AI-First Connected GRC

Drive a Connected GRC Program for Improved Agility, Performance, and Resilience

Discover Connected GRC Solutions for Enterprise and Operational Resilience

Explore What Makes MetricStream the Right Choice for Our Customers

Discover How Our Collaborative Partnerships Drive Innovation and Success

- Want to become a Partner?

Your Insight Hub for Simpler, Smarter, Connected GRC

Sound and effective Compliance Risk Management in Banks

Over the last decade, the business world has faced unprecedented changes and challenges, resulting in a slew of compliance regulations. Banks of all sizes are now more concerned than ever about compliance risk management. New banking products, increased government scrutiny and intense focus on compliance requirements bring forth greater risks and a larger set of rules and regulations. Banks are forced to take a fresh look at their compliance practices and the technology infrastructure that supports them and to pursue a broad range of compliance and risk initiatives across the organization.

What is Compliance Risk Management in Banks?

Compliance risk management in banks refers to the process of identifying, assessing, monitoring, and mitigating risks that arise from failing to comply with laws, regulations, industry standards, or internal policies. It ensures that banks operate within legal and ethical boundaries, protecting them from regulatory penalties, financial losses, and reputational damage.

Regulators and governments are issuing newer regulations to avoid future crises and cracking the whip down on banking organizations that do not conform. As a result, the average business today is confronted with a plethora of cross-industry regulations, each consisting of hundreds of requirements and rules. Dealing with these requirements in a traditional manner is no longer cost-effective or efficient. It requires a renewed business model that analyzes compliance requirements, prioritizes their importance to the business, applies the appropriate control and monitors the system consistently.

Need for streamlined Compliance Risk Management in banks

In today’s stringent regulatory business environment with new standards and mandates coming to effect at a never-before pace, the need to keep up with regulatory changes and ensure ongoing compliance with them has emerged as the bank’s crucial priority. Also, as banks face increasing compliance complexity from the growth of regulations, ad hoc approaches to compliance management can expose them to significant risks. Because of the nature and levels of risks inherent to their business activities, complex banking organizations should have in place a compliance-risk management framework that makes it possible to identify, monitor, and effectively control the compliance risks facing their entire organization. As a result, compliance risk management has emerged as key business concerns across the globe.

Compliance risk, which is often overlooked as it blends into operational risk and transaction processing, is the risk to earnings or capital arising from violations of, or non-conformance with, laws, rules & regulations, code of conduct, customer relationship rules or ethical standards. It encompasses all laws, as well as prudent ethical standards and contractual obligations. Compliance risk also arises in situations where the laws or rules governing certain bank products or activities of the bank's clients may be ambiguous or untested. Compliance risk, also referred to as integrity risk sometimes, exposes the organization to legal penalties, payment of damages, limitation of business opportunities, diminished reputation, reduced franchise value, lessened expansion potential and the voiding of contracts.

To strengthen its compliance risk program, the banks need an efficient solution for conducting compliance processes, identifying & assessing risks, implementing & monitoring controls and mitigating/eliminating the gaps across its vast multi-country operations.

Managing compliance risk has become a core skill that every bank must have in today’s highly regulated industry and a consolidated-or "enterprise-wide"-approach to compliance risk management has become "mission critical" for large, complex banking organizations.

Risk-based Compliance Management

Traditionally, risk management and compliance management were treated as separate disciplines. Risk managers dealt with risk identification and mitigation, while compliance managers dealt with compliance auditing. However, this approach is no longer cost-effective or efficient. Increasing compliance requirements call for a strategy that is integrated with risk management and corporate objectives.

Visionary companies have achieved this goal by adopting a risk based approach. Risk based compliance management allows compliance managers to first identify the most significant compliance risks, and then propose controls to mitigate those risks. This way, the focus is only on the risks and compliance regulations that really matter to banking institutions. Managers can also tailor the compliance program to meet the specifics of their business. The result is improved compliance management.

Further, basing a compliance management program on risk management can be an effective communication tool. Managers who may be averse to the term "compliance" may respond much more readily to "risk." This approach may therefore provide banks with an effective means of getting management to understand and give appropriate attention to compliance priorities.

What is required for a successful Compliance Risk Management?

