Introduction

Organizations navigate a complex web of laws and regulations, varying not just by country but often by state or region within countries. Additionally, the pace of regulatory change is such that more than one-third of firms spend at least a whole day every week tracking and analyzing regulatory change. The current regulatory landscape, along with the stakes of failing to comply, which are not just financial but can span legal entanglements and severe reputational damage, underscores the importance of compliance risk management. In fact, as stated in the 2023 Risk and Compliance Report by the Thompson Reuters Institute, the top two strategic priorities for compliance teams over the next 12 to 18 months would be to keep up with regulatory and legislative changes while mitigating emerging risks.

So, what is required? Read on to learn the key components of compliance risk management and how to create and implement a compliance risk management strategy.

Key Takeaways

- Compliance risk management is crucial for organizations to navigate complex regulatory environments and avoid financial, legal, and reputational risks.

- Key components include establishing policies, fostering a compliance culture, monitoring activities, and responding to compliance failures.

- A robust compliance risk management plan involves identifying, assessing, mitigating, and monitoring risks to ensure continuous compliance with laws and regulations.

- Effective practices include cross-functional teams, regular policy updates, a culture of compliance, and leveraging technology to streamline processes.

- Challenges include costs of compliance, data management and security, operational efficiency, resistance to change, and global compliance complexities.

What is Compliance Risk Management?

Compliance risk management is the process of identifying, assessing, and mitigating risks that arise from non-compliance with laws, regulations, and internal policies. It involves establishing controls and monitoring systems to ensure that an organization adheres to relevant legal and ethical standards, thereby avoiding legal penalties, financial losses, and reputational damage.

These risks can culminate in punitive fines, legal battles, or damage to an entity’s reputation that, in severe cases, might be irreparable. Therefore, it becomes crucial for organizations to adopt an integrated and proactive approach to manage these compliance risks. This is where compliance risk management plays a vital role.

Compliance risk management is the process by which organizations identify, assess, respond to, and monitor the compliance risks applicable to their operations. It encompasses the creation and implementation of strategies aimed at ensuring continuous compliance with all relevant legal, regulatory, and procedural requirements.

Instilling a culture of compliance and ethics compliance risk management aids organizations in not only averting potential penalties but also in safeguarding their integrity and enhancing their reputation in the marketplace.

Key Components Of Compliance Risk Management

Key components of compliance risk management include clear policies and procedures, employee training on laws and regulations, effective leadership emphasizing accountability, regular compliance monitoring through audits, and prompt response to compliance failures.

Here are some key components that form the foundation of a comprehensive compliance risk management program:

Policies and Procedures

Policies and procedures form the foundation for setting the standards and expectations for behavior within the organization. They provide a roadmap for decision-making and operational processes that comply with external legal and regulatory requirements, as well as internal standards.

Training and Education

Training and education equip employees with the knowledge and skills they need to understand and comply with applicable laws, regulations, and organizational policies. Regular training sessions ensure that employees are not only aware of the requirements but also understand their role in maintaining compliance.

Good Leadership

Good leadership establishes clear accountability and oversight structures within the organization to ensure that compliance is a top priority. Leadership sets the tone from the top, emphasizing the importance of ethical behavior and compliance with laws and regulations.

Monitoring Activities

Implementing processes to regularly monitor compliance and report on the effectiveness of the compliance program is an important component. This involves ongoing audits and reviews to ensure that policies and procedures are being followed and remain effective in managing compliance risks.

Response and Remediation

Establishing mechanisms for responding to compliance failures, including the investigation of incidents, implementation of corrective actions, and updates to policies and procedures to prevent future occurrences, is key to effective compliance management.

4 Steps to Creating a Compliance Risk Management Plan

Below are the four main steps of a sound compliance risk management strategy:

Identification

The foundation of a good compliance risk management strategy begins with the identification of potential compliance risks. This step involves a thorough examination of all areas of the organization's operations, looking for vulnerabilities where compliance failures might occur. Identifying these risks requires a detailed understanding of both internal processes and external regulatory requirements.

