AI-First Connected GRC

Drive a Connected GRC Program for Improved Agility, Performance, and Resilience

Discover Connected GRC Solutions for Enterprise and Operational Resilience

Explore What Makes MetricStream the Right Choice for Our Customers

Discover How Our Collaborative Partnerships Drive Innovation and Success

- Want to become a Partner?

Your Insight Hub for Simpler, Smarter, Connected GRC

4 Steps to Nurture a Better Relationship with Regulators

Overview

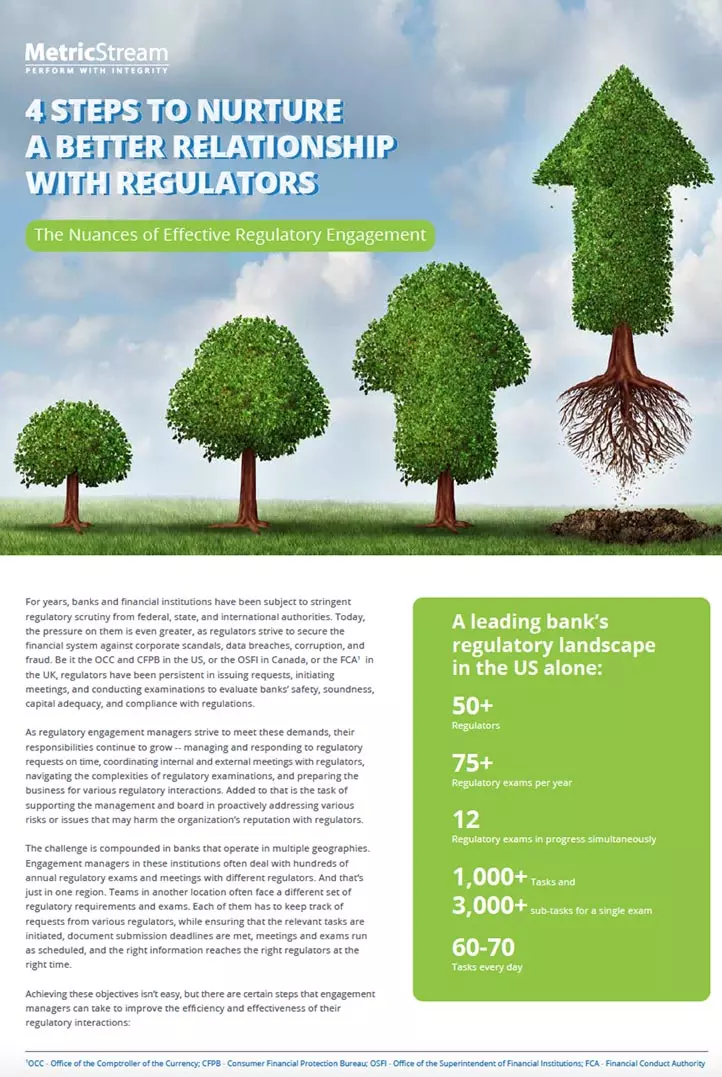

For years, banks and financial institutions have been subject to stringent regulatory scrutiny from federal, state, and international authorities. Today, the pressure on them is even greater, as regulators strive to secure the financial system against corporate scandals, data breaches, corruption, and fraud. Be it the OCC and CFPB in the US, or the OSFI in Canada, or the FCA 1 in the UK, regulators have been persistent in issuing requests, initiating meetings, and conducting examinations to evaluate banks’ safety, soundness, capital adequacy, and compliance with regulations.

As regulatory engagement managers strive to meet these demands, their responsibilities continue to grow -- managing and responding to regulatory requests on time, coordinating internal and external meetings with regulators, navigating the complexities of regulatory examinations, and preparing the business for various regulatory interactions. Added to that is the task of supporting the management and board in proactively addressing various risks or issues that may harm the organization’s reputation with regulators.

The challenge is compounded in banks that operate in multiple geographies. Engagement managers in these institutions often deal with hundreds of annual regulatory exams and meetings with different regulators. And that’s just in one region. Teams in another location often face a different set of regulatory requirements and exams. Each of them has to keep track of requests from various regulators, while ensuring that the relevant tasks are initiated, document submission deadlines are met, meetings and exams run as scheduled, and the right information reaches the right regulators at the right time.

