The Top 5 Enterprise Risk Management (ERM) Tools For 2026

- Risk Management

- 29 April 24

Introduction

In today’s global economy, where uncertainty is the only constant, savvy organisations treat risk as a strategic advantage. According to Aon’s 2025 Global Risk Management Survey, geopolitical volatility, cyber risk, and regulatory change have climbed into the top global risk rankings for the first time, underscoring the need for stronger ERM practices.

That’s where ERM tools come in - and why platforms like MetricStream matter. These tools provide organizations with the infrastructure to collect, analyze, and monitor risk data across the entire enterprise. By translating scattered risk signals into clear dashboards and actionable insights, they help leadership anticipate threats, prioritise mitigation, and steer strategy with confidence.

In 2026, as operational, cyber, and third-party exposures intensify, selecting the right ERM solution has become a critical priority for GRC leaders, CISOs, and risk professionals.

Use of modern ERM tools transforms risk management from a reactive chore into a proactive capability - centralising visibility over compliance, operational, strategic, and third-party risks so teams can act before issues escalate.

What is an ERM tool?

An ERM tool is software that centralises the identification, assessment, monitoring, and reporting of risks across an organisation. It collects risk data from business units, links exposures to strategy and controls, and presents actionable insights so leaders can prioritise and coordinate risk responses.

Top 5 ERM Tools For 2025

Here are some well-known vendors that are recognized as leaders in the ERM landscape.

1. MetricStream

MetricStream has carved its place as an indispensable ERM tool for businesses aiming to bolster their enterprise risk management capabilities. This ERM software is crafted with an eye for integrating various aspects of risk management under a single umbrella, making it a holistic platform for businesses aiming to stay ahead of uncertainties.

This tool is best suited for organizations seeking to streamline risk processes, gain real-time insights into their risk landscape, and drive informed decision-making to optimize business performance and resilience in dynamic environments.

Key Features:

- Centralized risk repository fostering a common language for risk across the organization, ensuring consistency and transparency.

- Standardized approach to risk assessment, enabling uniform risk identification and mitigation strategies.