Assessment

This step requires a thorough analysis to prioritize risks based on their severity and the business's vulnerability. The aim is to answer key questions, including which risks could most significantly affect our strategic goals or which areas of our business are most susceptible. By prioritizing risks, businesses can allocate resources more efficiently and ensure that they focus on the most critical areas first.

Mitigation

Once risks have been identified and assessed, developing and implementing strategies to mitigate those risks is crucial. This could involve revising policies, enhancing training programs, or incorporating new technology to ensure compliance. The goal here is to minimize the potential impact of identified risks or avoid them altogether.

Monitoring and Reporting

This step ensures that the compliance risk management strategies effectively control the risks and identify any new risks that may emerge. Regular reporting, supported by MetricStream's comprehensive analytics, helps keep stakeholders informed about the organization’s compliance posture and fosters a culture of transparency and continuous improvement.

Difference between Compliance Risk Management vs. Risk Management

Compliance risk management zeroes in on the organization's need to adhere to legal and regulatory requirements. It's a focused lens that primarily scrutinizes how the company's operations align with external laws, standards, and expectations.

This focus is crucial because failures in compliance can lead to significant penalties, legal issues, and damage to reputation. It's a defensive play, ensuring the organization does not violate the rules of the game it operates within.

Contrastingly, risk management embraces a broader spectrum, examining financial, operational, strategic, and compliance risks alike. While compliance risk management is an essential subset of risk management, the latter’s domain extends further into analyzing risks that could impact the organization’s overall health and objectives. Risk management is about playing offense and defense, not only preventing losses but also enabling the organization to make informed decisions that balance risks with opportunities.

In essence, they both differ in their scope and focus. Compliance risk management is about ensuring that the organization is a good citizen within its regulatory environment, playing by the rules set forth by authorities. Risk management, however, takes a bird's eye view, considering a wider range of factors that could impact the organization's journey toward its goals.

What Are the Benefits of Risk Management?

Risk management is more than a safeguard — it’s a strategic enabler. By proactively identifying, assessing, and mitigating risks, organizations not only avoid potential threats but also create opportunities for growth and resilience. Below are the key benefits of implementing a strong risk management framework:

Protects Business Assets and Reputation

Effective risk management helps prevent events that could damage an organization’s physical, digital, financial, or reputational assets. By anticipating and addressing threats early, companies can avoid crises that might otherwise result in customer loss, public scrutiny, or regulatory penalties.

Improves Decision-Making

With better insight into potential risks, leadership teams can make more informed, confident decisions. This foresight reduces uncertainty and supports long-term planning aligned with the organization’s risk appetite.

Ensures Compliance and Legal Safety

Risk management plays a vital role in ensuring regulatory compliance. By identifying and addressing legal and regulatory risks, businesses can avoid fines, litigation, and reputational damage, while also meeting the expectations of regulators and stakeholders.

Enhances Operational Efficiency

When risks are managed well, disruptions to operations are minimized. From supply chain disruptions to data breaches, risk management helps organizations maintain continuity and avoid costly delays or downtime.

Strengthens Organizational Resilience

A well-developed risk strategy equips companies to withstand adverse events and recover quickly. This builds resilience into the organization’s core and enhances its ability to adapt to change or crisis.

Supports Strategic Growth

Identifying and managing risks isn’t just about defense — it’s also about enabling bold moves. Organizations with a clear handle on risks can pursue innovation, expansion, or investment more confidently, knowing they have safeguards in place.

Builds Stakeholder and Investor Confidence

Investors, partners, and clients are more likely to trust and engage with organizations that demonstrate responsible risk management. It shows maturity, accountability, and foresight — qualities that attract long-term business relationships.

Promotes a Risk-Aware Culture

When risk management is integrated into day-to-day operations, it fosters a culture of responsibility and vigilance. Employees become more proactive in identifying and reporting issues, improving overall safety and performance.

