Introduction

In today’s regulatory landscape, organizations face increasing compliance demands that, if unmanaged, can impact operations, reputation, and profitability. A proactive approach rooted in education and awareness helps build a culture of compliance — turning it from a routine task into a strategic advantage. This article explores compliance risk, its types, and how organizations can effectively identify, assess, and manage it.

Key Takeaways

- Compliance risk refers to the financial, reputational, legal, or organizational risks that an organization is exposed to due to non-compliance with relevant laws, regulations, and standards, resulting in hefty fines and penalties.

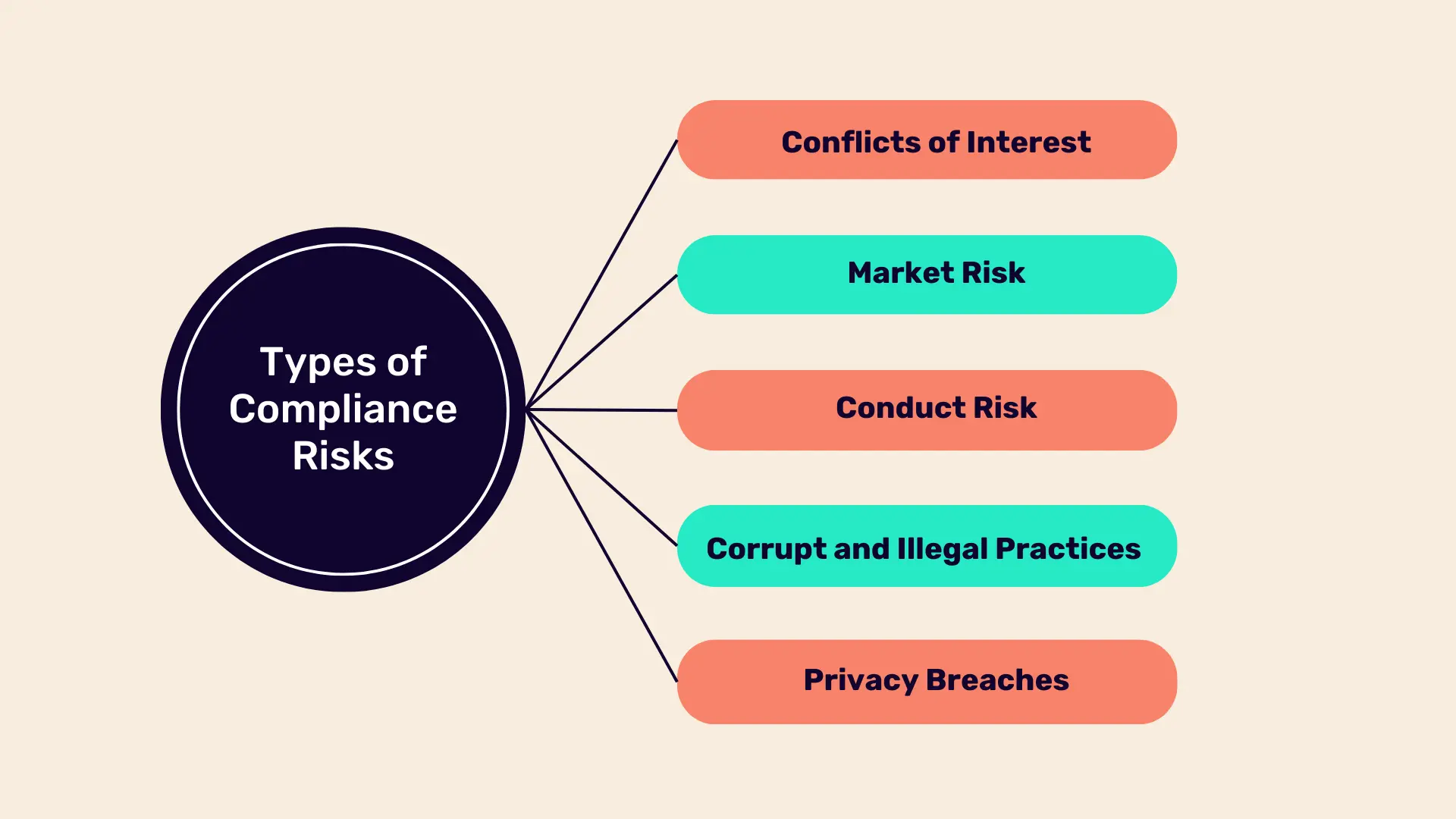

