Why Should Finance Take the Lead on ESG Strategy?

- ESGRC

- 14 April 23

Introduction

Environmental, social, and governance (ESG) considerations have become increasingly important for companies and investors alike. With the growing recognition of the impact of businesses on society and the environment, investors are increasingly prioritizing ESG factors when making investment decisions. In today's increasingly sustainability-focused business landscape, finance has a critical role to play in driving ESG strategy, both within the organization and as a global industry.

Here are the top reasons.

Promotion of Sustainable Business Practices

First and foremost, the role of finance and the Chief Financial Officer (CFO) has changed significantly over the years. CFOs are no longer solely focused on financial reporting and compliance, but also play a key role in formulating and executing the overall strategy of the organization. They use their financial expertise to help drive growth, reduce costs, and manage risks.

Allocation of capital to various projects and investments is primarily driven by finance. This makes the finance function and CFOs strategically placed to influence the direction of corporate and societal development. According to a survey by Accenture, 68% of global finance leaders said the ultimate ownership around ESG should lie with finance.

By prioritizing ESG considerations in investment decisions, finance can ensure that capital is directed towards projects and companies that align with sustainable and responsible practices. This can include investing in companies that have a strong track record of environmental stewardship, that treat their employees well, or that have a commitment to good governance. For example, if capital is invested primarily in fossil fuel projects, it will contribute to the ongoing problem of climate change. On the other hand, if capital is invested in renewable energy projects, it will contribute to a more sustainable future.

In practice, this can mean that finance professionals will look at a company's environmental impact, labor practices, and governance structure when making investment decisions. They might also consider the company's performance on broader ESG metrics, such as carbon emissions or diversity and inclusion. By doing so, finance can help promote sustainable and responsible practices and ensure that capital is directed towards projects that will have a positive impact on society.

Driving Decisions for Long-Term Financial Success

Secondly, there is increasing evidence that companies that prioritize ESG perform better financially in the long term. The NYU Stern Center for Sustainable Business, in collaboration with Rockefeller Asset Management, recently released a report examining the relationship between ESG and financial performance from 2015-2020. The report found positive correlations between ESG and financial performance for >50% of the corporate studies focused on operational metrics such as return on equity (ROE), return on assets (ROA), and stock price.

Better ESG practices help finance build strong relationships with investors, regulators, and other stakeholders. They must be able to communicate the financial performance of the organization effectively and transparently. By taking the lead on ESG, finance can help companies make decisions that will lead to long-term financial success. Several factors contribute to this, including:

- Increased brand value: Companies that prioritize ESG often have a better reputation and are viewed more favorably by consumers, which can lead to increased brand value.

- Better employee retention: Companies with strong social and governance policies often have better employee engagement, which can lead to increased productivity and lower turnover.

- Improved access to capital: Companies with strong ESG practices may be viewed as less risky investments by investors and may have better access to capital as a result.

- Cost savings: Companies that adopt sustainable practices can often achieve cost savings through energy efficiency, waste reduction, and reducing their environmental footprint.

- Innovation: Companies that prioritize ESG often drive innovation in their respective fields, as they constantly strive to improve their sustainable practices.

Moreover, institutional investors such as pension funds, endowments, and insurance companies are increasingly incorporating ESG in their investment strategies. This is because they realized that companies with strong ESG practices tend to be less risky investments and they are better positioned to weather market volatility.

Measuring Risks and Optimizing Opportunities Associated with ESG

Thirdly, finance is uniquely positioned to understand and measure the risks and opportunities associated with ESG issues. According to the 2022 PwC Corporate Directors Survey, fewer than two-thirds of directors say their board understands the company’s climate risk/strategy. Many of these issues, such as climate change and social inequality, can have a significant impact on a company's financial performance. Take, for example, a company that relies heavily on fossil fuels. It may be at risk if there is a policy shift towards renewable energy. Similarly, a company with poor labor practices may be at risk if there is an increase in consumer demand for socially responsible products.

By incorporating ESG considerations into risk management and analysis, finance can help companies identify and mitigate potential risks while also identifying opportunities for growth and innovation. A finance professional might assess a company's exposure to carbon risk and analyze potential scenarios, such as the implementation of a carbon tax or the growth of renewable energy, to help the company plan for the future. Finance as an industry has well-established risk and control assessments administered by the 2nd line (risk function) and executed by the 1st line (business). The same process can be extended to manage ESG risks and opportunities in line with Task Force for Climate-Related Disclosures (TCFD) recommendations. Thereby leading by example to ensure better quality ESG data/public disclosures.

Finance professionals therefore play a key role in helping companies understand the financial implications of ESG issues and incorporating ESG considerations into risk management and analysis—which in the long run can help companies make informed decisions that will lead to long-term financial success.

Finance is Optimally Positioned to Take the Lead

Finance is a global industry. It is optimally positioned to play an important role in promoting sustainable and responsible practices on a global scale. By leading the way on ESG, finance can help to set standards and best practices that can be adopted by other industries and countries.

In conclusion, the ability of finance to influence capital allocation, to understand and measure ESG risks and opportunities, to determine long-term financial success, makes finance the right advocate for not just policies that promote sustainable and responsible development but to lead the overall ESG strategy.