In summary, risk management isn’t just about avoiding losses — it’s about enabling success. By taking a proactive and structured approach, organizations can secure their operations, meet compliance requirements, and seize new opportunities with confidence.

Best Practices Of Compliance Risk Management

Here are five best practices that can help companies effectively manage compliance risks:

Establish a Cross-Functional Team

Creating a team with members from various departments, such as legal, finance, operations, and human resources, can provide a comprehensive view of the organization's compliance requirements. This approach ensures that all aspects of compliance are addressed from multiple perspectives, enhancing the effectiveness of the compliance program.

Consistent Reviews and Updates to Policies

The regulatory landscape is never static. As such, it’s imperative for organizations to review and update their compliance policies and procedures regularly. This ensures that the company remains in alignment with the latest regulations and standards, thereby minimizing the risk of non-compliance.

Foster a Culture of Compliance

Promoting a culture where compliance is everyone's responsibility can lead to significant improvements in managing compliance risk. Training and education programs for employees at all levels ensure that the workforce is aware of compliance policies, understands the implications of non-compliance, and is motivated to act in accordance with the regulations.

Leveraging Technology

Automated tools can help track regulatory changes, monitor compliance, and manage documentation and reporting requirements. Embracing technology streamlines processes and enhances accuracy and visibility into compliance risk management efforts.