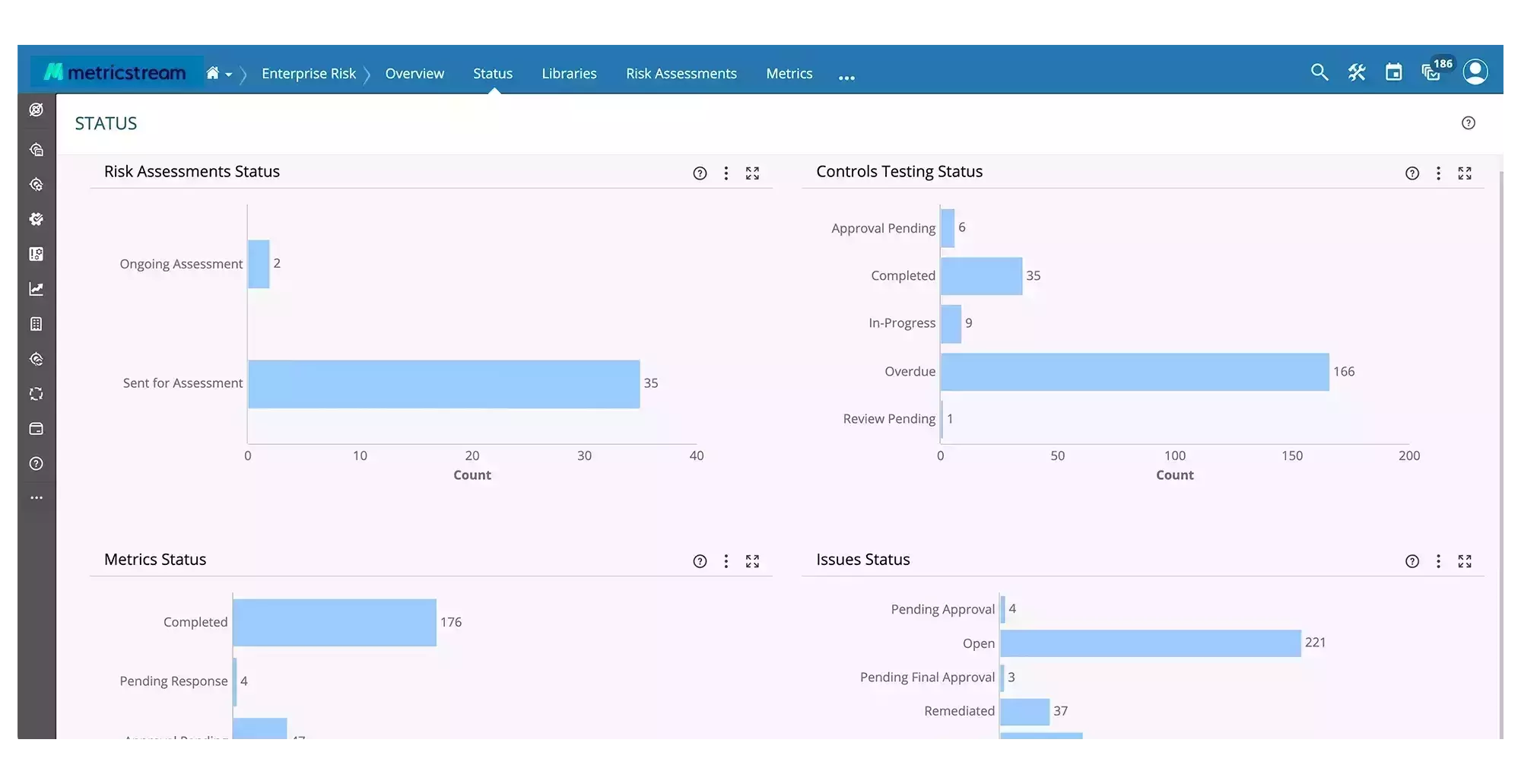

- Advanced analytics with real-time insights into the risk landscape, facilitating informed decision-making.

- Visualization tools that transform complex data sets into comprehensible insights for proactive risk management.

- Configurable risk assessment capabilities, incident tracking, and reporting functionalities for comprehensive risk management.

MetricStream's accolades, such as being named a Leader in The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023, highlight its effectiveness and reliability. Recognition from leading research and advisory firms attests to the platform's robust capabilities in IT/Cyber Risk Management, GRC Vision, and more

To read more, download your complimentary copy of The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023.

Customer feedback — why users trust MetricStream

- According to a review on Gartner Peer Insights, “Implementation of the MetricStream platform has empowered our GRC programme” — the user praised the platform’s intuitive interface, flexible configuration, and responsive support throughout procurement, deployment and day-to-day operations.

- Another Gartner reviewer rated MetricStream 5/5, calling it the most comprehensive GRC solution on the market. They highlighted its advanced integrated risk management framework, strong end-to-end visibility across processes, risks, and controls, and minimal need for customization.

Pricing will be available on request to the vendors.

2. Diligent

Diligent offers a compelling narrative for ERM, emphasizing the importance of aligning leadership with the full spectrum of risks that impact an organization.

This strategic alignment is pivotal in transforming risk into actionable insights, enabling data-driven decision-making at every turn.

Diligent's approach revolves around cultivating a much more comprehensive understanding of risks across all levels of the organization, fostering a proactive risk management culture.

Key Features:

- Utilizing advanced analytics, the platform automates risk monitoring, identifying patterns, and predicting threats to enhance operational efficiency without requiring additional personnel.

- By providing a unified risk viewpoint across teams, Diligent fosters collaboration, enhances scalability and improves visibility. Such a real-time perspective offers valuable insights into top risks, trends, and risk appetite for comprehensive risk portfolio management.

- Diligent employs a suite of detection, evaluation, and monitoring tools to identify and neutralize risks preemptively, preventing them from escalating into something worse.

- The tool also includes features to ensure regulatory compliance, offering built-in frameworks, controls, and workflows aligned with industry standards and regulations.

Pricing will be available on request to the vendors.

3. ServiceNow

ServiceNow is a robust platform that simplifies complex risk assessments and enhances decision-making capabilities across organizations.

It facilitates enhanced data communication using chat functionalities, web portals, and mobile applications, ensuring seamless sharing and dissemination of critical risk and compliance information across the organization.

This platform is ideal for organizations looking to centralize and optimize their risk management processes while enhancing overall operational resilience.

Key Features:

- Self-assessment design and scheduling based on maturity levels to monitor risks continuously and ensure control accuracy as the organization expands.

- Incorporation of a comprehensive risk statement library for consolidating ratings and reporting through a common risk taxonomy, enabling effective communication across different organizational departments.

- Implementation of smart issue management capabilities driven by AI and machine learning, automating risk assignment, grouping, and remediation suggestions to reduce manual effort significantly.