A successful compliance-risk management program which is an essential for sound and vibrant banking system contains the following elements:

- Active board and senior management oversight: An effective board and senior management oversight is the cornerstone of an effective compliance risk management process.

- Effective policies and procedures: Compliance risk management policies and procedures should be clearly defined and consistent with the nature and complexity of a banking institution’s activities.

- Compliance risk analysis and comprehensive controls: Banking organizations should use appropriate tools in compliance risk analysis like self-assessment, risk maps, process flows, key indicators and audit reports; which enables establishing an effective system of internal controls.

- Effective compliance monitoring and reporting: Banking organizations should ensure that they have adequate management information systems that provide management with timely reports on compliance like training, effective complaint system and certifications.

- Testing: Independent testing should be conducted to verify that compliance-risk mitigation activities are in place and functioning as intended throughout the organization.

MetricStream offers industry's most advanced and comprehensive suite of solutions to help banks adopt a customized, risk-based approach towards compliance management. The solution delivers end-to-end functionality for managing the entire compliance lifecycle including risk assessment, compliance planning, control management, compliance reporting and training. Powerful capabilities like built-in remediation workflows, time tracking, email based notifications and risk monitoring allow banks to implement industry best practices for efficient compliance management, and ensure integration of the compliance process with internal systems.

Using MetricStream Compliance Management Solution, banks can align enterprise risk with compliance initiatives. This enables compliance resources to be targeted towards high risk areas where they are most needed and will prove most effective. It also ensures that fewer controls are used with more focus and accountability, which are hallmarks of a successful compliance program.

Key Components of Compliance Risk Management in Banks

Effective compliance risk management in banks requires a structured framework that combines policies, processes, people, and technology. The following are the key components:

1. Regulatory Framework and Policy Management

Banks must stay aligned with national and international regulations such as Basel III, AML (Anti-Money Laundering), KYC (Know Your Customer), GDPR, and FATCA. Compliance teams establish internal policies and procedures to ensure all employees understand and adhere to these requirements.

2. Risk Identification and Assessment

This involves detecting areas where compliance risks might arise—such as customer onboarding, lending practices, data protection, or reporting obligations. Regular assessments help banks understand the likelihood and potential impact of these risks.

3. Internal Controls and Monitoring

Banks implement internal controls, including transaction monitoring systems, automated alerts, and periodic audits, to prevent regulatory breaches. These controls are continuously tested to ensure they are effective in mitigating risks.

4. Training and Awareness

Employees are often the first line of defense. Regular training programs help staff recognize potential compliance risks (e.g., suspicious transactions, insider trading) and understand their responsibilities under regulatory frameworks.

5. Governance and Oversight

Strong governance structures are critical. Compliance officers, risk committees, and the board of directors play active roles in overseeing compliance efforts, ensuring accountability, and making strategic risk-related decisions.

6. Reporting and Documentation

Transparent reporting of compliance activities is essential for both internal stakeholders and regulators. Proper documentation demonstrates adherence to regulations and provides evidence during inspections or audits.

7. Technology and Automation

With rising regulatory complexity, banks increasingly rely on RegTech solutions (Regulatory Technology) for real-time monitoring, transaction screening, risk analytics, and compliance reporting to reduce human error and improve efficiency.

Examples of Compliance Risks in Banks

Banks face diverse compliance risks due to the highly regulated and global nature of financial services. Some common examples include:

1. Anti-Money Laundering (AML) Violations

Failing to detect or report suspicious transactions can expose banks to hefty fines and reputational damage. For instance, banks are required to monitor unusual cash deposits or transfers that may signal money laundering.

2. Know Your Customer (KYC) Failures

Not adequately verifying customer identity can lead to illegal activities like fraud, terrorism financing, or sanctions violations slipping through the system.

3. Data Privacy Breaches

Banks handle massive amounts of sensitive customer data. Inadequate safeguards or non-compliance with privacy regulations like GDPR or India’s DPDP Act could result in financial penalties and loss of trust.

4. Insider Trading and Market Misconduct

Employees using privileged information for personal gain exposes banks to regulatory scrutiny and reputational damage.

5. Sanctions Violations

Engaging in business with entities or individuals subject to government sanctions (e.g., OFAC in the US) can lead to severe penalties.

6. Consumer Protection Breaches

Non-compliance with fair lending laws, mis-selling of products, or hidden fees may result in lawsuits, fines, and loss of customer confidence.