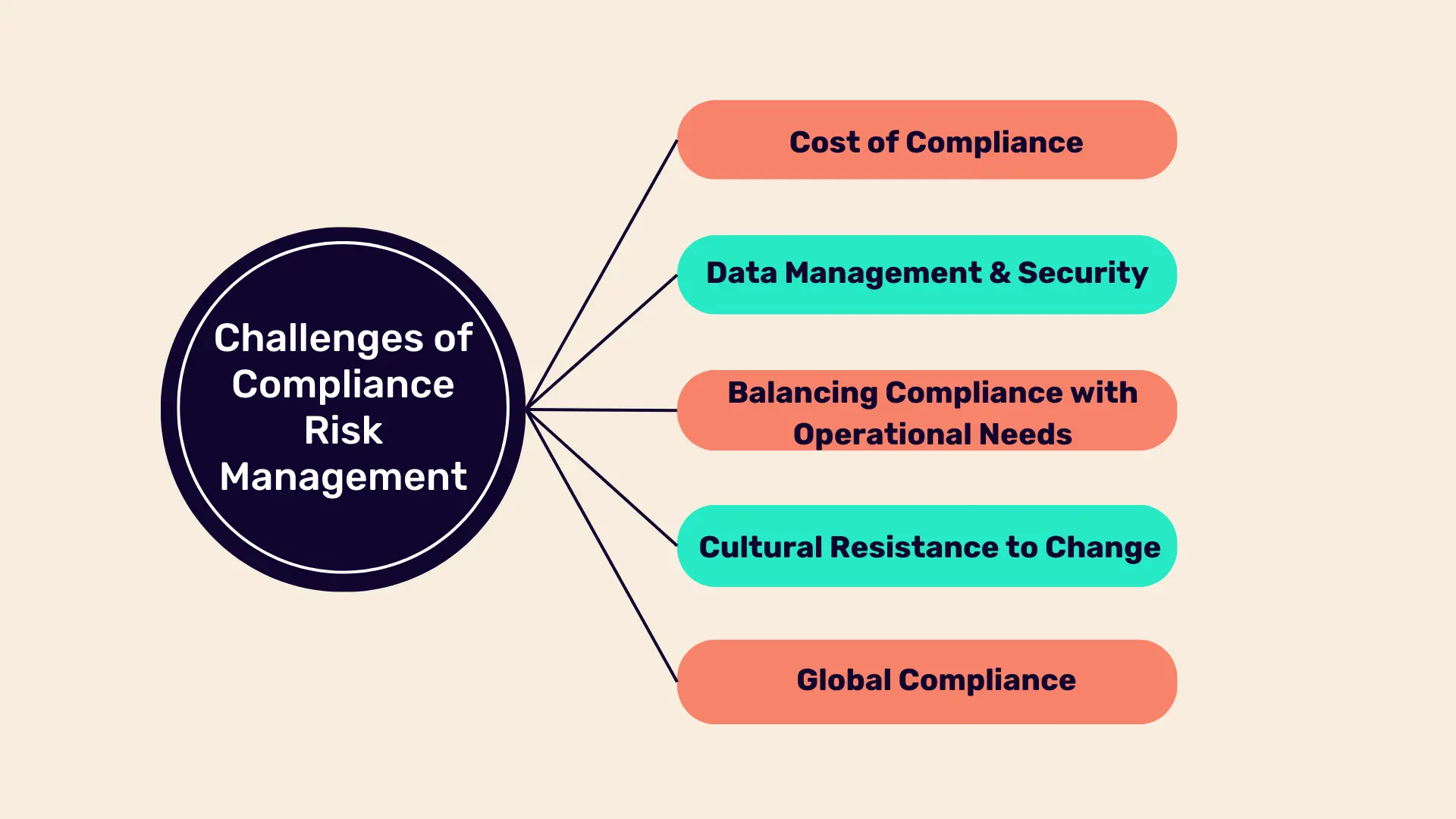

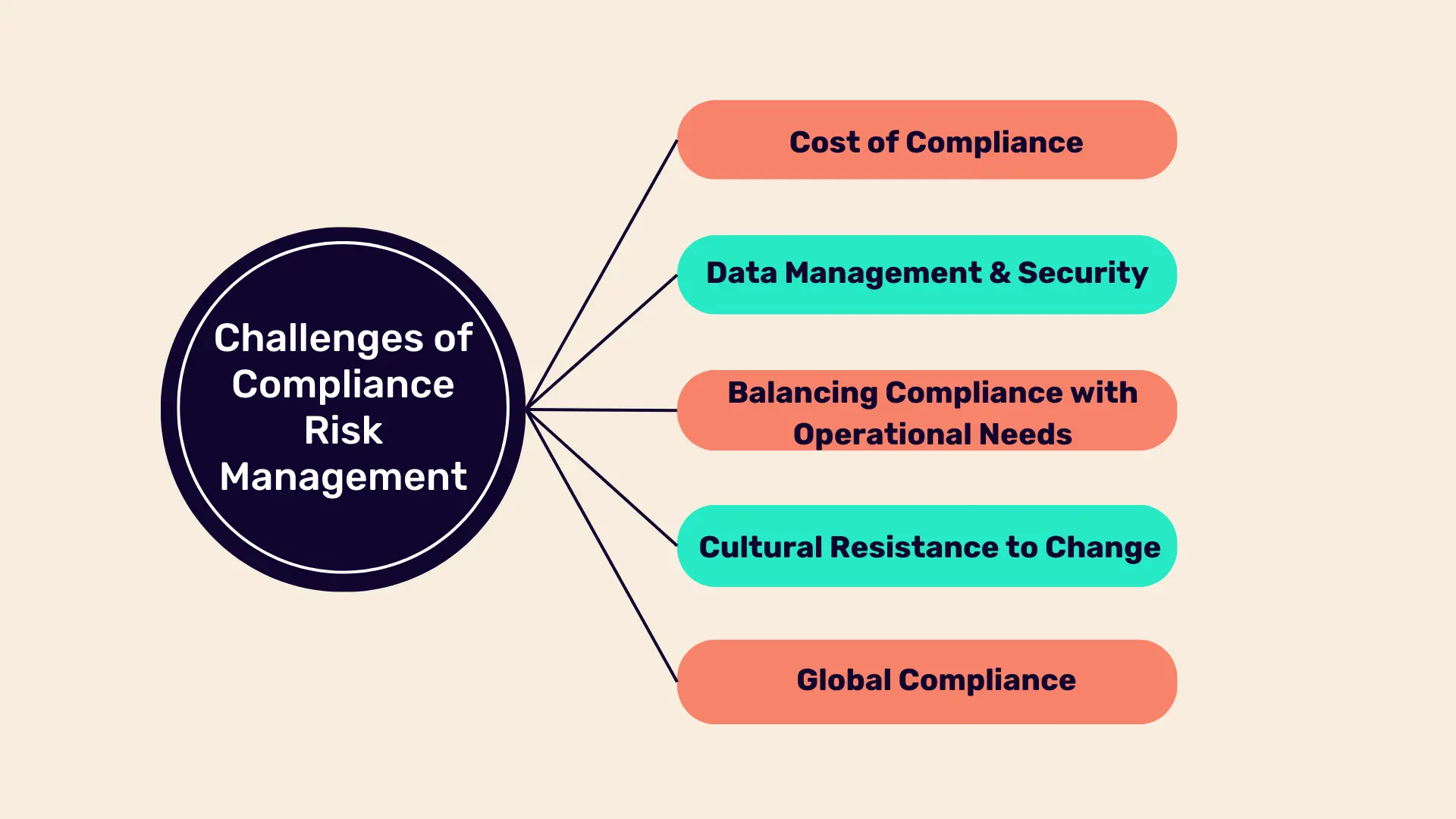

Challenges of Compliance Risk Management

While the path to robust compliance risk management is paved with good practices, it’s not without its challenges. Here are some common hurdles companies can face:

Cost of Compliance

Compliance comes with a price tag. From investing in compliance management systems to training employees and sometimes even paying fines for non-compliance, the costs can accumulate. Organizations must find efficient ways to manage these costs while still ensuring compliance.

Data Management and Security

With the increasing reliance on digital data, ensuring the integrity, confidentiality, and availability of data while complying with regulations such as GDPR becomes a challenge. This is a complex area that combines technological, legal, and procedural elements, demanding comprehensive strategies to manage.

Balancing Compliance with Operational Needs

Organizations must manage compliance requirements without hampering operational efficiency. Striking this balance often means making tough decisions about allocating resources, implementing new technologies, or changing operational processes.

Cultural Resistance to Change

Sometimes, the biggest hurdle in enhancing compliance isn’t the lack of resources or the dynamism of regulations but the resistance to change within the organization. Cultivating a compliance-friendly culture requires patience, persistent effort, and effective change management strategies.

Global Compliance

For organizations operating across borders, managing compliance becomes exponentially more complex. They must navigate not just one set of regulations but multiple, often conflicting, regulatory environments, making compliance an intricate puzzle to solve.

Conclusion

Compliance is the backbone of trust and reliability, crucial pillars upon which businesses build their reputation and competitive edge.