- Access to advanced reporting features with interactive dashboards and Performance Analytics, providing deep insights into data and risk trends for informed decision-making.

Custom pricing will be available on request.

4. OneTrust

OneTrust is a comprehensive tool that specializes in compliance and vendor risk management, addressing critical niches within the risk management ecosystem. This tool is particularly valuable today, where data privacy regulations and third-party relationships are under increased scrutiny.

It has made its mark as a versatile cloud-based GRC platform, renowned for its customizable functionalities that cater to a wide range of risk management needs.

Key Features:

- Its integrated GRC and security module stands out for enabling organizations to efficiently scale their risk and security functions, harmonizing risk assessment with mitigation efforts.

- OneTrust cleverly intertwines risk management with incident response, alongside automating the management of security standards, which can significantly ease the administrative burden on teams.

- OneTrust provides tools for vendor risk assessment and monitoring, enabling organizations to identify and mitigate risks associated with third-party relationships.

- The platform supports the management of security standards and frameworks such as ISO 27001 and NIST, assisting in aligning security policies and controls with industry best practices.

Pricing will be available on request.

5. LogicGate

LogicGate presents itself as a highly adaptive and modern ERM solution designed to meet the dynamic needs of contemporary businesses.

Known for its flexibility and the ease with which it can be customized, LogicGate stands as a powerful tool in any risk manager's arsenal, particularly for those looking to streamline their ERM processes without being bogged down by complex technical requirements.

With LogicGate, businesses can forge ahead confidently, equipped with a versatile platform that aligns seamlessly with their risk management goals and operational strategies.

Key Features:

- Utilizing a modern graph database, LogicGate enables dynamic connections between risks, controls, and various business units and owners. This helps maintain reporting speed and ensures the adaptability of the risk management program without compromising on efficiency.

- It offers quick-start features such as pre-configured risk scoring and guidance for assessing inherent and residual risk ratings, simplifying the initial setup and ongoing management of risk assessments, and enhancing overall accuracy.

- Their Quantify feature introduces a new dimension to traditional quantification methods through Monte Carlo simulations. This in turn provides a financial context to risk decisions, offering executives a clearer understanding of risk impacts in tangible financial terms.

Pricing will be available on request to the vendors.

Why ERM Tools Matter?

1. Consolidate risk information across the enterprise

An ERM tool pulls risk data from different teams into one place. Instead of juggling spreadsheets or chasing updates, you get a clear picture of what the organisation is facing and where the pressure points are.

2. Quantify risk impact and likelihood

Good tools help translate concerns into measurable terms. You can see how big a risk truly is, what it might cost, and how likely it is to materialise—making comparisons and decisions far more grounded.

3. Predict emerging risks through analytics

Modern ERM platforms spot patterns that teams may miss. Early signals, trends, and shifting conditions become easier to detect, giving leaders more time to respond.

4. Support informed, data-led decisions

By connecting risks to business goals and controlling performance, ERM tools help leaders decide where to act and where to invest. Choices become clearer, faster, and easier to justify.

5. Strengthen organisational resilience

With better visibility and more timely insights, organisations can respond to shocks with less disruption. ERM tools help teams prepare, adapt, and stay steady even when conditions change suddenly.

What are the Key Features of ERM tools?

Here are the key features that CROs and risk managers should keep in mind while selecting an ERM tool:

- Risk identification and assessment capabilities

The best ERM platforms provide a centralized place to log risks from across the organization. With an easy-to-use interface, they make it easy for the first line of defense to report any observation, issue, or warning signal which can be further analyzed by the second line. Features like risk questionnaires, heat maps, and automatic risk correlation provide a holistic view of your risk landscape. - Scenario analysis and risk quantification

To prepare for uncertainty, organizations need tools that can simulate 'what-if' scenarios. Simulating and testing plausible scenarios help them better understand potential risks, devise effective response strategies, and identify control gaps and other weaknesses. Tools supporting risk quantification help transform range-based estimates into more accurate values, enabling businesses to prioritize investments better, drive alignment between risk programs and business goals, and understand why and how recovery processes and priorities operate. - Integration with strategic planning processes

These ERM tools provide dashboards, reports, and analytics that give executives insight into how various risks might affect key business objectives. - Automated reporting and analytics

ERM software should make risk data easy to understand and share across the organization. This requires solutions that offer capabilities to generate custom reports, interactive risk dashboards, and risk analytics powered by data visualization. Incorporating AI-powered processes can further enhance the accuracy of risk assessment and decision-making, analyzing vast amounts of data to identify patterns, trends, and correlations that might not be immediately apparent via human efforts.