1 OCC - Office of the Comptroller of the Currency; CFPB - Consumer Financial Protection Bureau; OSFI - Office of the Superintendent of Financial Institutions; FCA - Financial Conduct Authority

Achieving these objectives isn’t easy, but there are certain steps that engagement managers can take to improve the efficiency and effectiveness of their regulatory interactions:

1. Formulate a Strategy

Building successful relationships with regulators takes planning and commitment. The key is to develop a solid strategy on how the bank will manage various types of regulatory engagements and relationships. Doing so will not only position the bank for optimal success in their regulatory interactions, but will also prepare them to deal with potential regulatory issues or risks that may have an adverse impact on their operations.

Banks that do not have a well-thought-out strategy and good relationship with their regulators are likely to be put in a tight spot if and when they get involved in a regulatory issue. Senior management and compliance teams could end up scrambling to gain control of the situation and to convince regulators that adequate controls, processes, and procedures are in place.

An effective regulatory engagement strategy focuses on ensuring that all engagements are managed in a logical, transparent, and well-coordinated manner through standardized practices, processes, and tools. It also defines how regulatory relationships and communication are to be handled across various stages (e.g., when there are no proposed regulations, when there are no examinations underway, when a rule is likely to be proposed, or when an examination is in progress).

2. Streamline Regulatory Examinations

At the start of each year or quarter, a company-wide calendar of all scheduled regulatory examinations should be published, along with regular updates every time a schedule is changed. Generally, banks that have a good rapport with their regulators are more tuned in to upcoming examinations, requirements, and schedule updates than those that don’t take the time to build these relationships.

Before an examination, engagement managers would do well to coordinate with internal stakeholders to ensure appropriate allocation and ownership of examination management responsibilities. A pre-examination training can also be conducted to get members of the regulatory team and affected businesses up to speed. Ideally, the training should include an overview of policy requirements, examination procedures, and best practices. Team members interfacing with examiners should be coached on the conduct expected of them, as well as other relevant information about the regulators and their areas of focus.

It helps to have a robust regulatory engagement software system that can provide a single point of reference for bank representatives to communicate with examiners and to capture all forms of information exchange. The system can also be used to organize and maintain relevant documents, including exam workpapers, interim status reports, exception sheets, draft comments, and other key findings. Having all this data together in one place makes it simple for stakeholders to keep track of the examination, flag important documents, and stay alert to any major findings or issues before the conclusion of each examination, so that they can then proactively clarify the bank’s position.

3. Manage Regulatory Meetings Efficiently

One way to optimize the time and effort spent on regulatory meetings is to standardize the process as much as possible—right from the meeting preparation stage, to the actual interaction and subsequent follow-ups. Another way is to assign an engagement coordinator to lead the meeting planning process and other activities. He or she can work in close consultation with other stakeholders to ensure that the organization is adequately prepared for the regulatory interaction.

During the actual meeting, participants will be expected to accurately and comprehensively answer questions on their areas of accountability. The engagement coordinator can summarize the key feedback from the meeting and communicate with regulators on follow-up tasks.

To make things easier, a regulatory engagement management system can be used to record upcoming regulatory meetings, and tag them to the relevant operational locations, business units, and meeting owners. Applicable notes and documents can also be attached and sorted into pre-defined categories.

The system will essentially act as a database of meetings by capturing all required details, including meeting dates and participant information. Each meeting can be mapped to existing regulatory engagements, regulatory authorities, areas of compliance, and associated risks. This integrated data model gives engagement coordinators and other stakeholders a birds-eye view of each regulatory interaction. They can also document and track meeting findings till closure.

4. Strengthen Collaboration through Centralized Document Management

Since there are so many types of documents that banks need to share with regulators, it helps to have them all stored in one central location where they can be sorted and worked on collaboratively by multiple stakeholders. These documents typically include first day letters, findings response letters, regulatory notifications, supervisory letters, evidence of action plans, and email records. With a centralized document repository, engagement managers can easily attach supporting files at each stage of the regulatory interaction or task management process. They can also enable a quick search of documents based on title and type.

Being Examination-Ready :

Every bank must decide on their regulatory engagement strategy, and establish a structured process to see it through. Successful regulatory engagements are about being examination-ready and investigation-ready at all times. That, in turn, requires thorough planning and preparation. Having clearly-defined processes and tools goes a long way in managing regulatory requests, and ensuring that the required information is quickly gathered and submitted. The more efficient the regulatory engagement process, the higher a bank’s chances of increasing trust and credibility with regulators.

Subscribe for Latest Updates

Subscribe Now