7. Financial Reporting Errors

Inaccurate financial statements, whether intentional or due to weak internal controls, can result in violations of SOX (Sarbanes-Oxley Act) or other disclosure requirements.

How to Manage Compliance Risk in Banks

Managing compliance risk in banks is a continuous, multi-layered process that requires a blend of regulatory awareness, strong governance, effective internal controls, and the right technology. With the volume of global financial regulations constantly increasing, banks must build robust compliance frameworks that not only reduce risks but also foster trust with regulators, investors, and customers.

1. Stay Ahead of Regulatory Changes

Banks must closely monitor evolving regulations from global and local authorities—whether it’s AML (Anti-Money Laundering) directives, Basel norms, GDPR, FATCA, or sanctions requirements. A structured process for regulatory change management ensures timely policy updates, staff training, and implementation of necessary controls.

2. Strengthen Risk Identification and Assessment

Compliance teams should conduct regular assessments to pinpoint areas most vulnerable to risk, such as customer onboarding, high-value transactions, or cross-border payments. Risk assessments should evaluate both the likelihood and potential impact of non-compliance.

3. Implement Robust Internal Controls

Proactive measures such as automated transaction monitoring, audit trails, data encryption, and real-time alerts help banks prevent and detect violations. These controls must be periodically tested to ensure their effectiveness.

4. Enhance Employee Training and Awareness

Since employees are often the first to spot compliance issues, continuous training programs on AML, KYC, data privacy, and fraud detection are critical. Clear communication channels for reporting potential breaches also build a culture of compliance.

5. Foster Governance and Accountability

Strong oversight by the compliance committee, risk officers, and the board ensures accountability at every level. Clearly defined roles and responsibilities, combined with a tone-from-the-top approach, strengthen the compliance culture.

6. Leverage Technology and Automation

Manual compliance tracking is no longer sufficient. Modern banks are turning to RegTech and integrated compliance management platforms that automate monitoring, streamline reporting, and provide real-time visibility into compliance risks.

7. Establish Continuous Monitoring and Reporting

Compliance is not a one-time exercise. Ongoing monitoring of risks and transparent reporting to regulators and internal stakeholders ensures sustained compliance and readiness for audits or inspections.

Managing compliance risk in today’s fast-changing regulatory environment can be overwhelming without the right tools. MetricStream’s compliance risk management solutions provide banks with a unified platform to:

- Map regulations to internal policies and controls

- Automate compliance assessments and reporting

- Monitor risks in real-time using advanced analytics and dashboards

- Ensure accountability through clear workflows and governance structures

By integrating governance, risk, and compliance efforts, MetricStream helps banks streamline compliance management, reduce costs, and strengthen resilience against regulatory breaches.

The MetricStream Solution - Enabling a strong compliance culture

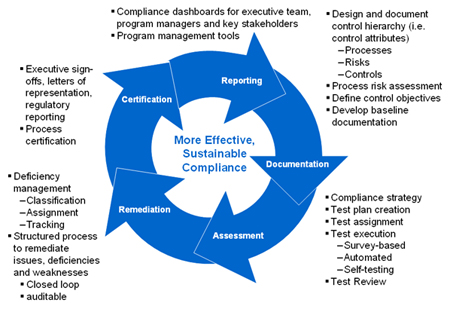

MetricStream enables banking organizations to meet regulatory demands efficiently and effectively using a risk-based compliance framework. First, high risk areas of compliance are assessed. Then the appropriate compliance strategies and controls are identified, evaluated and applied. Finally, monitoring and reporting processes are conducted at regular intervals to ensure that the organization is always fully compliant.

MetricStream Compliance Risk Management Lifecycle

- Prioritizing risks and controls

- Determining the right controls

- Compliance Reporting

- Mitigating and eliminating risks

Prioritizing risks and controls

The MetricStream Solution provides a systematic assessment of compliance risks across all dimensions of the enterprise. The solution includes powerful tools for risk analysis and monitoring such as configurable risk calculators and risk heat maps. It supports assessment and computations based on configurable methodologies and algorithms, providing a clear view into organization's compliance risk profile and enabling managers to prioritize their compliance issues. This helps you choose the right compliance approach based on your risk assessment results.

