Introduction

In an age where business dynamics are continually shifting and the global market is becoming more interconnected, the importance of operational risk management (ORM) cannot be overstated. At its core, ORM is about anticipating, identifying, and managing the risks that could potentially hinder financial services organizations’ operations, reputation, and profitability. The essence of ORM lies not just in averting financial losses but in preserving the corporate integrity and trust that organizations spend years building.

As businesses evolve, so does the landscape of operational risks. From cyber threats and data breaches to supply chain disruptions, IT failure, and regulatory compliance issues, the spectrum of risks is vast and continuously changing. This fluid landscape necessitates the adoption of sophisticated ORM tools, making them no longer just advantageous but essential for businesses aiming to navigate the intricacies of modern-day risks.

Key Takeaways

- ORM tools help organizations identify, assess, monitor, and mitigate risks associated with their operations, enhancing visibility and decision-making.

- Consider capabilities such as built-in support for industry frameworks, scalability, reporting capabilities, ease of configuration, integration with existing systems, user-friendliness, and vendor support when choosing an ORM tool.

- Implementing ORM tools improves risk visibility, decision-making, operational resilience, compliance with regulations, and overall efficiency.

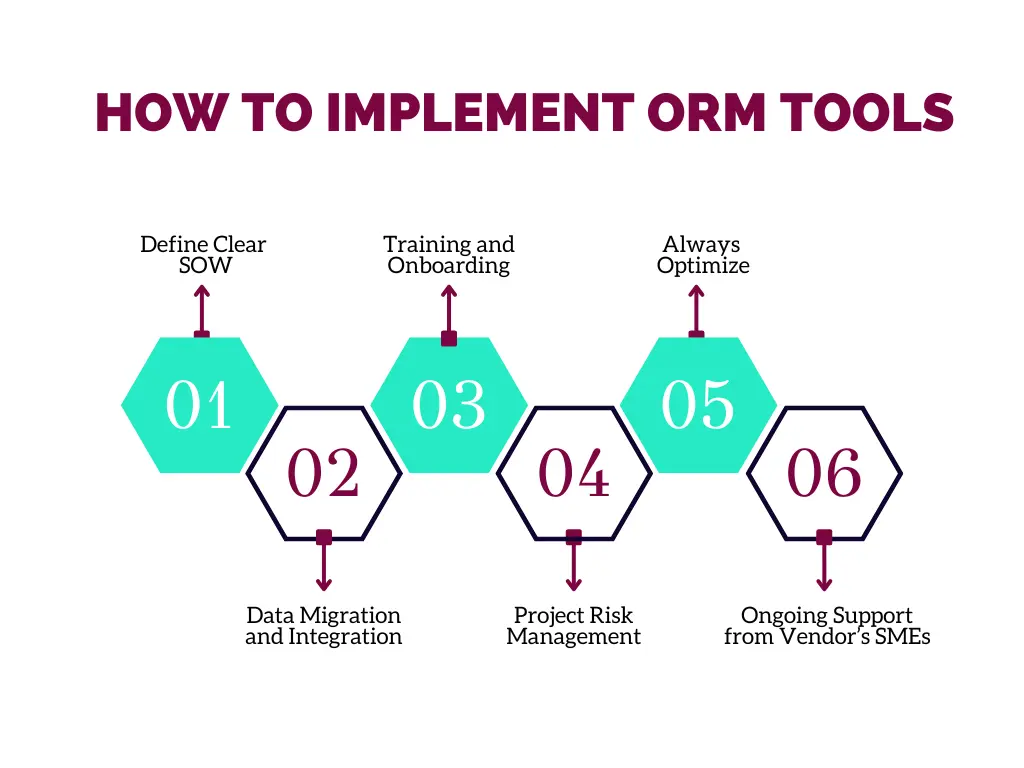

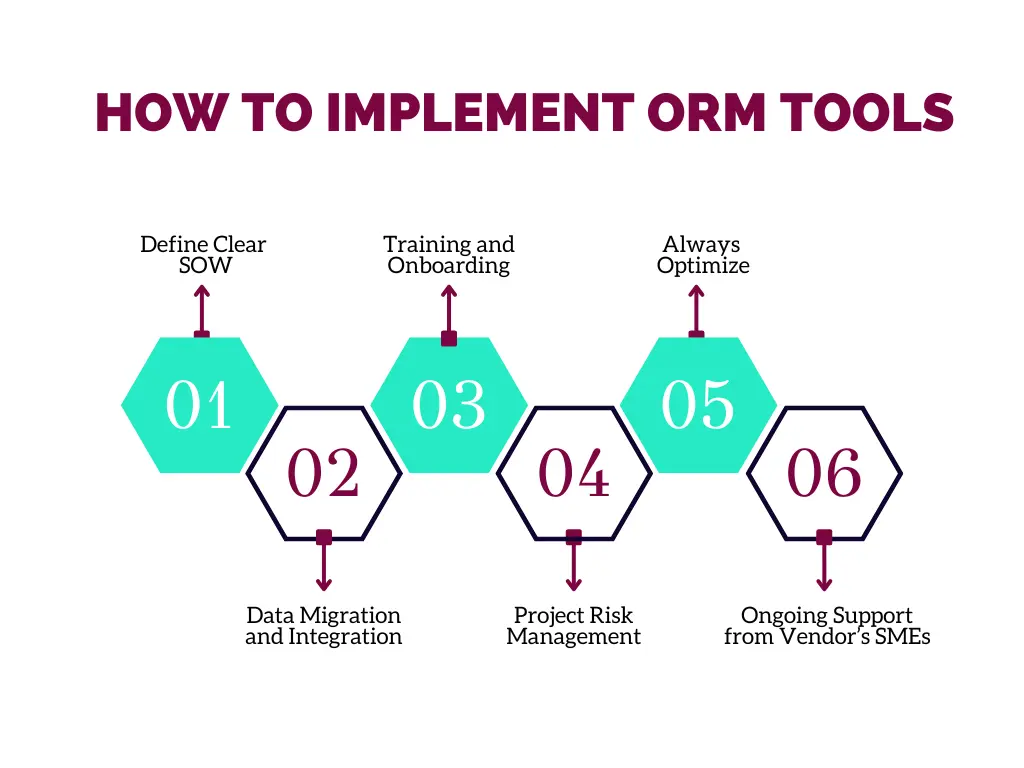

- Implementing an ORM tool requires following several steps, including defining a clear Statement of Work (SOW), ensuring accurate data migration and integration, providing comprehensive training, managing project risks, and continuously optimizing the tool with vendor support.

What is an ORM Tool?

An operational risk management (ORM) tool is a specialized software solution designed to help organizations identify, assess, monitor, and mitigate risks associated with their operational processes. By leveraging advanced analytics and well-defined workflows, ORM tools facilitate the systematic management of risks that could potentially disrupt business operations, impact financial performance, or harm an organization’s reputation.