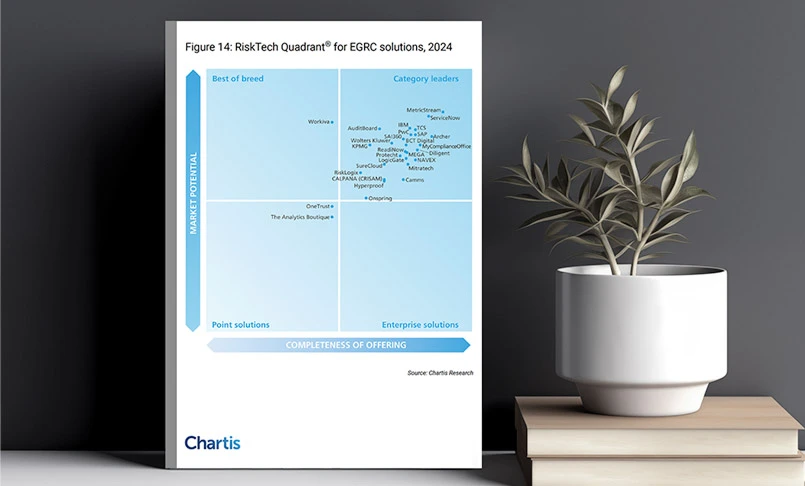

With MetricStream’s ESGRC product, your organization can gain a simplified and streamlined approach towards meeting all of your organizational requirements relating to Environmental, Social, Governance, Risk and Compliance (ESGRC).

Learn more: Request a personalized demo now!

Read the eBook: ESG Buyer’s Guide

Download Infographic: 7 ESG Trends for 2023

UK's Extended Producer Responsibility for Packaging Regulation: How to Prepare

- ESGRC

- 11 April 23

Introduction

More than 9.2 billion tons of plastic has been produced between 1950 and 2017, of which 7 billion tons has ended up in landfills where it will take hundreds of years to biodegrade. The equivalent of a garbage truck full of plastic waste finds its way into the oceans every minute. If the above numbers are not shocking enough, a recent report by earth.org found that if no action is taken, plastic pollution will grow to 29 million metric tons per year in less than 20 years. At the same time, the production of new plastic products requires the use of fossil fuels that add to greenhouse gas emissions.

Plastic pollution and its contribution to climate change is already proving to be a significant threat to the lives and livelihoods of millions across the world. As a result, there is now increasing regulatory scrutiny on Environment, Social, and Governance (ESG) matters, and new frameworks and standards are being introduced to help organizations account for and ensure corporate responsibility and relevant action in these areas. The latest entrant is the UK’s packaging waste reform or the Extended Producer Responsibility for Packaging (EPR).

What is the Packaging EPR Regulation?

From February 28, 2023 onward, packaging producers are required to comply with EPR reporting requirements. Some of the key highlights include:

- The packaging EPR scheme aims give organizations in England, Northern Ireland, and Scotland an incentive to reduce and recycle packaging

- Wales will also be added to this list within a few months

- The regulations are applicable to:

- Any organization based in the UK that manufactures, handles, and supplies more than 25 tons of packaging in a year

- Has an annual turnover of more than £1 million

- Large scale producers of packaging materials are required to report their findings to the Environment Agency as well. These are organizations with

- More than £2 million of annual revenue

- More than 50 tons of packaging handled annually

- Organizations are expected to collect and report data on the volume and type of packaging they use through the year

- Submission of reports will start from October 2023

- From 2024 organizations will have to pay an EPR fee for the cost of collecting and treating waste packaging material that is currently handled by local civic bodies

What Does the EPR Regulation Aim to Do?

The EPR regulations have been implemented to encourage environmentally sustainable practices. Businesses use large volumes of packaging materials, and with these regulations in place the UK hopes to drive wider adoption of reusable and refillable packaging. This will have a significant impact on the amount of plastic waste ending up in landfills and help reduce fossil fuel emissions by reducing the production of new packaging materials. Lawmakers in the UK argue that the reduction in virgin packaging production will help cut down greenhouse emissions by at least 2.2 million tons by 2023. This is a significant metric that will contribute to the country’s efforts to achieve net zero goals by 2050. It will also help reduce the burden of handling packaging waste on taxpayers and local councils. In fact, this shift of cost to the producers of packaging material will make approximately £1.2 billion of funding available to local authorities annually for managing used packaging. The UK Government has already published a guidance on EPR reporting and intends to launch a digital platform on the regulation. The EPR regulations come on the heels of the EU’s Corporate Sustainability Reporting Directive (CSRD). Both of these reporting standards stress on sustainability reporting as the world steps up its efforts to achieve net zero by 2050.

As the climate crisis worsens, there is an increased demand for accountability and positive action from corporates to help the world reduce emissions and plastic pollution. ESG risks can also negatively impact bottom lines and profitability. Failure to meet sustainability standards, and non-compliance with ESG reporting frameworks and regulations can have severe consequences. There are financial repercussions of non-compliance as well as severe damage to brand image and corporate reputation. Modern customers do not hesitate to stop engaging with organizations that fail to meet sustainability standards and this can have a long-term impact on revenues as well. Organizations now have to deploy robust, intelligent technology solutions to manage ESG compliance and reporting.

Stay Ahead with MetricStream

The climate crisis is escalating and positive action on sustainability is no longer a good to have measure but a business imperative. Even as global leaders vow to address climate change on a war footing, there is increasing pressure from stakeholders including customers and investors for corporate accountability and action on these fronts. New regulations like the UK’s EPR are being introduced across the world to ensure sustainable business practices and corporate responsibility. Organizations can no longer manage ESG compliance in a haphazard manner as the cost of non-compliance is severe. Investing in a robust ESG platform is a sound business strategy that will set the business up for long term compliance health and sustainable growth.