Therefore, it calls for an orchestrated effort across all levels of an organization, ensuring that compliance becomes a shared responsibility, infused within the culture and operations rather than being siloed as a departmental function.

Implementing MetricStream’s Compliance Management solution can significantly lift the burden off your teams, allowing them to focus on core business functions while staying assured that compliance is being managed efficiently.

Our solutions are here to guide and support you every step of the way, ensuring that your journey towards compliance excellence is both successful and sustainable.

Frequently Asked Questions

Is compliance part of risk management?

Yes, compliance is a critical component of risk management. It focuses on adhering to laws, regulations, and standards to avoid legal and reputational risks.

What is a compliance failure?

Compliance failure occurs when an organization does not adhere to applicable laws, regulations, industry standards, or internal policies. This can result from inadequate processes, insufficient training, poor communication, or intentional misconduct. Consequences of compliance failure can include legal penalties, financial losses, operational disruptions, and damage to the organization's reputation. Effective compliance programs and regular audits are essential to prevent such failures.

What are some common compliance risks for businesses?

Common compliance risks for businesses include data security breaches, regulatory non-compliance (e.g., GDPR, HIPAA), conflicts of interest, insider trading, unethical behavior, environmental violations, and health and safety issues.

What is the meaning of compliance risk management?

Compliance risk management refers to the process of identifying, assessing, and mitigating risks related to non-compliance with laws, regulations, and internal policies.

How do you manage compliance risks?