The solution meets these objectives by providing a single platform through which your organization can manage multiple compliance requirements and regulations. A central repository is provided to store and document all compliance related content. Integrated collaboration and workflow tools can be used to access, create, modify, review, and approve compliance content globally in a controlled manner.

External information repositories and content services can be fully integrated with MetricStream platform and applications to create a unique environment. Customers benefit from best practices content library that are accessible from within the applications. It also enables intelligent and content driven features such as triggering of business processes for compliance risk assessments and policy reviews based on a regulatory notifications and compliance alerts.

Determining the right controls

Once compliance risks are assessed and ranked, the appropriate control can be chosen either to prevent or detect the risk. Controls have to be evaluated based on their operating effectiveness. Higher risk controls need a more comprehensive evaluation, while lower risk controls don't.

The MetricStream solution helps you ensure that controls and other compliance activities are designed to meet regulatory requirements. The system supports assessments based on predefined criteria and checklists and has a mechanism of scoring, tabulating and reporting results.

For issue and exceptions that pose a risk of non-compliance, the MetricStream solution ensures seamless integration with Incident management and Remediation Management modules. Once issues are identified and documented, a systematic mechanism of investigation and remediation is triggered by the underlying workflow and collaboration engine.

Compliance Reporting

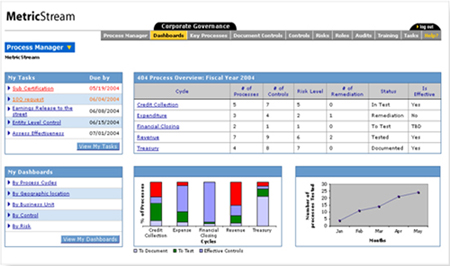

Compliance Managers are always under pressure to report on the status of organization’s compliance risks and controls. This can be extremely difficult given the number of departments and processes that a compliance program covers. With outlets across the globe, compliance reporting becomes even more complex.

The MetricStream platform provides an embedded reporting engine for powerful and flexible reporting. In addition to reports, the solution also provides Executive Dashboards. Managers can proactively track metrics and indices on compliance programs leading to improved decisions. The solution provides complete visibility into the compliance process with comprehensive aggregate reporting as well as individual status tracking in real-time. It allows for complete historical or real-time access to all data and histories as well as analysis of results.

Graphical executive dashboards and flexible reports, with drill-down capability, provide statistics on a variety of parameters such as type, status, due dates, closure times, region. This allows compliance managers to stay in constant touch with the ground reality and progress on compliance programs. Automated alerts for events such as exceptions and failures eliminate any surprises and make the process predictable.

Mitigating and eliminating risks

MetricStream’s organization-wide platform enables consistent compliance risk and control processes across the enterprise, thus eliminating any deviations and errors as well as redundant activities. The MetricStream solution maintains a centralized repository of issues and action plans focused on risk mitigation.

Once issues are identified and documented, a systematic mechanism of investigation and remediation is triggered by the underlying workflow and collaboration engine. The solution supports triggering automatic alerts and notifications to appropriate personnel for task assignments for investigation and remedial action. The exception cases remains open till the action plan is carried out and results verified for effectiveness. Managers can track the status of issues as they automatically moves from one stage to the next based on organizations compliance management procedures.

Conclusion

Growing regulatory environment, higher business complexity and increased focus on accountability has led banks to pursue risk and compliance initiatives across the organization. However, these initiatives are uncoordinated in an era when risks are interdependent and controls are shared, leading to gross inefficiency, duplication of efforts and a silo view of the world. Compliance Risk Management system through control, definition, enforcement, and monitoring have the ability to coordinate and integrate these initiatives and address the above mentioned issues. MetricStream provides the most comprehensive Compliance Risk Management solution in the industry today. The MetricStream solution help banks significantly in streamlining elaborate and intricate processes of compliance risk management with an integrated enterprise-wide system.

Benefits of MetricStream Compliance Risk Management Solution

- Tailor compliance to deal with the most significant risks

- Proactively mitigate risks and compliance issues

- Higher visibility into compliance profile

- Best practices content library accessible within the application

- Improve efficiency and lower costs

- Ensure systematic and consistent compliance across the enterprise

- Eliminate compliance errors and inconsistencies

- Make informed strategic decisions and maximize business performance

Subscribe for Latest Updates

Subscribe Now