How Do ERM Tools Support Regulatory Compliance?

Here are some ways in which efficient ERM tools help support regulatory compliance:

- Map Rules To Controls

ERM platforms let you link specific regulations to the exact policies and controls that enforce them. That makes it fast to show auditors which controls cover which legal obligations. - Automate Evidence Collection

Systems pull logs, approvals, and test results automatically. That removes manual assembly of audit packs and creates a defensible trail of proof. - Run Regulatory-Ready Reports

Configurable reports give regulators the exact view they expect. You can produce standardised dashboards or ad-hoc extracts in minutes, not days. - Manage Regulatory Change

When rules shift, tools track the impact on controls, owners, and processes. Change items are assigned and monitored until compliance is restored. - Enforce Remediation Workflows

Failed tests become tracked issues with owners, deadlines, and escalation rules. That ensures fixes happen, and supervisors can see progress in real time. - Demonstrate Continuous Assurance

Continuous monitoring and scheduled testing prove controls work overtime. This moves compliance from a point-in-time exercise to ongoing assurance that regulators value.

How To Evaluate ERM Tools?

When evaluating ERM tools, prioritize ease of use with intuitive interfaces that encourage user adoption. Consider the ROI beyond upfront costs, aiming for reduced risk event losses and improved efficiency. Assess functionality for alignment with specific needs, such as configurable risk assessments and reporting. Lastly, prioritize integration capabilities for smooth connectivity with existing platforms.

Gauging the success of your ERM implementation involves reviewing a range of criteria that validate its benefits. with some of them being:

- Ease of Use

An ERM solution is only effective if people use it. Organizations should choose a tool with an intuitive, user-friendly interface so it's easy for everyone to enter, access, and act on risk data. The easier it is to use, the more the user adoption and the more likely people will keep the tool up to date. - Return on Investment

While cost is a factor when choosing an ERM solution, organizations should not just look at the initial price tag but also consider the ROI the tool can provide, like reducing losses from risk events, lowering insurance premiums, and improving operational efficiency, all based on your industry. - Functionality

Organizations need to assess if the functionalities and capabilities of the ERM tool are aligned with their specific needs. They should look for features such as configurable risk assessment capabilities, risk registers, incident tracking, and reporting functionalities to support comprehensive risk management processes. - Integration Capabilities

Seamless integration with platforms such as enterprise resource planning (ERP) systems, project management tools, and data analytics platforms can enhance the efficiency and effectiveness of risk management processes by facilitating data sharing and streamlining workflows across different departments.

What are the Benefits of Using an ERM Tool?

Implementing an ERM tool brings a host of advantages to organizations seeking to enhance their risk management practices. Here are the top four benefits of using an ERM tool:

Improved Risk Visibility and Understanding

Implementing ERM tools enables organizations to peel back the layers of potential risks, revealing unseen threats and opportunities alike. This clarity enables businesses to anticipate challenges and navigate them with greater assurance.

Enhanced Decision-Making and Resource Allocation

With the insights garnered from these tools, organizations can make better-informed decisions that align closely with their goals. ERM tool offers the unique advantage of data-driven guidance, helping firms to allocate their resources more effectively, and ensuring that efforts are directed toward areas of highest impact.

Strengthened Resilience Against Uncertainties

ERM tools empower organizations with a proactive defense mechanism against potential disruptions. This robust preparedness doesn’t just mitigate risks, it also fosters an agile environment that can adapt and thrive in the face of uncertainties.

Regulatory Compliance and Governance Support

ERM tools serve as an invaluable ally, ensuring that compliance is maintained, and governance standards are met. This compliance is a strategic move that enhances credibility and stakeholder trust, paving the way for smoother operations and market growth.

Feature Comparison — ERM / GRC Platforms

Below is a concise, accurate comparison of five leading platforms across a few practical dimensions:

Addressing Common Challenges in Implementation

Implementing ERM tools presents unique challenges that organizations must strategically address to ensure successful adoption and integration. From overcoming resistance to change and data quality issues to promoting cross-functional collaboration and enhancing risk assessment processes, navigating these challenges is essential for maximizing the effectiveness of ERM tools within companies.