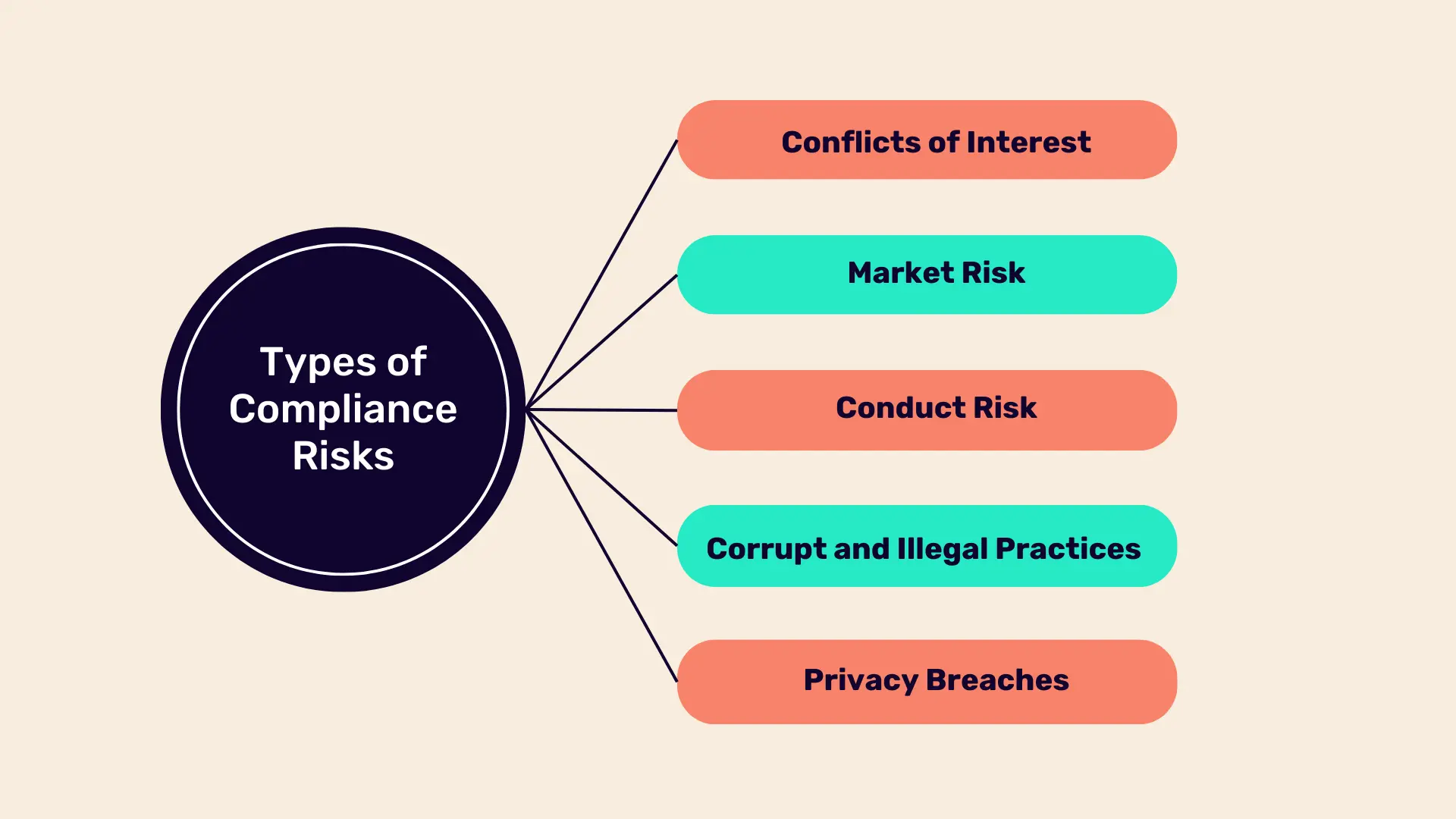

- Common compliance risks include conflicts of interest, market fluctuations, conduct issues, corrupt practices, and privacy breaches, each of which can have significant consequences if not managed effectively.

- Effective compliance risk management involves identifying, assessing, and mitigating compliance risks through policies, training, technology, and continuous improvement, integral to organizational success.

- To efficiently navigate complex regulatory environments, organizations need to stay updated on regulations, conduct regular assessments, engage employees through training, leverage technology for tracking and analytics, and seek expert guidance when needed.