Selecting the Right ORM Tool

Think of these factors as the necessary ingredients for an effective ORM solution.

Industry Frameworks and Best Practices

The tool should enable organizations to align their ORM program to industry frameworks and best practices. This includes capabilities and functionalities such as a centralized risk and control library, well-defined risk and control self-assessment (RCSA) workflows, loss management as per industry regulations like the Basel Accords, systematic issue and action management, and more.

Scalability and Adaptability

Look for a tool that can handle increasing data volumes and complexity over time, as your processes and risks evolve. A solution that offers modules to address specific areas like vendor or cyber risk demonstrates adaptability. As new impacts come into effect, the tool should be able to pivot quickly.

Reporting and Visualization

Data is useless without the ability to analyze it and gain insights. Look for tools with robust reporting features that provide an at-a-glance view of your risk indicators through interactive dashboards and visuals.

Easy Configuration and Personalization

A tool that allows for flexible configuration ensures that it can be tailored to align with unique business processes and risk management frameworks. This adaptability can significantly reduce the time and effort required to implement and maintain the tool.

Seamless Integration with External Systems

With organizations increasingly depending on external systems to streamline and accelerate their processes, pull relevant information for better-informed decision-making, and take a comprehensive approach to the bigger picture, integration capabilities have become extremely important. An effective ORM tool should seamlessly integrate with your existing external systems, such as ERP, CRM, and other enterprise software.

Easy to Use and Intuitive

Choose an ORM tool that is user-friendly and intuitive. The easier it is for your team to navigate and use the tool, the quicker they can adopt it and leverage its full potential. A complicated interface can hinder productivity and can possibly lead to user frustration.