You manage compliance risks by regularly monitoring regulations, conducting risk assessments, implementing internal controls, training staff, and maintaining clear documentation and reporting systems.

Organizations navigate a complex web of laws and regulations, varying not just by country but often by state or region within countries. Additionally, the pace of regulatory change is such that more than one-third of firms spend at least a whole day every week tracking and analyzing regulatory change. The current regulatory landscape, along with the stakes of failing to comply, which are not just financial but can span legal entanglements and severe reputational damage, underscores the importance of compliance risk management. In fact, as stated in the 2023 Risk and Compliance Report by the Thompson Reuters Institute, the top two strategic priorities for compliance teams over the next 12 to 18 months would be to keep up with regulatory and legislative changes while mitigating emerging risks.

So, what is required? Read on to learn the key components of compliance risk management and how to create and implement a compliance risk management strategy.

- Compliance risk management is crucial for organizations to navigate complex regulatory environments and avoid financial, legal, and reputational risks.

- Key components include establishing policies, fostering a compliance culture, monitoring activities, and responding to compliance failures.

- A robust compliance risk management plan involves identifying, assessing, mitigating, and monitoring risks to ensure continuous compliance with laws and regulations.

- Effective practices include cross-functional teams, regular policy updates, a culture of compliance, and leveraging technology to streamline processes.

- Challenges include costs of compliance, data management and security, operational efficiency, resistance to change, and global compliance complexities.

Compliance risk management is the process of identifying, assessing, and mitigating risks that arise from non-compliance with laws, regulations, and internal policies. It involves establishing controls and monitoring systems to ensure that an organization adheres to relevant legal and ethical standards, thereby avoiding legal penalties, financial losses, and reputational damage.

These risks can culminate in punitive fines, legal battles, or damage to an entity’s reputation that, in severe cases, might be irreparable. Therefore, it becomes crucial for organizations to adopt an integrated and proactive approach to manage these compliance risks. This is where compliance risk management plays a vital role.

Compliance risk management is the process by which organizations identify, assess, respond to, and monitor the compliance risks applicable to their operations. It encompasses the creation and implementation of strategies aimed at ensuring continuous compliance with all relevant legal, regulatory, and procedural requirements.

Instilling a culture of compliance and ethics compliance risk management aids organizations in not only averting potential penalties but also in safeguarding their integrity and enhancing their reputation in the marketplace.

Key components of compliance risk management include clear policies and procedures, employee training on laws and regulations, effective leadership emphasizing accountability, regular compliance monitoring through audits, and prompt response to compliance failures.

Here are some key components that form the foundation of a comprehensive compliance risk management program:

Policies and Procedures

Policies and procedures form the foundation for setting the standards and expectations for behavior within the organization. They provide a roadmap for decision-making and operational processes that comply with external legal and regulatory requirements, as well as internal standards.

Training and Education

Training and education equip employees with the knowledge and skills they need to understand and comply with applicable laws, regulations, and organizational policies. Regular training sessions ensure that employees are not only aware of the requirements but also understand their role in maintaining compliance.

Good Leadership

Good leadership establishes clear accountability and oversight structures within the organization to ensure that compliance is a top priority. Leadership sets the tone from the top, emphasizing the importance of ethical behavior and compliance with laws and regulations.

Monitoring Activities

Implementing processes to regularly monitor compliance and report on the effectiveness of the compliance program is an important component. This involves ongoing audits and reviews to ensure that policies and procedures are being followed and remain effective in managing compliance risks.

Response and Remediation

Establishing mechanisms for responding to compliance failures, including the investigation of incidents, implementation of corrective actions, and updates to policies and procedures to prevent future occurrences, is key to effective compliance management.

Below are the four main steps of a sound compliance risk management strategy:

Identification

The foundation of a good compliance risk management strategy begins with the identification of potential compliance risks. This step involves a thorough examination of all areas of the organization's operations, looking for vulnerabilities where compliance failures might occur. Identifying these risks requires a detailed understanding of both internal processes and external regulatory requirements.