What is Compliance Risk?

Compliance risk refers to the potential for legal penalties, financial losses, and reputational damage that arise when an organization fails to follow laws, regulations, industry standards, or internal policies. These violations can trigger regulatory scrutiny, lead to costly fines, and harm public trust — ultimately affecting business operations, customer loyalty, and employee morale.

Compliance Risk Management vs Enterprise Risk Management

While both compliance risk management (CRM) and enterprise risk management (ERM) are essential for organizational resilience, they differ in scope, focus, and approach.

Compliance Risk Management (CRM) is a focused subset of risk management that deals specifically with the risks associated with failing to comply with applicable laws, regulations, and internal policies. The goal is to prevent legal penalties, reputational damage, and operational disruptions by ensuring that the organization adheres to external and internal standards. CRM is typically reactive and driven by regulatory requirements, often involving legal, audit, and compliance teams.

Enterprise Risk Management (ERM), on the other hand, is a broader, more strategic framework that addresses all types of risks—financial, operational, strategic, reputational, and compliance. ERM integrates risk awareness into every part of the organization, aiming to identify, assess, and respond to risks that could prevent the achievement of business objectives. It is proactive and forward-looking, emphasizing risk appetite, risk tolerance, and holistic risk oversight.

| Aspect | Compliance Risk Management | Enterprise Risk Management |

|---|---|---|

| Focus | Legal, regulatory, and policy compliance | All business risks, including compliance |

| Scope | Narrow and specific | Broad and organization-wide |

| Nature | Mostly reactive | Proactive and strategic |

| Responsibility | Compliance officers and legal teams | Senior leadership, risk officers, and cross-functional teams |

| Objective | Avoid fines, sanctions, and reputational damage | Achieve business objectives while managing risks |

In summary, while CRM is essential for staying legally compliant, ERM provides a strategic lens to manage risk across the entire enterprise. An effective organization integrates both approaches to create a comprehensive risk management ecosystem.

What are the Different Types of Compliance Risks?

Let's explore the various types of compliance risks that organizations commonly encounter:

Conflicts of Interest

At the heart of many compliance issues lies the risk of conflicts of interest. These situations arise when the personal interests of an individual or group within the organization could potentially influence, or appear to influence, the impartial and objective decision-making process.If not managed correctly, conflicts of interest can significantly damage an organization's reputation and shake the trust of stakeholders.

For instance, an employee who is in a position to influence the procurement process could have a financial interest in a supplier company. Without appropriate disclosure and management of this conflict, decisions may be made that benefit the individual over the organization or its clients, leading to significant ethical and legal ramifications.

Market Risk

Market risk, also known as systemic risk, pertains to the uncertainty due to changes in market conditions. This could be fluctuations in interest rates, exchange rates, or stock prices which can affect an organization's performance and compliance posture. For companies operating on a global scale, these risks are compounded by the variegated regulatory environments across different regions.

A nuanced understanding of how these market dynamics interact with local and international compliance standards is vital. Say, an MNC operating globally faces market risks due to fluctuations in currency exchange rates.

To mitigate this, the company conducts regular risk assessments and hedges its currency exposure through financial instruments.

Conduct Risk

Conduct risk focuses on the misbehaviors or misconduct that can lead to financial loss or damage to a firm's reputation. This type of risk arises from within and encompasses any action of an organization’s employees and managers that is unethical or improper, even if it's not necessarily illegal.

Examples include the misselling of products, mishandling of client funds, or discrimination against customers or employees.

Organizations must foster a strong ethical culture and robust internal controls to minimize conduct risk. This entails not just laying down the law but creating an environment where ethical behavior is valued and rewarded.

Corrupt and Illegal Practices

In an age where global businesses can span multiple jurisdictions, the risk of engaging in or being associated with corrupt and illegal practices increases significantly. This encompasses a broad range of activities, from bribery and money laundering to fraud and tax evasion.

For example, a construction company faces the risk of engaging in corrupt practices when bidding for government contracts in a foreign country. To solve this, it can conduct thorough diligence on its partners and suppliers and implement robust internal controls.

Not only such practices can result in hefty fines and legal penalties, but the reputational damage can be irreparable. An effective compliance program must include diligent background checks, strict adherence to Anti-Money Laundering (AML) protocols, and ongoing education and training for employees on ethical conduct.