Resistance to Change

Implementing ERM tools often requires changes in workflows and processes, which can be met with resistance from employees accustomed to traditional methods. Overcoming resistance to change involves effective change management strategies, such as stakeholder engagement, training programs, and transparent communication about its benefits.

Data Quality and Integrity

ERM tools rely heavily on accurate and reliable data to perform effective risk assessments and analyses. However, organizations may often struggle with data quality issues, including incomplete or outdated information, inconsistent data formats, and data silos.

Siloed thinking

Different departments often have narrow views of risk that don't account for how their risks might impact the rest of the organization. Organizations need to promote a culture of collaboration and an understanding of the interconnectedness of risks by establishing cross-functional risk committees and information-sharing protocols.

Inefficient risk assessment processes

Organizations need to assess risks timely, systematically, and objectively to strengthen risk preparedness and to be ready for the unexpected curveballs waiting to surface at the most inconvenient times. This requires developing comprehensive methodologies that consider risk likelihood, impact, velocity, and interconnectivity. Furthermore, organizations should update their risk profile regularly as conditions change.

Insufficient reporting and communication

Stakeholders can't make good risk-based decisions without timely and relevant information. It is imperative to establish risk reporting procedures to keep executives and risk owners in the loop. A risk dashboard or scorecard is a useful way to provide at-a-glance overviews and details on key risks.

How To Measure The Success of Your ERM Tools?

Determining the success of your ERM implementation entails examining critical factors that showcase its achievements and improvements, such as:

- Key Performance Indicators (KPIs): Establishing measurable KPIs allows organizations to track the effectiveness of their ERM implementation. Metrics such as risk mitigation rates, incident response times, and compliance levels provide tangible evidence of success.

- Stakeholder Satisfaction: Keeping an ear to the ground and gathering feedback from stakeholders gives you a sense of how well our risk management efforts are working. When stakeholders are happy, it's a good sign that you’re on the right track with identifying and tackling risks throughout the organization.

- Adaptability: Success in ERM is closely linked to an organization's ability to adapt to change and withstand unforeseen disruptions. Monitoring the organization's resilience to emerging risks and its capacity to pivot strategies accordingly signifies effective ERM implementation.

- Financial Performance Improvement: By analyzing metrics such as cost savings from risk mitigation efforts, reduction in insurance premiums, and increased revenue from improved decision-making, organizations can gauge the effectiveness of their risk management strategies.

Trends Shaping the Future of ERM

Here are some of the latest trends that companies can look forward to, when it comes to boosting the effectiveness of ERM tools.

- Enhanced Predictive Analytics: These tools not only assess risks as they emerge but also forecast future threats and opportunities with a high degree of precision. For organizations, this means a more proactive stance in risk management, moving from reactive responses to strategic risk anticipation and mitigation.

- Adoption of cognitive, cloud, and other innovative technology: Organizations are increasingly adopting ERM tools that offer Artificial Intelligence (AI) and Internet of Things (IoT) capabilities, cloud support, integrations with external systems, and more. IoT devices feed real-time data into risk management systems, offering a live pulse on various risk factors while AI enhances decision-making with actionable insights, creating a highly responsive and dynamic risk management ecosystem. Cloud support is important as it is one of the key areas for organizations that are undergoing/considering digital transformation. It also enables seamless integrations with external systems which helps in a more comprehensive approach to ERM across an organization’s extended enterprise.

- Greater Emphasis on Interconnectedness of Risks Given the growing complexity of the risk landscape, the scope of ERM is expanding to include cyber risks, geopolitical risks, environmental, social, and governance (ESG) risks, and other risks. These various risks have multiple points of intersection with other risks, resulting in a labyrinth of risks and risk relationships. Organizations today need tools that can help them understand this interconnectedness of risks to better gauge their probable impact and devise appropriate response strategies.

- Continuous Improvement for Resilience: Enterprise risk management is not a one-time activity; it is a continuous, iterative process. Organizations need to implement tools that allow continuous testing and monitoring of controls, evidence collection, etc. that provide them regular insights into gaps and loopholes that need to be addressed for fine-tuning the risk strategy on an ongoing basis. This approach is important to improve risk visibility, foresight, and preparedness, and strengthen organizational resilience.

- AI-Driven Risk Insights and Decision Support: ERM tools are moving beyond simple analytics into AI-supported decision-making. Instead of merely flagging risks, next-generation platforms will recommend mitigation options, highlight the most cost-effective response paths, and help teams model the downstream impact of decisions. This shift will give risk owners more confidence and reduce the time spent interpreting complex risk data.

