pivotal role in fine-tuning the risk documentation strategy.

Ongoing Assessment and Review of Policies:

Regular review of policies and procedures provides insights into the effectiveness and relevance of the current documentation. This includes reviewing incidents and loss data, analyzing escalations, and exceptions, performing root cause analysis, and more. Adjustments based on these reviews ensure that the organization’s risk mitigation strategies are deeply ingrained and reflective of its operational realities.

Here are the different types of risk documents that can come in handy for an organization:

Risk Management Plan:

This foundational document outlines your organization's risk management process, from risk identification and analysis to mitigation and monitoring strategies. It serves as a roadmap for managing risks throughout the project or business operation lifecycle.Risk Register:

Perhaps the most crucial of all risk documents, the risk register is a comprehensive log of identified risks, their severity, mitigation measures, and the current status of each risk. It's a living document that evolves as new risks emerge and existing risks are resolved.Risk Analysis Reports:

These detailed reports break down the potential impact and likelihood of identified risks. Risk analysis reports help prioritize risks and are essential for informed decision-making regarding resource allocation for risk mitigation.Risk Mitigation Plans:

Once risks are identified and prioritized, risk mitigation plans detail the specific steps and measures taken to reduce or eliminate the impacts of those risks. These plans are tailored to each identified risk and include timelines, responsible parties, and budget considerations.Incident Reports:

If a risk materializes into an event, incident reports provide a retrospective analysis of what happened, why it happened, and how similar incidents can be prevented in the future. These documents are vital for learning from past mistakes and fortifying risk management strategies.Compliance Documentation:

Compliance documents prove adherence to regulatory requirements and internal policies. They provide evidence of the organization's commitment to meeting legal, ethical, and regulatory standards, reducing the risk of non-compliance penalties and reputational damage.

Effective risk documentation is foundational to any risk management program. It ensures that risks are consistently tracked, evaluated, and addressed, while also providing a clear record for accountability, audits, and continuous improvement. Proper documentation supports decision-making by making risk information transparent, structured, and easily accessible to stakeholders. Below are the key components every comprehensive risk document should include:

Risk Identification

This section clearly outlines each identified risk, including a unique ID or code, a brief description, and the category of risk (e.g., financial, operational, cybersecurity, regulatory). It provides a clear reference point for tracking and management.

Example: "Risk ID: CYB-001 – Unauthorized access to customer data via phishing attacks."Risk Source and Trigger

Detailing the origin of the risk — whether internal (e.g., outdated systems, human error) or external (e.g., market volatility, natural disasters) — helps in understanding its context. Including possible triggers highlights scenarios that could cause the risk to materialize.

Risk Likelihood and Impact Assessment

Documenting the probability of the risk occurring and its potential consequences is crucial. This may include:

- Qualitative ratings (e.g., High, Medium, Low)

- Quantitative scores or financial estimates

- Descriptions of the impact on operations, reputation, compliance, or financial performance

Risk Rating or Score

A risk score, often calculated using a matrix that considers both likelihood and impact, helps prioritize risks. This scoring helps teams quickly identify which risks require immediate action.

Example: Likelihood (High) x Impact (High) = Risk Score: 9 (Critical)Risk Owner

Identifying the person or department responsible for managing the risk ensures accountability. Risk owners are tasked with overseeing response plans and reporting on the risk’s status.

Risk Response Strategy

This component outlines the chosen mitigation approach, such as:

- Avoidance

- Reduction

- Transfer (e.g., insurance, outsourcing)

- Acceptance

Each strategy should include a rationale and be tied to the organization's risk appetite.

Mitigation Actions and Controls

Document the specific controls or activities being implemented to address the risk. This includes preventive, detective, and corrective controls, along with deadlines, resource allocation, and responsible parties.

Monitoring and Review Plan

Risks evolve over time, so the documentation should include how and when the risk will be reviewed. This might involve:

- Key Risk Indicators (KRIs)

- Review frequency (e.g., quarterly)

- Metrics or performance benchmarks

Residual Risk Assessment

After mitigation measures are in place, it’s important to document the residual risk — the level of risk that remains. This helps determine if further action is needed or if the risk falls within acceptable levels.

Supporting Evidence and Attachments

Include references to reports, audit results, compliance logs, or other documents that support the assessment and decisions. This strengthens the credibility of the documentation and facilitates audits.

Status and History

A log of status updates, changes in risk profile, and historical actions taken provides an audit trail. It also helps new stakeholders quickly understand the risk’s journey and current position.

By thoroughly documenting each of these components, organizations can ensure they have a clear, consistent, and actionable view of their risk landscape — one that enables timely decisions and improves enterprise-wide resilience.

Below are some of the challenges companies face when dealing with the mammoth process of risk documentation:

Maintaining Relevance:

With the business landscape and external environment continuously changing, keeping risk documents up-to-date is a daunting task.

Solution: Implementing regular review cycles and assigning specific ownership for updates can ensure that documents remain relevant and reflective of the current risk landscape.

Ensuring Accessibility and Usability:

Often, risk documentation is stored in formats or locations that are not readily accessible or understandable to all stakeholders.

Solution: Leveraging centralized and user-friendly GRC platforms like MetricStream can enhance accessibility, making it easier for stakeholders to engage with risk documentation meaningfully.

Data Overload:

With vast amounts of data available, there's a risk of including too much detail in risk documents, making it challenging to distill actionable insights.

Solution: Prioritizing data and focusing on key metrics can streamline documentation, ensuring clarity and usability.

Integration with Business Processes:

Often, risk management processes and documentation are siloed from the core business operations.

Solution: Ensuring that risk management is integrated into the DNA of organizational processes through clear procedures and workflows can enhance the relevance and impact of risk documentation.