Strong Roadmap and Innovation Strategy Alignment

Ensure that the ORM solution provider has a robust innovation strategy and a product roadmap that aligns with your company’s goals and objectives. A forward-thinking provider will continually evolve their tool to meet emerging risk management needs, ensuring long-term relevance and value.

User groups

Consider whether the ORM solution provider has established user groups such as product councils, customer councils, and special interest groups. These forums are valuable for knowledge sharing, gaining product feedback, and staying updated on best practices.

Cost and Implementation

Solutions vary widely in pricing models and implementation requirements. Evaluate your budget, resources, and timeline to choose a tool that you can implement successfully.

Top 5 Operational Risk Management (ORM) Tools

Operational Risk Management (ORM) tools help organizations identify, assess, and mitigate risks related to daily operations, compliance, and internal processes. Here are five of the top ORM tools used by businesses today:

1. MetricStream

MetricStream is a leading ORM platform offering comprehensive risk assessment, compliance management, and audit tracking. It provides real-time risk monitoring, AI-driven analytics, and automated workflows to streamline risk management processes.

2. RSA Archer

RSA Archer delivers a robust risk management framework with customizable dashboards, regulatory compliance tracking, and scenario analysis. Its integration capabilities allow businesses to align risk management with broader governance strategies.

3. LogicGate Risk Cloud

LogicGate Risk Cloud is a flexible ORM solution that offers no-code automation, dynamic reporting, and AI-powered risk assessment. It allows organizations to tailor workflows and streamline risk identification and mitigation efforts.

4. RiskWatch

RiskWatch is a cloud-based ORM tool that helps organizations assess operational risks through automated reporting, compliance tracking, and real-time data analysis. It is widely used in industries like healthcare, finance, and manufacturing.

5. Fusion Risk Management

Fusion provides a unified platform for risk management, business continuity planning, and incident tracking. With AI-driven insights and scenario planning capabilities, it helps businesses proactively manage operational risks.

Selecting the right ORM tool depends on an organization's specific risk management needs, industry requirements, and integration capabilities.

How to Choose the Best Operational Risk Management Tool

Choosing the right ORM tool is critical to ensuring an effective risk management strategy. Here are key factors to consider when selecting an ORM tool for your organization:

1. Identify Your Risk Management Needs

Evaluate your organization's specific risk areas, such as compliance, cybersecurity, supply chain disruptions, or financial risks. The tool should align with your business objectives.

2. Assess Ease of Use and Integration

Look for a user-friendly interface that allows seamless integration with existing systems like ERP, CRM, or compliance software. A tool that requires minimal training can enhance efficiency.

3. Ensure Scalability and Flexibility

Choose a tool that can scale with your organization’s growth and adapt to evolving risk landscapes. Customizable workflows and modular features help in future-proofing your ORM strategy.

4. Check Reporting and Analytics Capabilities

Robust reporting and analytics features enable data-driven decision-making. Look for a tool with real-time dashboards, risk heat maps, and AI-driven insights for better risk visualization.

5. Verify Compliance and Regulatory Support

The tool should support compliance frameworks relevant to your industry, such as ISO 31000, NIST, or GDPR. Automated compliance tracking reduces the risk of regulatory penalties.

6. Evaluate Cost and Return on Investment (ROI)

While cost is a factor, consider the long-term value the tool brings in terms of risk mitigation, compliance efficiency, and operational resilience. Compare pricing models and feature sets before making a decision.

By considering these factors, organizations can select an ORM tool that enhances their risk management framework, improves decision-making, and safeguards business continuity.

How to Implement ORM Tools

Here are the key steps that organizations can follow to implement an ORM software solution:

Define Clear SOW

Start by defining a clear Statement of Work (SOW). Outline the scope, including what the ORM tool will cover and what it won't. Set realistic timelines for each phase of the implementation. Assign responsibilities to team members, ensuring everyone understands their role and deliverables.

Data Migration and Integration

Ensure that all relevant data is accurately transferred to the new system. Verify the integrity and completeness of data before going live. Additionally, focus on integrating the ORM tool with existing systems to create a unified data environment.

Training and Onboarding

Don't just drop the new tool into your organization's lap and expect people to figure it out. Develop a comprehensive training program to teach employees how the tool works and their benefits. Onboard people slowly in phases so they can get used to the tool gradually.