- Private AI and Strong Model Governance: With businesses increasingly deploying AI internally, ERM tools will need stronger oversight mechanisms to track model performance, detect bias, monitor drift, and ensure outputs stay aligned with regulatory expectations. This will be crucial for organizations adopting private AI environments, where risk and governance responsibilities sit directly with the enterprise rather than a cloud provider.

- Scenario Planning as a Core ERM Capability: Boards and executive teams are seeking more clarity on potential futures. ERM platforms will expand their scenario-modelling capabilities to help organizations simulate geopolitical shocks, climate risks, economic downturns, and emerging cyber threats. These simulations will support strategic decisions by revealing vulnerabilities, stress-testing assumptions, and improving preparedness for high-impact events.

Conclusion

As we look forward to the trends of 2025, it’s clear that the future of ERM is not just about navigating uncertainties but about thriving in them. And when it comes to turning risks into rewards, MetricStream is a trusted partner, equipped to tackle the future of risk-management head-on.

To learn how MetricStream Enterprise Risk Management can help, request a personalized demo today.

FAQ

What is an Enterprise Risk Management (ERM) tool?

An ERM tool is software that helps organizations identify, assess, manage, and monitor risks across the enterprise. It centralizes risk data, streamlines workflows, and provides real-time visibility into the organization’s overall risk posture.

Why do organizations use ERM tools?

Organizations use ERM tools to break down silos, improve risk transparency, automate assessments, and make risk management more consistent and data-driven. These tools also help strengthen compliance, reduce operational surprises, and support strategic planning.

What are the key features to look for in an ERM tool?

The most important features include risk scoring and analytics, dashboards and reporting, control monitoring, issue and incident tracking, integrations, workflow automation, and the ability to map risks to controls, assets, and regulations.

How do ERM tools improve decision-making?

ERM tools turn scattered risk data into clear insights, helping leaders understand which risks matter most and why. They support better prioritization, align risks with business impact, and provide evidence-based guidance for allocating resources.

What are the top ERM tools for 2026?

Top ERM tools include MetricStream, LogicGate, Resolver, AuditBoard, and Archer. These platforms stand out for strong analytics, flexible workflows, and support for integrated risk management programs.

How do I evaluate the right ERM tool for my organization?

Start by defining your risk goals, maturity level, and workflows. Then compare tools based on usability, configurability, reporting, integrations, customer support, and scalability. Pilots, demos, and customer reviews also help clarify the best fit.

What industries benefit most from ERM tools?

Industries with complex, fast-changing risk environments benefit the most—such as financial services, manufacturing, healthcare, energy, technology, government, and retail. These sectors rely on ERM tools to manage regulatory demands, cybersecurity threats, operational risks, and third-party exposure.

What is the difference between ERM tools and GRC suites?

ERM tools focus primarily on identifying, assessing, and monitoring enterprise-wide risks. GRC suites are broader and include governance management, compliance tracking, audit workflows, and policy management. ERM is often a core module within a larger GRC platform.

How do ERM tools support strategic decision making?

They connect risk exposure to business objectives and financial impact. Scenario analysis and aggregated dashboards help leadership evaluate trade-offs. This enables informed choices about growth, investment, and resilience.

Which ERM tool provides the best scalability for multinational enterprises?

Scalability depends on architecture rather than brand alone. Enterprise-grade platforms with modular design, multi-language support, and regional regulatory mapping tend to scale best. Cloud-native systems often provide greater flexibility for global operations.

How do integrations matter in ERM tool choice?

Integration allows risk data to flow from security tools, finance systems, and operational platforms into a single view. Without integration, risk insights remain fragmented. Strong APIs reduce manual work and improve real-time visibility.

Are there industry-specific ERM tools tailored to healthcare, finance, or energy?

Some platforms provide industry templates, regulatory libraries, and preconfigured risk taxonomies. Financial services, healthcare, and energy sectors often require specialized reporting and compliance features. However, many enterprise tools can be configured to meet sector-specific needs.

What are common pitfalls when implementing ERM software?

Poor data quality and unclear ownership can weaken adoption. Over-customization may increase complexity and cost. Lack of executive sponsorship often limits long-term impact.

How do ERM tools support audit and compliance workflows?

They centralize control documentation, testing results, and remediation tracking. Automated reporting and evidence collection simplify audit preparation. Clear audit trails strengthen defensibility during regulatory reviews.