Privacy Breaches

Organizations collect, store, and process vast amounts of personal data. The legal landscape surrounding data privacy is complex and varies widely between jurisdictions. Compliance involves understanding these laws (e.g., GDPR in Europe, and CCPA in California) and implementing rigorous data protection measures.

For instance, a healthcare provider faces the risk of privacy breaches when unauthorized individuals gain access to patient medical records. This could prove to be catastrophic.

Privacy breaches can lead to severe penalties and loss of trust among consumers. To mitigate such a risk, organizations must ensure robust data security practices, regular audits, and foster a culture of privacy awareness.

Examples Of Compliance Risks

Here are some examples of compliance risks organizations can face:

Data Security Breaches

Mishandling or loss of sensitive customer information due to inadequate cybersecurity measures can lead to severe penalties and reputational damage. A breach of this nature can also trigger legal actions and regulatory investigations.

Employee Misconduct

Compliance risks can arise from employee actions that violate company policies or ethical standards. This includes insider trading, conflicts of interest, or unethical behavior in customer interactions. Such misconduct can result in regulatory sanctions and damage the organization's reputation.

Environmental Regulations

Organizations operating in industries like manufacturing or energy are subject to environmental regulations. Compliance risks in this area arise from violations of environmental laws, such as improper waste disposal or failure to meet emissions standards. Legal actions and negative publicities can be a dire consequence of such violations.

Contractual Obligations

Failing to meet contractual obligations with clients or partners can pose problems in the compliance aspect. This could include missing delivery deadlines, quality standards, or payment terms stipulated in contracts.

Ethical Violations

Ethical compliance risks involve actions that go against accepted moral principles or industry codes of conduct. This includes bribery, corruption, or deceptive marketing practices, which can further lead to public scrutiny, legal actions, and loss of consumer trust.

Health and Safety Regulations

Organizations must comply with health and safety regulations to protect employees and the public from workplace hazards. Failure to maintain safe working conditions, provide adequate training, or follow occupational health guidelines can result in compliance risks, including workplace accidents and regulatory penalties.

What is Compliance Risk Management?

Compliance risk management is an essential, strategic process within any organization, aimed at identifying, assessing, managing, and mitigating the risk of failing to comply with industry laws, regulations, and standards.

It encompasses a broad scope, involving the integration of policy management, regulatory change awareness, and compliance reporting. First and foremost, organizations must aim to correctly identify the pain points, after which diligent action is necessary to resolve them.

How to Identify and Assess Compliance Risks

Effective compliance risk identification and assessment involves staying updated on regulations, conducting regular assessments, and engaging employees through training. Organizations can leverage structured frameworks to identify and evaluate risks, supported by compliance management software for efficient tracking. They should embrace continuous improvement and seek expert guidance when needed to navigate regulatory complexities effectively.

Here are some tips on diverse ways to correctly assess compliance risks:

Stay Updated on Relevant Regulations

Whether it’s changes in data protection laws, environmental standards, or industry-specific regulations, businesses must stay abreast of these updates.

It is essential to do regulatory horizon scanning regularly. Organizations can assign a dedicated team or individual and equip them with effective horizon scanning tools for monitoring regulatory changes. This can involve subscribing to newsletters from regulatory bodies, attending industry seminars, or leveraging specialized regulatory tracking software.

The key here is proactivity; anticipating changes allows you to adjust your compliance strategies promptly, reducing the risk of inadvertent non-compliance.

Conduct Regular Compliance Risk Assessments

Regular assessments are vital to identifying potential compliance risks. This should not be a one-time activity but an integral part of the organizational risk management strategy.

Organizations can leverage a comprehensive framework for assessing risks, which involves identifying potential compliance risks, evaluating their impact on your organization, and determining their likelihood.

Engaging with various departments during these assessments can provide a more comprehensive view of potential risks.

Tools like SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis can also provide insights into areas that might be more susceptible to compliance risks.

Engage and Train Your Employees

Often, compliance risks stem from a need for more awareness or understanding of applicable laws and regulations among employees. Regular training programs can equip your team with the knowledge they need to identify and avoid compliance pitfalls.

Organizations need to build and strengthen a culture where compliance is everyone’s responsibility, encouraging employees to report potential risks without fear of retribution.

Moreover, they should customize their training programs to fit the roles and responsibilities of different departments, making the training more relevant and effective.