MetricStream’s ESGRC solution is built on the AI-powered MetricStream GRC platform and is designed to simplify and streamline ESG reporting and compliance. It can help your organization:

- Ensure compliance with ESG reporting standards and frameworks

- Gain real time ESG intelligence

- Manage disclosure frameworks and reporting

- Simplify content integration

- Identify ESG issues and recommend remedial ESG-related actions

- Map common requirements across multiple ESG standards

- Identify relevant metrics and documents pertaining to ESG risk

With MetricStream’s ESGRC solution your organization can ensure sustainable growth and increase the confidence and trust of all stakeholders with a healthy ESG rating.

Interested to learn more?

Sign up for our upcoming webinar on Managing the E in ESG: The Role of Technology and Carbon Accounting in Achieving Environmental Sustainability

MetricStream and Greenly have partnered to speak on a how carbon accounting is necessary in achieving sustainability goals. Our guest speaker, Hasitha Sridharan, from Greenly and I will discuss the EPR Regulation as well as other reforms and regulations developing around the world. You will also gain insights into:

- The latest trends and best practices in environmental sustainability and the importance of the "E" component in ESG

- The role of ESG technology in measuring, managing, and reporting your environmental impact and how it can provide insights into your energy usage, greenhouse gas emissions, and other environmental metrics.

- How to leverage carbon accounting to track and report carbon emissions, a critical step in reducing your carbon footprint.

- The importance of accurate data collection and reporting in carbon accounting

- The benefits of leveraging ESG technology and carbon accounting, including improved operational efficiency, reduced costs, enhanced reputation, and increased stakeholder engagement.

Interested to learn more about how MetricStream can help with your ESG requirements. Request a for personalized demo now!

Check out new ESG resources:

eBook: ESG Buyer’s Guide

Infographic: 7 ESG Trends for 2023

Article: TCFD Recommendations and their Significance for Your Organization

ESG: Don’t Get Sacked

- ESGRC

- 28 February 23

Introduction

I love football, so bear with me. I see leaders contemplating ESG like a quarterback at the Super Bowl. If you wait too long to release the ball, you might get sacked.

The topic of ESG is also one of interest to me, not just because we were one of the first movers in the GRC space to provide an ESG solution but also because of the growing regulatory focus on climate-related financial disclosures. Having spent most of my career working for large global banks, I see the real value and brand equity that ESG can bring to your business and your customers, employees, and investors. As a CEO, I also understand that companies need to grow and remain competitive.

Conflicting views about whether ESG will result in real change or if it’s just hype is slowing the adoption of well-rounded ESG strategies by organizations. As businesses continue to experience pressure to implement proactive ESG measures, the conversation is becoming more divided. This includes conflicting views on balancing profit with purpose, what’s real and what’s under development, and who has the most to gain. Watching from the sidelines is no longer an option.

The Balancing Act

There is often a tradeoff between business goals and doing what’s right for the greater good. Undoubtedly, a dramatic and polarizing dichotomy is at play concerning ESG. On the one hand, businesses might need to take some cost-intensive measures to keep their emissions in check and build a sustainable future, which directly impacts their profits and dividend payouts. On the other hand, the regulatory landscape is starting to heat up; and customers, partners, and employees are beginning to demand more ESG-friendly practices and reporting.

Investments in ESG

Investors and customers are starting to cry foul and push back as ESG funds do not deliver on their promise of strong financial gains.

For example, after the California Public Employees’ Retirement System posted a decade of lackluster returns, Heather Gillers reported in the Wall Street Journal that “there is no such thing as a free lunch. Activists who think they can use public companies to pursue political agendas without endangering shareholder returns are indulging in a fantasy. Disappointing results at a giant government pension fund cannot all be tied to political agendas. Still, the retired workers who rely on Calpers have every right to demand that fund managers adopt a singular focus on maximizing returns.”

More recently, Florida Governor DeSantis also approved measures to “protect Florida’s investments blocking ESG investments” and ensuring that all investment decisions focus solely on maximizing the highest rate of return.

At the same time, the World Economic Forum recently released the Global Risk Report, which stated that “over a 10-year horizon, the health of the planet dominates concerns: environmental risks are perceived to be the five most critical long-term threats to the world as well as the most potentially damaging to people and planet, with “climate action failure,” “extreme weather,” and “biodiversity loss” ranking as the top three most severe risks.” The report also cited that, “racial justice also remains a pressing issue in many countries, notably the United States.”

I believe this provides a clear indication of where regulatory bodies will focus over the next few years.

Regulations are Coming

Regulators are already starting to gain traction in the development of ESG metrics. We are also beginning to see companies like Mastercard tie employee compensation to ESG metrics creating a sense of urgency to do good. So, while today some may enjoy the choice of improving ESG standings, this luxury will fade quickly.

On the regulatory front, the Climate Change Act commits the UK government by law to reduce greenhouse gas emissions by at least 100% of 1990 levels (net zero) by 2050. Large UK companies are already required to report publicly on energy use and carbon emissions. This January, the EU’s Corporate Sustainability Reporting Directive (CSRD) brought in stronger rules around the social and environmental data that companies will need to report. Approximately 50,000 companies, both large and small, are covered under the new directive. Also, in January this year, the U.S. Securities and Exchange Commission has cited April 2023 as the release date for a long-anticipated rule on companies' climate-related disclosures according to a recent federal notice. All of the above only scratches the surface, with many more regulations expected to come.

Reputations are at Stake

As a CEO, I am acutely aware that the culture I help build within my organization is critical to my success and that happy purpose-driven employees lead to more satisfied customers and growth. Building purpose in an organization means ensuring that employees feel proud and are confident that they are working towards a greater goal, protecting people, using natural resources wisely, and caring for the environment. Who can argue that these are not all good things and that organizations that drive towards creating a better future will be recognized?