Securing Stakeholder Buy-in:

Engaging stakeholders and securing their buy-in for risk management initiatives can be challenging.

Solution: Clear communication of the value of risk management and how it aligns with broader organizational objectives can foster a culture of proactive risk management.

Risk documents are crucial for any organization because they provide clarity on potential pitfalls, enable the prioritization of resources, ensure compliance with regulatory requirements, and support informed decision-making. By documenting risks, organizations can avoid unanticipated crises and financial losses, steering toward sustainable growth and success.

Let's delve into the pivotal reasons why risk documents hold importance for any entity:

Clarity and Understanding:

Risk documents clarify what might go wrong, providing a clear view of potential pitfalls. This understanding is critical in ensuring that all members of the organization are on the same page and can work towards common mitigation strategies.

Prioritization of Resources:

By documenting risks, organizations can prioritize resources, focusing on mitigating the risks with the highest probability of occurrence and the most severe potential impact. This efficient allocation of resources is indispensable for any business aiming to thrive.

Compliance and Regulatory Adherence:

Many industries are governed by strict regulatory requirements that mandate risk assessments and documentation. Failure to comply can result in severe penalties, making risk documentation not just prudent but obligatory.

Informed Decision-Making:

Equipped with a comprehensive risk document, decision-makers can make informed choices, weighing the potential risks against the anticipated rewards. This foresight is crucial for steering the organization towards sustainable growth and success.

A Consequence of Lacking Proper Documentation:

With adequate risk documentation, organizations are more likely to avoid unanticipated crises, financial losses, and damage to their reputation, which could have been mitigated or avoided with proper foresight and planning.

Effective risk documentation is more than just record-keeping — it's a strategic tool that helps organizations track, assess, and respond to risks in a structured and consistent manner. Following best practices ensures that risk records are accurate, useful, and actionable, especially during audits, compliance reviews, or crisis response. Here are the key best practices to follow:

Use a Standardized Template

A consistent format across all risk documentation improves readability, simplifies reporting, and helps ensure that no critical information is overlooked. Include predefined fields such as risk description, owner, likelihood, impact, response strategy, and status.

Align With Your Risk Framework

Ensure your documentation is aligned with your organization’s broader risk management framework (such as ISO 31000 or COSO). This alignment helps maintain consistency in terminology, methodology, and assessment criteria across departments.

Define Clear Ownership

Assign each risk to a dedicated owner responsible for tracking, managing, and updating it. This encourages accountability and ensures timely follow-up on mitigation activities.

Include Quantitative and Qualitative Data

Use a mix of numerical risk scores (e.g., likelihood x impact) and narrative descriptions to provide a well-rounded view of each risk. This approach helps both data-driven decision-makers and executive stakeholders interpret the information effectively.

Keep It Up to Date

Risks evolve, so stale documentation can lead to poor decisions. Schedule periodic reviews (monthly, quarterly, or annually) to reassess risks, update controls, and reflect any new developments or residual risks.

Ensure Version Control and Audit Trails

Track changes over time by maintaining version histories. This is crucial during audits and compliance checks, where traceability and documentation integrity are key.

Integrate With Risk Management Tools

Use digital tools or risk management platforms that centralize documentation, enable real-time updates, and allow for easy reporting. This minimizes human error and increases collaboration across teams.

Focus on Actionability

Risk documentation should not just record the risk—it should clearly outline next steps, deadlines, and resources required. Ensure that each entry leads to tangible follow-up or monitoring activities.

Secure Confidential Information

Some risks may involve sensitive data or internal vulnerabilities. Always apply appropriate access controls and encryption protocols to keep documentation secure and in compliance with data privacy regulations.

Make it Accessible and Clear

Ensure documentation is easy to understand for both technical and non-technical stakeholders. Avoid jargon, use clear language, and provide visual aids (like risk matrices or dashboards) where helpful.

By following these best practices, organizations can ensure that their risk documentation serves as a reliable foundation for informed decision-making, continuous improvement, and regulatory compliance.

Organizations that prioritize an all-encompassing risk management strategy find themselves better equipped to anticipate risks, make informed decisions, and maintain a competitive edge. Risk documentation is an essential and reliable investment in the company's future stability and success.

Don’t let the lack of proper risk documentation be your organization’s Achilles' heel.

Adopting MetricStream’s Enterprise Risk Management software can be a game-changer for organizations looking to fortify their risk management strategies. Embrace the strategic advantage and transform your approach to risk management, turning potential risks into tangible opportunities for growth and innovation.

How does a risk register help in risk management?

A risk register helps in risk management by providing a centralized repository of all identified risks, their potential impacts, likelihood, and the strategies for mitigating them. It facilitates tracking and ensures that risks are systematically monitored and managed throughout the project or organizational lifecycle.

How often should risk documents be updated?

Risk documents should be updated regularly, typically at key milestones, during major changes in project scope, or whenever new risks are identified. Continuous monitoring and updating ensure that the risk management process remains relevant and effective.

Why is risk documentation important?

Risk documentation is essential for tracking, analyzing, and responding to potential threats, ensuring consistency, accountability, and regulatory compliance across the organization.

What is the meaning of risk documentation?

Risk documentation refers to the structured recording of identified risks, their potential impact, mitigation strategies, and ongoing status within an organization.

What are the key aspects of risk documentation?

Key aspects include risk identification, ownership, assessment of impact and likelihood, mitigation plans, monitoring processes, and regular updates.

What are the elements of a good risk document?

A good risk document includes a clear risk description, assessment details, responsible owners, mitigation strategies, timelines, monitoring plans, and evidence of review or updates.