Leverage Technology

Technology plays a critical role in identifying and managing compliance risks. Implementing compliance management software can help organizations track and manage their compliance efforts efficiently.

These systems can automate many compliance aspects, from monitoring regulatory changes and managing documentation to conducting risk assessments.

Additionally, data analytics tools can analyze vast amounts of data to spot trends, anomalies, or patterns that might indicate a compliance risk, providing you with actionable insights.

Engage in Continuous Improvement

Identifying compliance risks is not a one-and-done activity. It requires a mindset of continuous improvement. This means regularly revisiting and updating your compliance strategies based on new insights, changes in regulations, or outcomes of previous compliance efforts.

Encouraging feedback from employees and stakeholders on the effectiveness of the organization’s compliance strategies and being open to adapting your approach based on this feedback will go a long way in fine-tuning the compliance strategy.

An iterative approach to managing compliance risks helps ensure that your strategies remain effective and relevant over time.

Consult with Experts

Sometimes, the complexity of regulations requires expertise that you may not have in-house. Organizations should not hesitate to consult with legal experts or compliance consultants. These professionals can provide valuable insights into potential compliance risks and offer advice on mitigating them.

They can also help interpret complex regulations, ensuring that your compliance strategies align with the latest legal requirements.

How MetricStream Compliance Management Can Help

If maintaining regulatory compliance is among your organization's top priorities, exploring what MetricStream has to offer in this domain is a step in the right direction. MetricStream Compliance Management helps organizations navigate compliance challenges effectively and protect their operations. It enables efficient management of a wide range of regulatory requirements through an integrated approach. Organizations gain better visibility into the effectiveness of their control environment and are better equipped to address and remediate issues and gaps in a proactive manner.

To learn how the MetricStream Compliance Management software solution can help you stay ahead of the curve, request a personalized demo today.

Frequently Asked Questions (FAQs)

How important is compliance risk?

Compliance risk is paramount for organizations as it encompasses the potential threats arising from violations of laws, regulations, and industry standards. Effectively managing compliance risk ensures legal adherence, maintains business integrity, and safeguards an organization's reputation.

What are the repercussions of not complying?

Not complying with regulations and standards can lead to severe repercussions such as hefty fines, legal sanctions, loss of business licenses, reputational harm, decreased customer trust, and potential litigation.

How can compliance risk management contribute to business success?

Effective compliance risk management contributes to business success by enhancing operational efficiency, reducing the likelihood of legal and financial setbacks, bolstering stakeholder confidence, and fostering a positive organizational culture.

What is meant by compliance risk?

Compliance risk refers to the potential for legal penalties, financial loss, or reputational damage an organization faces when it fails to follow laws, regulations, or internal policies.

How to identify compliance risk?

Compliance risks can be identified by conducting internal audits, reviewing regulatory requirements, analyzing past incidents, and monitoring changes in laws and industry standards.

In today’s regulatory landscape, organizations face increasing compliance demands that, if unmanaged, can impact operations, reputation, and profitability. A proactive approach rooted in education and awareness helps build a culture of compliance — turning it from a routine task into a strategic advantage. This article explores compliance risk, its types, and how organizations can effectively identify, assess, and manage it.

- Compliance risk refers to the financial, reputational, legal, or organizational risks that an organization is exposed to due to non-compliance with relevant laws, regulations, and standards, resulting in hefty fines and penalties.

- Common compliance risks include conflicts of interest, market fluctuations, conduct issues, corrupt practices, and privacy breaches, each of which can have significant consequences if not managed effectively.

- Effective compliance risk management involves identifying, assessing, and mitigating compliance risks through policies, training, technology, and continuous improvement, integral to organizational success.

- To efficiently navigate complex regulatory environments, organizations need to stay updated on regulations, conduct regular assessments, engage employees through training, leverage technology for tracking and analytics, and seek expert guidance when needed.

Compliance risk refers to the potential for legal penalties, financial losses, and reputational damage that arise when an organization fails to follow laws, regulations, industry standards, or internal policies. These violations can trigger regulatory scrutiny, lead to costly fines, and harm public trust — ultimately affecting business operations, customer loyalty, and employee morale.

While both compliance risk management (CRM) and enterprise risk management (ERM) are essential for organizational resilience, they differ in scope, focus, and approach.

Compliance Risk Management (CRM) is a focused subset of risk management that deals specifically with the risks associated with failing to comply with applicable laws, regulations, and internal policies. The goal is to prevent legal penalties, reputational damage, and operational disruptions by ensuring that the organization adheres to external and internal standards. CRM is typically reactive and driven by regulatory requirements, often involving legal, audit, and compliance teams.