At the end of the day, building a more sustainable and equitable future will require nonprofits, governments, and the private sector to agree and work collaboratively. In the meantime, we also desire to foster a more equitable and inclusive environment within our organization. The diversity of thoughts and ideas is an essential strength within an organization. Ensuring an inclusive environment, especially in the workforce, is paramount. Employees, customers, and partners are demanding it in the form of choosing one company over another and considering ESG metrics before taking the next step.

Reaching Your Common Ground

Just like any conflict, whether business or personal, we all know that at some point, we must come together in reconciliation and reach a conclusion that serves the masses and not just a few. So, while the politicians hash out their views, you need to consider your balanced approach and what strategy best fits the culture of your organization and your people. To ignore the inevitable has never worked, ever. You have nothing to lose by being the first mover on the road to a more sustainable and equitable future. I encourage you to take the first step, and here’s how.

If you have already invested in a governance, risk, and compliance solution, you are halfway there. A GRC platform allows an organization to address evolving business and market needs. It will enable you to accelerate decision-making with contextual, real-time intelligence delivered through advanced reports and analytics, all via the cloud. You can easily add an ESG solution to your existing GRC platform, gaining the ability to centrally manage disclosure requirements of various ESG frameworks, including GRI, SASB, and TCFD, and optimize the process with automated reporting.

If you do not have a GRC solution, you can look at standalone ESG solutions, but point solutions only offer an incomplete picture and result in a siloed approach to managing risk. Organizations implementing a more connected approach and ensuring collaboration between risk, compliance, audit, cybersecurity, and sustainability teams are more successful in the long run. Access to standardized, complete, and accurate data across the enterprise is critical to having confidence in the output and analysis.

Also important is to understand the role third parties play. Third-party risk management can often focus just on operational disruptions, bribery, corruption, and compliance risks, but an organization’s supply chain can account for more than 90% of its greenhouse gas (GHG) emissions. Incidents of child labor, worker exploitation, and health and safety issues can also emerge from your supply chains.

A common platform for all this data can significantly improve risk visibility, giving management a more nuanced and contextual understanding of ESG risks across their supply chain. An integrated platform also helps ESG and supply chain governance teams communicate and share data, thus minimizing redundancies and enabling a more comprehensive approach.

Don’t let the dichotomy of political tensions slow down your ESG journey or divert your attention away from what is just good governance. At the end of the day, the defensive end is heading your way, and he’s 6 feet 5 inches and 275 pounds. You better release that ball or tuck and run.

Register for the upcoming webinar: The Interconnectedness of ESG, ERM, and Third-Party Risk Management

Read the eBook: ESG and ERM: Bridging the Gap

Download the Resource: ESG Buyer’s Guide

ESG and ERM: Optimizing Risk Resilience

- ESGRC

- 14 February 23 |

Introduction

Environmental, social and governance (ESG) concerns are rapidly emerging as critical factors that can impact and disrupt business, livelihoods, and life itself. Organizations are now aware of the significance of ESG compliance, though it is still considered primarily from a financial reporting lens. And despite there being several overlaps in terms of best practices, requirements, and reporting, many companies have still not integrated ESG reporting and compliance with their enterprise risk management (ERM) practices. As the risks continue to escalate, ESG will only increase in organizational importance, and become a permanent part of GRC. More specifically, it will become a risk category positioned under the overall risk umbrella of enterprise risk management.

The question, of course, is why many organizations are still hesitant to adopt ESG as a business-critical requirement. Unfortunately, too many businesses still perceive environmental or social activism as irrational with little or no connection to business productivity and success. But today, extreme weather events, droughts and lessening snow packs, and global temperature increases are a reality, and instances of discrimination, incivility, and harassment are widely reported across the world, resulting widespread public condemnation, reputational damage, and demands for accountability.

We are at an inflection point with consumers recognizing their influence and demanding that businesses and industries to do better – for the environment and social governance. Their influence extends beyond condemning poor actors to buying behavior, where their demands for accountability have the power to force business, sectors, and even governments to ensure public reporting of ESG compliance, and its impact on the environment, people, and communities. The public in key markets is already making ESG value statements with their pocketbooks. It should not surprise any business today that when given the choice consumers are often more likely to do business with a company that demonstrates its commitment to sustainability. It has been shown that they are willing to pay a premium for products where the brand showcases its approach to ethical, social, and environmental causes. In short, it is time businesses realized that climate-consciousness and pursuing ESG best practices and standards can help increase profits and ensure long-term business success.

At the same time, organizations are beginning to understand the direct impact of climate change on business continuity, resilience, and profitability. It is important to remember that the increasing number of businesses and governments are declaring that climate change and environmental sustainability are real and legitimate risks to operations. This means that committing to an ESG program is no longer a nice-to-have measure that can elevate the reputation of and profitability of a business. It is a must-have critical element within a larger risk management and operational resiliency strategy.

Why Integrating ESG into ERM frameworks is Critical?

Enterprise Risk Management is an umbrella approach for managing multiple risk categories across the business. These include external risks such as economic or geopolitical risks, cybersecurity, or environmental risks, and internal risks like reputational risks, financial risks, product risks, partner risks, data privacy risks, leadership, employee churn risks, and compliance risks. Most ERM strategies include specific categories such as operational risk management, regulatory & compliance programs, third-party risk management, IT and cybersecurity risk management, and audit programs. Many expect ESG to migrate from a standalone practice to become one more of these risk categories housed under a larger ERM framework. But we believe that time has not yet come, as the distinct practices, values, and measures within ESG need to mature further and be more widely adopted before it can be appropriately positioned under an ERM umbrella.