Project Risk Management

Identify the risks to the tool’s implementation and user adoption and draw a project risk management plan. Regularly monitor the risks and address any issues promptly. Proactive risk management ensures the smooth implementation and adoption of the tool and minimizes disruptions.

Always Optimize

Once the tool is deployed, it needs to be reviewed and upgraded to ensure it is working as intended. Monitor how people use them and look for ways to enhance the user experience. Send out surveys to get feedback on what's working and not working. This feedback can then be shared with the software provider to innovate and optimize the tool, driving more user adoption.

Ongoing Support from Vendor’s SMEs

Following the initial launch and training, organizations should engage with the software providers to not just escalate issues and provide feedback on the tool but also share knowledge, expertise, and best practices with their subject matter experts (SMEs), customer and product councils, special interest groups, etc. This will help organizations continuously improve their ORM strategy and ensure that it is aligned with industry best practices.

The Future of Operational Risk Management Tools

With technology advancing at breakneck speed, ORM tools will look very different in just a few years. Some of the most promising innovations include:

- Risk modeling algorithms: AI can analyze huge volumes of data to detect complex patterns and insights humans might miss.

- Automated risk assessments: Tedious risk assessment processes like surveys, checklists, and risk rating matrices could be automated using natural language processing. AI could review policies, incident reporting, and audit findings to detect, categorize, and score risks.

- Risk visualization dashboards: Advanced data visualization tools can translate complex risk data into intuitive, interactive dashboards. These dashboards provide a holistic view of risks across the company with drill-down capabilities to analyze risks.

How MetricStream Operational Risk Management (ORM) Software Can Help

MetricStream Operational Risk Management helps organizations automate and streamline operational risk processes. It is purpose-built to meet the operational risk needs of banks and financial services institutions, including a centralized risk and control library and well-defined workflows for risk and control self-assessments, loss management, KRIs tracking, issue management, and more. Graphical dashboards and powerful reports with drill-down capabilities enable risk practitioners to gain actionable risk insights and slide and dice the data to pinpoint problem areas to address them proactively.

To learn more about MetricStream Operational Risk Management (ORM) software, request a personalized demo today.

Frequently Asked Questions

What are the top ORM tools of 2025?

Organizations contemplating which ORM tool to purchase can refer to the reports from independent research firms, including Chartis, Forrester, and Gartner. MetricStream has been named a Category Leader in all seven quadrants of the Chartis Research RiskTech Quadrant® for Integrated GRC Solutions, 2024, including Operational risk, Internal audit, Third-party risk, IT risk, Conduct risk and controls, GRC analytics, and Enterprise GRC. MetricStream was also recognized as a Leader in The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023.

To learn more, read our blog “What It Takes to Be a Leader in Governance, Risk, and Compliance”, by Pat McParland, AVP of Product Marketing at MetricStream.

In an age where business dynamics are continually shifting and the global market is becoming more interconnected, the importance of operational risk management (ORM) cannot be overstated. At its core, ORM is about anticipating, identifying, and managing the risks that could potentially hinder financial services organizations’ operations, reputation, and profitability. The essence of ORM lies not just in averting financial losses but in preserving the corporate integrity and trust that organizations spend years building.

As businesses evolve, so does the landscape of operational risks. From cyber threats and data breaches to supply chain disruptions, IT failure, and regulatory compliance issues, the spectrum of risks is vast and continuously changing. This fluid landscape necessitates the adoption of sophisticated ORM tools, making them no longer just advantageous but essential for businesses aiming to navigate the intricacies of modern-day risks.

- ORM tools help organizations identify, assess, monitor, and mitigate risks associated with their operations, enhancing visibility and decision-making.

- Consider capabilities such as built-in support for industry frameworks, scalability, reporting capabilities, ease of configuration, integration with existing systems, user-friendliness, and vendor support when choosing an ORM tool.

- Implementing ORM tools improves risk visibility, decision-making, operational resilience, compliance with regulations, and overall efficiency.

- Implementing an ORM tool requires following several steps, including defining a clear Statement of Work (SOW), ensuring accurate data migration and integration, providing comprehensive training, managing project risks, and continuously optimizing the tool with vendor support.

An operational risk management (ORM) tool is a specialized software solution designed to help organizations identify, assess, monitor, and mitigate risks associated with their operational processes. By leveraging advanced analytics and well-defined workflows, ORM tools facilitate the systematic management of risks that could potentially disrupt business operations, impact financial performance, or harm an organization’s reputation.