Enterprise Risk Management (ERM), on the other hand, is a broader, more strategic framework that addresses all types of risks—financial, operational, strategic, reputational, and compliance. ERM integrates risk awareness into every part of the organization, aiming to identify, assess, and respond to risks that could prevent the achievement of business objectives. It is proactive and forward-looking, emphasizing risk appetite, risk tolerance, and holistic risk oversight.

| Aspect | Compliance Risk Management | Enterprise Risk Management |

|---|---|---|

| Focus | Legal, regulatory, and policy compliance | All business risks, including compliance |

| Scope | Narrow and specific | Broad and organization-wide |

| Nature | Mostly reactive | Proactive and strategic |

| Responsibility | Compliance officers and legal teams | Senior leadership, risk officers, and cross-functional teams |

| Objective | Avoid fines, sanctions, and reputational damage | Achieve business objectives while managing risks |

In summary, while CRM is essential for staying legally compliant, ERM provides a strategic lens to manage risk across the entire enterprise. An effective organization integrates both approaches to create a comprehensive risk management ecosystem.

Let's explore the various types of compliance risks that organizations commonly encounter:

Conflicts of Interest

At the heart of many compliance issues lies the risk of conflicts of interest. These situations arise when the personal interests of an individual or group within the organization could potentially influence, or appear to influence, the impartial and objective decision-making process.If not managed correctly, conflicts of interest can significantly damage an organization's reputation and shake the trust of stakeholders.

For instance, an employee who is in a position to influence the procurement process could have a financial interest in a supplier company. Without appropriate disclosure and management of this conflict, decisions may be made that benefit the individual over the organization or its clients, leading to significant ethical and legal ramifications.

Market Risk

Market risk, also known as systemic risk, pertains to the uncertainty due to changes in market conditions. This could be fluctuations in interest rates, exchange rates, or stock prices which can affect an organization's performance and compliance posture. For companies operating on a global scale, these risks are compounded by the variegated regulatory environments across different regions.

A nuanced understanding of how these market dynamics interact with local and international compliance standards is vital. Say, an MNC operating globally faces market risks due to fluctuations in currency exchange rates.

To mitigate this, the company conducts regular risk assessments and hedges its currency exposure through financial instruments.

Conduct Risk

Conduct risk focuses on the misbehaviors or misconduct that can lead to financial loss or damage to a firm's reputation. This type of risk arises from within and encompasses any action of an organization’s employees and managers that is unethical or improper, even if it's not necessarily illegal.

Examples include the misselling of products, mishandling of client funds, or discrimination against customers or employees.

Organizations must foster a strong ethical culture and robust internal controls to minimize conduct risk. This entails not just laying down the law but creating an environment where ethical behavior is valued and rewarded.

Corrupt and Illegal Practices

In an age where global businesses can span multiple jurisdictions, the risk of engaging in or being associated with corrupt and illegal practices increases significantly. This encompasses a broad range of activities, from bribery and money laundering to fraud and tax evasion.

For example, a construction company faces the risk of engaging in corrupt practices when bidding for government contracts in a foreign country. To solve this, it can conduct thorough diligence on its partners and suppliers and implement robust internal controls.

Not only such practices can result in hefty fines and legal penalties, but the reputational damage can be irreparable. An effective compliance program must include diligent background checks, strict adherence to Anti-Money Laundering (AML) protocols, and ongoing education and training for employees on ethical conduct.

Privacy Breaches

Organizations collect, store, and process vast amounts of personal data. The legal landscape surrounding data privacy is complex and varies widely between jurisdictions. Compliance involves understanding these laws (e.g., GDPR in Europe, and CCPA in California) and implementing rigorous data protection measures.

For instance, a healthcare provider faces the risk of privacy breaches when unauthorized individuals gain access to patient medical records. This could prove to be catastrophic.

Privacy breaches can lead to severe penalties and loss of trust among consumers. To mitigate such a risk, organizations must ensure robust data security practices, regular audits, and foster a culture of privacy awareness.

Here are some examples of compliance risks organizations can face:

Data Security Breaches

Mishandling or loss of sensitive customer information due to inadequate cybersecurity measures can lead to severe penalties and reputational damage. A breach of this nature can also trigger legal actions and regulatory investigations.