Management of existing risk categories today apply certain common structures, workflows, assessment practices within ERM frameworks. This includes standard practices for the identification, assessment, and prioritization of individual risks, and the evaluation of risk velocity, severity, and the connections between different risks. ERM frameworks also tend to include a centralized risk registry for easy reference. A centralized system provides the controls, procedures, and policies that can be applied when responding to any category of risks, based on the organization’s predefined risk profile and appetites. Modern ERM frameworks leverage data analytics for real time insights that facilitate better decision making across the risk universe.

Most ERM practices have been around for decades, and the best practices have been designed, tested and reviewed over time. While it is a living process that is flexible enough to adapt to risk scale, diversity and changes in organizational risk profile, program validation, scope, scale, and performance adaptation is constant. In a well-run risk management program, many processes are automated, which allows risk leaders to focus on strategy rather than day to day operations. Reapplying or extending existing standard procedures, automation, assessments, scoring methodologies, data collection and reporting – with some evolution and adaptation – to newer risk management categories like ESG makes good business sense. Pursuing ESG as a risk category and integrating it into existing ERM frameworks should help expedite program accountability and ensure reporting consistency.

Over the last few years several ESG reporting standards such as TCFD, CSRD have emerged, reaching a definitive and defensible market position. These standards define how ESG-related data is to be collected, reporting formats and requirements, as well as other criteria pertaining to what, when, where and who collects ESG data. These reporting outcomes can be easily incorporated into existing ERM frameworks and may enhance data and reporting across additional risk categories. In fact, ESG and Third-Party Risk Management (TPRM) are central to and can be further integrated into resiliency strategies within ERM. Their inclusion will be invaluable for accelerating recovery from environmental and social risk events. Integrating ESG into ERM frameworks can also add to commonly accepted structures and expand the scale, scope and depth of understanding risks. It would be a mutually beneficial move where each discipline would benefit from the data and values of the other to deliver holistic legitimacy.

ESG and ERM: The Road Ahead

There is a growing expectation that within the next five to ten years, ESG will be housed within and enhance ERM programs. For now, ESG deserves focused attention from the market to refine its reporting and frameworks as it matures. While there will clearly be distinct risks, reporting structures, frameworks, and stakeholders for ESG information, it will increasingly be viewed as one of several important risk categories under the ERM umbrella. In a sense, it must ‘cross the chasm’ to a degree of standardization, consistency, commonality, to capture the market buy-in it doesn’t yet have. Once this is achieved, organizations will more easily integrate ESG risk assessments, reporting, and definition into enterprise risks.

Want to learn how to integrate ESG risks into Enterprise Risk Management (ERM) processes.

Register for the upcoming webinar: The Interconnectedness of ESG, ERM, and Third-Party Risk Management

Read the eBook: ESG and ERM: Bridging the Gap

What are Carbon Offsets? Can they Help with Your ESG Strategy?

- ESGRC

- 10 November 22

Introduction

Evidence of the climate crisis is all around us in the form of record-breaking heat waves, floods, wildfires, and drought. To combat this global challenge, our first and foremost priority must be to directly reduce emissions across our businesses and supply chains – be it through the use of renewable energy, better waste management practices, or simply, less travel.

Beyond that, there’s another strategy that many companies are using to get to net zero faster – buying carbon offsets.

What are Carbon Offsets?

Carbon offsets are essentially a way for businesses to compensate for their carbon footprint by investing in emission-reducing projects elsewhere. For example, a company might finance a wind farm in a developing country to replace coal-fired power plants. Or, fund a waste-to-energy project that captures and converts methane from landfills into electricity for local communities.

There are broadly two types of offset schemes:

- Removal offsets are generated from activities that remove carbon from the atmosphere (e.g., restoring a damaged mangrove ecosystem)

- Avoidance offsets are from activities that prevent the release of emissions into the atmosphere (e.g., replacing wood or charcoal stoves with energy-efficient alternatives).

Why are companies making a beeline for offsets? Because while the end goal is to eventually eliminate all emissions, that can be harder to achieve for some businesses - especially, those that sell commodities like oil and gas, or whose production depends on fossil fuels. While they wait for new zero-emissions infrastructure to be built, many are accelerating their progress toward carbon neutrality by purchasing carbon offsets.

The Compliance Perspective: How Carbon Offsets Help Companies Meet Emission Reduction Requirements

Offsets aren’t just bought voluntarily. They’re also used to meet compliance requirements around emissions thresholds.

For example, under the Kyoto Protocol’s Clean Development Mechanism (CDM), companies can earn a carbon credit for every tonne of CO2 they reduce through decarbonization projects, usually in developing countries. These credits can then be exchanged for carbon allowances – or, sold to meet legally binding emission reduction targets.

COP26’s Article 6 also provides a mechanism to trade carbon credits – but it takes things further with more stringent rules around additionality, permanence, and double counting (more on that in the next section). These measures are poised to improve the transparency of carbon markets, and result in higher-quality credits.

The other way to ‘offset’ excess emissions is through ‘cap and trade’ schemes which allow companies to purchase carbon allowances - certificates or permits that represent the legal right to emit one tonne (metric ton) of CO2 or equivalent greenhouse gas (GHG).

For example, under the EU Emissions Trading System (EU ETS) – which is part of EU climate legislation – companies can buy and trade emission allowances within a certain cap which keeps reducing every year.