Think of these factors as the necessary ingredients for an effective ORM solution.

Industry Frameworks and Best Practices

The tool should enable organizations to align their ORM program to industry frameworks and best practices. This includes capabilities and functionalities such as a centralized risk and control library, well-defined risk and control self-assessment (RCSA) workflows, loss management as per industry regulations like the Basel Accords, systematic issue and action management, and more.

Scalability and Adaptability

Look for a tool that can handle increasing data volumes and complexity over time, as your processes and risks evolve. A solution that offers modules to address specific areas like vendor or cyber risk demonstrates adaptability. As new impacts come into effect, the tool should be able to pivot quickly.

Reporting and Visualization

Data is useless without the ability to analyze it and gain insights. Look for tools with robust reporting features that provide an at-a-glance view of your risk indicators through interactive dashboards and visuals.

Easy Configuration and Personalization

A tool that allows for flexible configuration ensures that it can be tailored to align with unique business processes and risk management frameworks. This adaptability can significantly reduce the time and effort required to implement and maintain the tool.

Seamless Integration with External Systems

With organizations increasingly depending on external systems to streamline and accelerate their processes, pull relevant information for better-informed decision-making, and take a comprehensive approach to the bigger picture, integration capabilities have become extremely important. An effective ORM tool should seamlessly integrate with your existing external systems, such as ERP, CRM, and other enterprise software.

Easy to Use and Intuitive

Choose an ORM tool that is user-friendly and intuitive. The easier it is for your team to navigate and use the tool, the quicker they can adopt it and leverage its full potential. A complicated interface can hinder productivity and can possibly lead to user frustration.

Strong Roadmap and Innovation Strategy Alignment

Ensure that the ORM solution provider has a robust innovation strategy and a product roadmap that aligns with your company’s goals and objectives. A forward-thinking provider will continually evolve their tool to meet emerging risk management needs, ensuring long-term relevance and value.

User groups

Consider whether the ORM solution provider has established user groups such as product councils, customer councils, and special interest groups. These forums are valuable for knowledge sharing, gaining product feedback, and staying updated on best practices.

Cost and Implementation

Solutions vary widely in pricing models and implementation requirements. Evaluate your budget, resources, and timeline to choose a tool that you can implement successfully.

Operational Risk Management (ORM) tools help organizations identify, assess, and mitigate risks related to daily operations, compliance, and internal processes. Here are five of the top ORM tools used by businesses today:

1. MetricStream

MetricStream is a leading ORM platform offering comprehensive risk assessment, compliance management, and audit tracking. It provides real-time risk monitoring, AI-driven analytics, and automated workflows to streamline risk management processes.

2. RSA Archer

RSA Archer delivers a robust risk management framework with customizable dashboards, regulatory compliance tracking, and scenario analysis. Its integration capabilities allow businesses to align risk management with broader governance strategies.

3. LogicGate Risk Cloud

LogicGate Risk Cloud is a flexible ORM solution that offers no-code automation, dynamic reporting, and AI-powered risk assessment. It allows organizations to tailor workflows and streamline risk identification and mitigation efforts.

4. RiskWatch

RiskWatch is a cloud-based ORM tool that helps organizations assess operational risks through automated reporting, compliance tracking, and real-time data analysis. It is widely used in industries like healthcare, finance, and manufacturing.

5. Fusion Risk Management

Fusion provides a unified platform for risk management, business continuity planning, and incident tracking. With AI-driven insights and scenario planning capabilities, it helps businesses proactively manage operational risks.

Selecting the right ORM tool depends on an organization's specific risk management needs, industry requirements, and integration capabilities.

Choosing the right ORM tool is critical to ensuring an effective risk management strategy. Here are key factors to consider when selecting an ORM tool for your organization:

1. Identify Your Risk Management Needs

Evaluate your organization's specific risk areas, such as compliance, cybersecurity, supply chain disruptions, or financial risks. The tool should align with your business objectives.

2. Assess Ease of Use and Integration

Look for a user-friendly interface that allows seamless integration with existing systems like ERP, CRM, or compliance software. A tool that requires minimal training can enhance efficiency.