Assessment

This step requires a thorough analysis to prioritize risks based on their severity and the business's vulnerability. The aim is to answer key questions, including which risks could most significantly affect our strategic goals or which areas of our business are most susceptible. By prioritizing risks, businesses can allocate resources more efficiently and ensure that they focus on the most critical areas first.

Mitigation

Once risks have been identified and assessed, developing and implementing strategies to mitigate those risks is crucial. This could involve revising policies, enhancing training programs, or incorporating new technology to ensure compliance. The goal here is to minimize the potential impact of identified risks or avoid them altogether.

Monitoring and Reporting

This step ensures that the compliance risk management strategies effectively control the risks and identify any new risks that may emerge. Regular reporting, supported by MetricStream's comprehensive analytics, helps keep stakeholders informed about the organization’s compliance posture and fosters a culture of transparency and continuous improvement.

Compliance risk management zeroes in on the organization's need to adhere to legal and regulatory requirements. It's a focused lens that primarily scrutinizes how the company's operations align with external laws, standards, and expectations.

This focus is crucial because failures in compliance can lead to significant penalties, legal issues, and damage to reputation. It's a defensive play, ensuring the organization does not violate the rules of the game it operates within.

Contrastingly, risk management embraces a broader spectrum, examining financial, operational, strategic, and compliance risks alike. While compliance risk management is an essential subset of risk management, the latter’s domain extends further into analyzing risks that could impact the organization’s overall health and objectives. Risk management is about playing offense and defense, not only preventing losses but also enabling the organization to make informed decisions that balance risks with opportunities.

In essence, they both differ in their scope and focus. Compliance risk management is about ensuring that the organization is a good citizen within its regulatory environment, playing by the rules set forth by authorities. Risk management, however, takes a bird's eye view, considering a wider range of factors that could impact the organization's journey toward its goals.

Risk management is more than a safeguard — it’s a strategic enabler. By proactively identifying, assessing, and mitigating risks, organizations not only avoid potential threats but also create opportunities for growth and resilience. Below are the key benefits of implementing a strong risk management framework:

Protects Business Assets and Reputation

Effective risk management helps prevent events that could damage an organization’s physical, digital, financial, or reputational assets. By anticipating and addressing threats early, companies can avoid crises that might otherwise result in customer loss, public scrutiny, or regulatory penalties.

Improves Decision-Making

With better insight into potential risks, leadership teams can make more informed, confident decisions. This foresight reduces uncertainty and supports long-term planning aligned with the organization’s risk appetite.

Ensures Compliance and Legal Safety

Risk management plays a vital role in ensuring regulatory compliance. By identifying and addressing legal and regulatory risks, businesses can avoid fines, litigation, and reputational damage, while also meeting the expectations of regulators and stakeholders.

Enhances Operational Efficiency

When risks are managed well, disruptions to operations are minimized. From supply chain disruptions to data breaches, risk management helps organizations maintain continuity and avoid costly delays or downtime.

Strengthens Organizational Resilience

A well-developed risk strategy equips companies to withstand adverse events and recover quickly. This builds resilience into the organization’s core and enhances its ability to adapt to change or crisis.

Supports Strategic Growth

Identifying and managing risks isn’t just about defense — it’s also about enabling bold moves. Organizations with a clear handle on risks can pursue innovation, expansion, or investment more confidently, knowing they have safeguards in place.

Builds Stakeholder and Investor Confidence

Investors, partners, and clients are more likely to trust and engage with organizations that demonstrate responsible risk management. It shows maturity, accountability, and foresight — qualities that attract long-term business relationships.

Promotes a Risk-Aware Culture

When risk management is integrated into day-to-day operations, it fosters a culture of responsibility and vigilance. Employees become more proactive in identifying and reporting issues, improving overall safety and performance.

In summary, risk management isn’t just about avoiding losses — it’s about enabling success. By taking a proactive and structured approach, organizations can secure their operations, meet compliance requirements, and seize new opportunities with confidence.