Other ‘cap-and-trade’ schemes include the US’s Regional Greenhouse Gas Initiative (RGGI) and the UK Emissions Trading Scheme (UKETS).

What to Consider When Buying a Carbon Offset

Here are four principles to keep in mind when investing in a project to offset your carbon footprint:

- Additionality: Will the project lead to a reduction in emissions that would not have happened otherwise? For example, if a reforestation initiative would have been funded by the local government regardless of other contributions, then your investment is additional and doesn’t really count as a carbon offset.

- Permanence: Will the project permanently lower GHG emissions? For example, you might invest in a reforestation initiative – but if a wildfire burns down the forest, the carbon stored in it will be released back into the atmosphere, thereby negating your efforts.

- Double counting: Is another company claiming the same emissions reduction as you? This isn’t allowed.

- Leakage: Will a reduction of GHG emissions in your project location simply shift the source of those emissions to another place? For example, your offset project might focus on preventing deforestation in one site – but it’s entirely possible that the people who want to clear the land will simply move their operations to the adjoining forest.

- Verifiability: Is your project data being verified by an objective third party? This helps confirm that the emissions reductions are authentic, credible, and compliant with reporting standards.

Why a Connected ESG Strategy is Important in Enabling Growth with Purpose

Before buying a carbon offset, the first step is to understand what percentage of your carbon footprint remains to be addressed after you’ve exhausted all other feasible emission-reducing opportunities. Only then can you know how much to offset in a cost-efficient manner.

That’s where a connected ESGRC (environmental, social, governance, risk, and compliance) program can help. It brings together all your environmental metrics, ESG-related risks, supplier assessment results, and more into a single source of truth.

With software like MetricStream ESGRC, you can streamline, automate, and centrally manage ESG disclosure requirements. Our technology makes it simple to assess, understand, and disclose your carbon footprint in compliance with ESG standards and frameworks. It also provides a unified view of the risks and impact of all your emission-reducing initiatives – including carbon offsets. With these insights, you can make better decisions that drive sustainable growth, and win the trust of both investors and stakeholders.

Carbon offsets aren’t a silver bullet, for the simple reason that carbon offsets don’t work on their own. Companies have mostly used offsets as a way to easily achieve carbon neutrality. If your business is looking to build long-term strategic plans to not just ensure ESG compliance but to also make a conscientious effort to save the planet, taking a connected ESGRC approach will help grow your business with purpose.

3 Steps to Future Proof Your ESG Program

- ESGRC

- 17 August 22

Introduction

With environmental, social, and governance (ESG) metrics now being established as an important strategic and financial imperative, there is mounting pressure from various sides for organizations to set up ESG programs. Investors, consumers, and other stakeholders are increasingly expecting companies to proactively meet ESG standards. Regulatory bodies worldwide are also stepping in with enforcements.

However, the ESG maturity level of companies varies widely. In a global survey conducted by OCEG, more than half of the respondents—58%—said that they had minimal or no confidence in the ESG programs run by their company. Companies are also at a loss when it comes to reporting tools and methods. In a survey of US companies by Global ESG Monitor (GEM), it was found that only 35% of the respondents were able to demonstrate transparency in their ESG reports. Organizations are also concerned about the risks associated with climate change, sustainability, and social factors. 68% of general counsels in large and mid-sized companies expressed worry about new legal and regulatory ESG risks.

To help your organization simplify and streamline ESG-related activities including data collection, regulatory requirements, investor disclosure requirements, ESG reporting, ESG risk assessment, mitigation, etc., here are 3 essential steps to build a future-proof ESG program.

1. Start by Leveraging GRC for ESG

Implement your ESG program by integrating it with your Governance, Risk Management, and Compliance (GRC) strategy. Organizations need structured guidance when setting up their ESG program and GRC offers the foundation to build a single connected system and approach to systematically collect, record, monitor, analyze, comply, report, and mitigate.

To break it down further:

- Governance enables monitoring and reporting with accurate information rolled up with ESG-specific metrics to be set up. GRC policies mapped to ESG frameworks provide measurements on ESG improvements to investors, customers, partners, and other stakeholders.

- Risk management offers a unique and disciplined approach to analyze ESG data to identify and prioritize risk and opportunities and develop risk mitigation strategies.

- Compliance, by mapping GRC controls to multiple ESG frameworks, helps provide a comprehensive view, especially as ESG standards and frameworks such as SASB, GRI, TCFD, etc., are being adopted by regulators as foundations for their new ESG regulations.

In addition, building your ESG program will require ensuring third-party management of ESG data to drive compliance and mitigate risk. Regulations such as the draft European Corporate Due Diligence Direction and the German Supply Chain Due Diligence Act (set to be enacted on Jan 1, 2023), will require organizations to create documented processes to report environmental and social metrics concerning their extended supply chains. Taking a proactive approach to manage ESG risk across third and fourth parties will help companies future-proof their ESG programs.

2. Make the Move from Manual to Automated

ESG programs are heavily data dependent. Most organizations launching ESG programs are faced with a myriad of data-related challenges, especially, a lack of clarity on what ESG data needs to be collected, a lack of visibility into the data collection process, difficulty in benchmarking progress, and the inability to perform data discovery. Moreover, ESG data spread across multiple sources including spreadsheets, documents, and databases, along with inconsistency in data formats make it difficult to collect, analyze, or report.

Risks today are interconnected, and a manual approach makes integration with other systems difficult. Accurate assessment of how ESG risks relate to other risks in the organization—both direct and indirect—will not be possible through manual processes. With ESG standards and frameworks evolving, consolidating, and rapidly being adopted as regulations, managing the alphabet soup of these standards via manual means is not efficient in any way.