3. Ensure Scalability and Flexibility

Choose a tool that can scale with your organization’s growth and adapt to evolving risk landscapes. Customizable workflows and modular features help in future-proofing your ORM strategy.

4. Check Reporting and Analytics Capabilities

Robust reporting and analytics features enable data-driven decision-making. Look for a tool with real-time dashboards, risk heat maps, and AI-driven insights for better risk visualization.

5. Verify Compliance and Regulatory Support

The tool should support compliance frameworks relevant to your industry, such as ISO 31000, NIST, or GDPR. Automated compliance tracking reduces the risk of regulatory penalties.

6. Evaluate Cost and Return on Investment (ROI)

While cost is a factor, consider the long-term value the tool brings in terms of risk mitigation, compliance efficiency, and operational resilience. Compare pricing models and feature sets before making a decision.

By considering these factors, organizations can select an ORM tool that enhances their risk management framework, improves decision-making, and safeguards business continuity.

Here are the key steps that organizations can follow to implement an ORM software solution:

Define Clear SOW

Start by defining a clear Statement of Work (SOW). Outline the scope, including what the ORM tool will cover and what it won't. Set realistic timelines for each phase of the implementation. Assign responsibilities to team members, ensuring everyone understands their role and deliverables.

Data Migration and Integration

Ensure that all relevant data is accurately transferred to the new system. Verify the integrity and completeness of data before going live. Additionally, focus on integrating the ORM tool with existing systems to create a unified data environment.

Training and Onboarding

Don't just drop the new tool into your organization's lap and expect people to figure it out. Develop a comprehensive training program to teach employees how the tool works and their benefits. Onboard people slowly in phases so they can get used to the tool gradually.

Project Risk Management

Identify the risks to the tool’s implementation and user adoption and draw a project risk management plan. Regularly monitor the risks and address any issues promptly. Proactive risk management ensures the smooth implementation and adoption of the tool and minimizes disruptions.

Always Optimize

Once the tool is deployed, it needs to be reviewed and upgraded to ensure it is working as intended. Monitor how people use them and look for ways to enhance the user experience. Send out surveys to get feedback on what's working and not working. This feedback can then be shared with the software provider to innovate and optimize the tool, driving more user adoption.

Ongoing Support from Vendor’s SMEs

Following the initial launch and training, organizations should engage with the software providers to not just escalate issues and provide feedback on the tool but also share knowledge, expertise, and best practices with their subject matter experts (SMEs), customer and product councils, special interest groups, etc. This will help organizations continuously improve their ORM strategy and ensure that it is aligned with industry best practices.

With technology advancing at breakneck speed, ORM tools will look very different in just a few years. Some of the most promising innovations include:

- Risk modeling algorithms: AI can analyze huge volumes of data to detect complex patterns and insights humans might miss.

- Automated risk assessments: Tedious risk assessment processes like surveys, checklists, and risk rating matrices could be automated using natural language processing. AI could review policies, incident reporting, and audit findings to detect, categorize, and score risks.

- Risk visualization dashboards: Advanced data visualization tools can translate complex risk data into intuitive, interactive dashboards. These dashboards provide a holistic view of risks across the company with drill-down capabilities to analyze risks.

MetricStream Operational Risk Management helps organizations automate and streamline operational risk processes. It is purpose-built to meet the operational risk needs of banks and financial services institutions, including a centralized risk and control library and well-defined workflows for risk and control self-assessments, loss management, KRIs tracking, issue management, and more. Graphical dashboards and powerful reports with drill-down capabilities enable risk practitioners to gain actionable risk insights and slide and dice the data to pinpoint problem areas to address them proactively.

To learn more about MetricStream Operational Risk Management (ORM) software, request a personalized demo today.

What are the top ORM tools of 2025?

Organizations contemplating which ORM tool to purchase can refer to the reports from independent research firms, including Chartis, Forrester, and Gartner. MetricStream has been named a Category Leader in all seven quadrants of the Chartis Research RiskTech Quadrant® for Integrated GRC Solutions, 2024, including Operational risk, Internal audit, Third-party risk, IT risk, Conduct risk and controls, GRC analytics, and Enterprise GRC. MetricStream was also recognized as a Leader in The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023.

To learn more, read our blog “What It Takes to Be a Leader in Governance, Risk, and Compliance”, by Pat McParland, AVP of Product Marketing at MetricStream.