Here are five best practices that can help companies effectively manage compliance risks:

Establish a Cross-Functional Team

Creating a team with members from various departments, such as legal, finance, operations, and human resources, can provide a comprehensive view of the organization's compliance requirements. This approach ensures that all aspects of compliance are addressed from multiple perspectives, enhancing the effectiveness of the compliance program.

Consistent Reviews and Updates to Policies

The regulatory landscape is never static. As such, it’s imperative for organizations to review and update their compliance policies and procedures regularly. This ensures that the company remains in alignment with the latest regulations and standards, thereby minimizing the risk of non-compliance.

Foster a Culture of Compliance

Promoting a culture where compliance is everyone's responsibility can lead to significant improvements in managing compliance risk. Training and education programs for employees at all levels ensure that the workforce is aware of compliance policies, understands the implications of non-compliance, and is motivated to act in accordance with the regulations.

Leveraging Technology

Automated tools can help track regulatory changes, monitor compliance, and manage documentation and reporting requirements. Embracing technology streamlines processes and enhances accuracy and visibility into compliance risk management efforts.

While the path to robust compliance risk management is paved with good practices, it’s not without its challenges. Here are some common hurdles companies can face:

Cost of Compliance

Compliance comes with a price tag. From investing in compliance management systems to training employees and sometimes even paying fines for non-compliance, the costs can accumulate. Organizations must find efficient ways to manage these costs while still ensuring compliance.

Data Management and Security

With the increasing reliance on digital data, ensuring the integrity, confidentiality, and availability of data while complying with regulations such as GDPR becomes a challenge. This is a complex area that combines technological, legal, and procedural elements, demanding comprehensive strategies to manage.

Balancing Compliance with Operational Needs

Organizations must manage compliance requirements without hampering operational efficiency. Striking this balance often means making tough decisions about allocating resources, implementing new technologies, or changing operational processes.

Cultural Resistance to Change

Sometimes, the biggest hurdle in enhancing compliance isn’t the lack of resources or the dynamism of regulations but the resistance to change within the organization. Cultivating a compliance-friendly culture requires patience, persistent effort, and effective change management strategies.

Global Compliance

For organizations operating across borders, managing compliance becomes exponentially more complex. They must navigate not just one set of regulations but multiple, often conflicting, regulatory environments, making compliance an intricate puzzle to solve.

Compliance is the backbone of trust and reliability, crucial pillars upon which businesses build their reputation and competitive edge.

Therefore, it calls for an orchestrated effort across all levels of an organization, ensuring that compliance becomes a shared responsibility, infused within the culture and operations rather than being siloed as a departmental function.

Implementing MetricStream’s Compliance Management solution can significantly lift the burden off your teams, allowing them to focus on core business functions while staying assured that compliance is being managed efficiently.

Our solutions are here to guide and support you every step of the way, ensuring that your journey towards compliance excellence is both successful and sustainable.

Is compliance part of risk management?

Yes, compliance is a critical component of risk management. It focuses on adhering to laws, regulations, and standards to avoid legal and reputational risks.

What is a compliance failure?

Compliance failure occurs when an organization does not adhere to applicable laws, regulations, industry standards, or internal policies. This can result from inadequate processes, insufficient training, poor communication, or intentional misconduct. Consequences of compliance failure can include legal penalties, financial losses, operational disruptions, and damage to the organization's reputation. Effective compliance programs and regular audits are essential to prevent such failures.

What are some common compliance risks for businesses?

Common compliance risks for businesses include data security breaches, regulatory non-compliance (e.g., GDPR, HIPAA), conflicts of interest, insider trading, unethical behavior, environmental violations, and health and safety issues.

What is the meaning of compliance risk management?

Compliance risk management refers to the process of identifying, assessing, and mitigating risks related to non-compliance with laws, regulations, and internal policies.

How do you manage compliance risks?

You manage compliance risks by regularly monitoring regulations, conducting risk assessments, implementing internal controls, training staff, and maintaining clear documentation and reporting systems.