By leveraging automation for your ESG program, your organization will be able to automatically:

- Capture ESG metrics from various data sources and third-parties

- Define calculation logic and aggregate metrics

- Facilitate analysis through reports and dashboards

- Create standard reporting based on ESG requirements

- Provide regulatory changes and updates

3. Streamline ESG Reporting for Key Stakeholders

When it comes to setting up ESG programs, the toughest challenge often lies in reporting ESG information to key stakeholders such as investors, consumers, and regulatory bodies. The breadth of ESG data (data may be sourced from financial and non-financial systems and even third-party vendors), evolving global reporting expectations, and lack of proper governance and reporting structures in place, are just some of the challenges that organizations face. In a recent PwC survey of global investors, 61% agreed that it is important that ESG reporting by companies follows recognized non-financial reporting frameworks such as SASB, TCFD, or GRI.

While establishing your ESG program, your organization should ensure that your reporting capabilities can:

- Accurately report the ESG issues each stakeholder group needs to know about your organization

- Effectively identify potential ESG risks and opportunities (such as new innovations, revenue streams, and more)

- Transparently report ESG metrics to the board through real-time and visually-effective reports

- Provide the agility required to collect, integrate, and generate reports of the new types of information from new sources as the ESG landscape evolves

- Integrate with existing tools and processes for data sourcing, aggregation, analytics, and reporting

Stay Ahead with MetricStream ESGRC

MetricStream’s Environmental, Social, Governance, Risk, and Compliance (ESGRC) solution is built to empower your organization with a simplified and streamlined approach to meeting the various requirements of setting up a future-proof ESG program. Built on the industry-leading, AI-powered MetricStream Platform, ESGRC enables your organization to:

- Centrally manage ESG standards, frameworks and disclosure requirements including GRI, SASB, TCFD, etc., and map these requirements to various business units and locations

- Automatically capture data for a broad range of environmental, social, and governance metrics and define calculation logic

- Manage and mitigate third-party ESG risk and compliance systematically through a supplier portal

- Document and manage ESG risks and related details and perform simple and advanced risk assessments and analysis with heat maps

- Identify and document ESG-related issues and leverage AI to identify similar issues based on relation and recommend issue classification and action plans

- Integrate seamlessly with third-party systems to pull in relevant information related to environmental, social, and governance metrics

- Gain comprehensive and real-time visibility into various ESGRC management processes and metrics through graphical dashboards and configurable reports

Interested to learn more about MetricStream ESGRC? Request a custom demo now.

Explore our ESGRC resources:

eBook: Building an Enterprise ESG Program? Here's How Technology Can Help You Succeed

Infographic: Why ESG Matters?

Product Overview: Enable Your Growth with Purpose

Greenwashing and the Invisible Enemy of Apathy

- ESGRC

- 13 July 22

Introduction

Reduce, reuse, and recycle; turn off light switches when not in use; use the washing machine on a cold cycle. The list goes on as we look to reduce waste and minimize our energy footprint in this world. While these concepts are not new, it is interesting to see how some organizations have now taken this to a new level. We don't have to look too far back to see similar recurring themes - let me explain.

Back in the 80s (think Stranger Things minus the paranormal events and horror) environmentalist Jay Westerveld walked into a hotel room in Fiji and noticed a card that read; "Save Our Planet: Every day, millions of gallons of water are used to wash towels that have only been used once. You make the choice: A towel on the rack means, 'I will use again.' A towel on the floor means, 'Please replace.' Thank you for helping us conserve the Earth's vital resources."

Jay rapidly saw the irony of this statement and composed an essay where he discussed how the hotel industry's motives had little to do with saving the planet, concluding that the real objective of promoting towel reuse was to reduce laundry costs and increase profits. A term he labeled as 'Greenwashing'.

This label re-emerged in 2021 when eco-activist Greta Thunberg referred to COP26 as a 'Greenwash Festival', extending the definition beyond that of product marketing and more towards corporations claiming green credentials and yet outsourcing their obligations. With the specter of legislation ever-present, these practices will need to stop if consumers, regulators, and crucially investors are to be kept happy. This will require organizations to pivot toward a more sophisticated approach to ESG if they are to convince the cynic's view that greenwashing is not the status quo.

Technology will play a key role in this ESG revolution, not just in producing disclosure reports and providing the required evidence, but crucially, the collection of those vital ESG metrics from across the organization and beyond in the supply chain.

These technology solutions will need to bring together all requirements into one central hub allowing organizations to manage the various disclosure frameworks across all geographies whether that be TCFD, GRI, SASB or indeed the various ESG Data Providers. It is crucial that there is consistency, with everyone speaking the same language, as there is little to be gained in actively measuring and managing ESG if the data cannot be aggregated into a single view.

Beyond creating efficiencies in data collection and aggregation, user adoption is essential if you are to embed a culture of ESG into an organization, and the invisible enemy of apathy is to be defeated. If not, 'Greenwashers' using ESG as a marketing tool will pay the price.

Streamline ESG Management with MetricStream ESGRC

MetricStream enables you to take a simplified and streamlined approach toward meeting all organizational requirements relating to Environmental, Social, Governance, Risk, and Compliance (ESGRC).

- Centrally manage disclosure requirements of various ESG frameworks, including GRI, SASB, TCFD, and others

- Leverage automated and standardized ESG reporting to optimize ESG processes

- Define calculated logic and aggregated metrics which can be analyzed and presented via dashboards

- Perform ESG self-assessment with questionnaires and link this to a risk assessment library

- Manage and link your third parties and vendors via a supplier portal to evaluate the ESG posture of your suppliers

- Automate your overall workflow and integrate data feeds from third-party ESG rating agencies

Interested to learn more about MetricStream ESGRC? Request a custom demo now.

Explore our ESGRC resources:

eBook: Building an Enterprise ESG Program? Here's How Technology Can Help You Succeed

Infographic: Why ESG Matters?

Product Overview: Enable Your Growth with Purpose

OMG it’s ESG

- ESGRC

- 11 May 22

Riding Your Bike Twice a Day is Not the Same as Recycling

Floating Wind Farms are no Sinking Feeling

The MetricStream London office is set alongside a 22km canal that has barges and narrowboats quaintly floating across the waterways. The UK was the first country to develop a nationwide canal network and earlier this year it was announced that a new floating wind farm is set to become an eminent landmark in Welsh and English waters. Technology for floating wind farms has been around for decades. They provide renewable energy without releasing environmental pollutants or greenhouse gases and wind power is more powerful at sea than on land. This initiative has several environmental benefits with the energy from wind not emitting any carbon emissions.

It’s not only governments that are doing their bit for the environment. Organizations are also taking charge to ensure a sustainable future for this and subsequent generations. Investors are searching for a convincing environmental, social, and governance (ESG) plan of action that helps pave the way to net-zero carbon emissions and a sustainable future. Furthermore, research shows that organizations with a purpose striving for ESG principles can significantly progress their innovation and employee retention rates.

The European Union’s (EU) target to be climate-neutral by 2050 with net-zero greenhouse gas emissions is legally binding for member states, and with a raft of governing bodies, task forces, and regulations, let me see if I can unravel some of the acronyms and guidelines that the UK and EU are facing:

Making Sense of ESG

The Task Force on Climate-related Financial Disclosures (TCFD)

TCFD was launched in December 2015 by the Financial Stability Board (FSB) and on 6 April 2022, the UK became the first G20 country to make it mandatory for large companies to disclose information and to better price climate-related risk and opportunities. It will help investors understand their financial exposure to climate change. The largest UK-traded companies, as well as private companies with over 500 employees and over £500m in turnover, are subject to this.

European Banking Authority (EBA)

In 2022, the EBA published its final draft implementing technical standards on climate change and how it might affect other risks on the balance sheet. Shareholders should be able to assess banks’ ESG-related risks and sustainable finance strategies. Reporting requirements will be applied to large institutions on an annual basis for the first year and semi-annually thereafter. Institutions will start disclosing this information from June 2022.

The European Central Bank (ECB)

The ECB has put an action plan in place to incorporate climate change considerations aligned with progress on the EU policies including sustainability disclosure and reporting. Climate change can pose a real risk to the financial system including systemic risk to the global markets.

The Sustainable Finance Disclosure Regulation (SFDR)

The SFDR was mandatory in Europe from March 2021 and was designed to help institutional asset owners and retail clients monitor the sustainability of investment funds by standardizing sustainability disclosures around climate-related risk and opportunities. SFDR applies to financial institutions within the EU and includes sectors they invest in and their portfolio companies.

Financial Conduct Authority (FCA)

The FCA is aware that many UK investment managers will need to comply with the SDFR.

The Climate Change Risk Assessment (CCRA)

CCRA has stipulated that every 5 years the UK government must prepare policies to reduce greenhouse gases and cope with changes in climate. There are three steps, 1: understand the current vulnerabilities, 2: understand the future vulnerabilities, and 3: prioritize the risks and opportunities over the next 5 years.

There are plenty more like the International Panel of Climate Change (IPCC) which is the intergovernmental body of the United Nations for accessing the science related to climate change.

Ok, I hope you are all still with me and I did not discuss America or Asia guidelines, after all this is a blog and not an eBook.

However, at MetricStream, we have published an eBook that discusses building an enterprise ESG program and how technology can help you optimize your ESG disclosure reporting. It’s well worth a read.

Download eBook: Building an Enterprise ESG Program

ESG and GRC Convergence – Let’s Hit our Targets Together

As you can see, there are a raft of regulations and guidelines, and companies are increasingly being held accountable for corporate practices that focus on climate sustainability. Funds that also invest in sustainability have to be made clearer to the customer.

You need to demonstrate a solid risk management practice to allow you to monitor, manage, and track your ESG metrics alongside a strategy that understands how you are going to reduce your carbon footprint.

There is a real convergence of governance, risk, and compliance (GRC) and ESG.

Streamline and Manage ESG Requirements with MetricStream

At MetricStream, we can help you manage your ESG frameworks and disclosures, so you can:

- Optimize the process with automated and standardized ESG reporting

- Define calculated logic and aggregated metrics which can be analyzed and presented via dashboards

- Perform ESG self-assessment questionnaires and link this to a risk assessment library

- Manage and link your third parties and vendors via a supplier portal

- Automate your overall workflow and integrate data feeds from third-party ESG rating agencies

By simplifying compliance through an integrated approach, you will be able to improve visibility into ESG metrics and strengthen your awareness around third-party ESG risks. And pave the way to a rich ESG culture through seamless collaboration.

Every company can make a difference to the planet.

Interested in our ESGRC product? Write to me at ssahi@metricstream.com. You can also book a personalized demo to understand more about our product.

Stay up-to-date with trending discussions and insights in the risk community. Subscribe to the Instagram of Risk Blog Series authored by Suneel Sahi, VP, Product Marketing at MetricStream.