Employee Misconduct

Compliance risks can arise from employee actions that violate company policies or ethical standards. This includes insider trading, conflicts of interest, or unethical behavior in customer interactions. Such misconduct can result in regulatory sanctions and damage the organization's reputation.

Environmental Regulations

Organizations operating in industries like manufacturing or energy are subject to environmental regulations. Compliance risks in this area arise from violations of environmental laws, such as improper waste disposal or failure to meet emissions standards. Legal actions and negative publicities can be a dire consequence of such violations.

Contractual Obligations

Failing to meet contractual obligations with clients or partners can pose problems in the compliance aspect. This could include missing delivery deadlines, quality standards, or payment terms stipulated in contracts.

Ethical Violations

Ethical compliance risks involve actions that go against accepted moral principles or industry codes of conduct. This includes bribery, corruption, or deceptive marketing practices, which can further lead to public scrutiny, legal actions, and loss of consumer trust.

Health and Safety Regulations

Organizations must comply with health and safety regulations to protect employees and the public from workplace hazards. Failure to maintain safe working conditions, provide adequate training, or follow occupational health guidelines can result in compliance risks, including workplace accidents and regulatory penalties.

Compliance risk management is an essential, strategic process within any organization, aimed at identifying, assessing, managing, and mitigating the risk of failing to comply with industry laws, regulations, and standards.

It encompasses a broad scope, involving the integration of policy management, regulatory change awareness, and compliance reporting. First and foremost, organizations must aim to correctly identify the pain points, after which diligent action is necessary to resolve them.

Effective compliance risk identification and assessment involves staying updated on regulations, conducting regular assessments, and engaging employees through training. Organizations can leverage structured frameworks to identify and evaluate risks, supported by compliance management software for efficient tracking. They should embrace continuous improvement and seek expert guidance when needed to navigate regulatory complexities effectively.

Here are some tips on diverse ways to correctly assess compliance risks:

Stay Updated on Relevant Regulations

Whether it’s changes in data protection laws, environmental standards, or industry-specific regulations, businesses must stay abreast of these updates.

It is essential to do regulatory horizon scanning regularly. Organizations can assign a dedicated team or individual and equip them with effective horizon scanning tools for monitoring regulatory changes. This can involve subscribing to newsletters from regulatory bodies, attending industry seminars, or leveraging specialized regulatory tracking software.

The key here is proactivity; anticipating changes allows you to adjust your compliance strategies promptly, reducing the risk of inadvertent non-compliance.

Conduct Regular Compliance Risk Assessments

Regular assessments are vital to identifying potential compliance risks. This should not be a one-time activity but an integral part of the organizational risk management strategy.

Organizations can leverage a comprehensive framework for assessing risks, which involves identifying potential compliance risks, evaluating their impact on your organization, and determining their likelihood.

Engaging with various departments during these assessments can provide a more comprehensive view of potential risks.

Tools like SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis can also provide insights into areas that might be more susceptible to compliance risks.

Engage and Train Your Employees

Often, compliance risks stem from a need for more awareness or understanding of applicable laws and regulations among employees. Regular training programs can equip your team with the knowledge they need to identify and avoid compliance pitfalls.

Organizations need to build and strengthen a culture where compliance is everyone’s responsibility, encouraging employees to report potential risks without fear of retribution.

Moreover, they should customize their training programs to fit the roles and responsibilities of different departments, making the training more relevant and effective.

Leverage Technology

Technology plays a critical role in identifying and managing compliance risks. Implementing compliance management software can help organizations track and manage their compliance efforts efficiently.

These systems can automate many compliance aspects, from monitoring regulatory changes and managing documentation to conducting risk assessments.

Additionally, data analytics tools can analyze vast amounts of data to spot trends, anomalies, or patterns that might indicate a compliance risk, providing you with actionable insights.

Engage in Continuous Improvement

Identifying compliance risks is not a one-and-done activity. It requires a mindset of continuous improvement. This means regularly revisiting and updating your compliance strategies based on new insights, changes in regulations, or outcomes of previous compliance efforts.

Encouraging feedback from employees and stakeholders on the effectiveness of the organization’s compliance strategies and being open to adapting your approach based on this feedback will go a long way in fine-tuning the compliance strategy.

An iterative approach to managing compliance risks helps ensure that your strategies remain effective and relevant over time.

Consult with Experts

Sometimes, the complexity of regulations requires expertise that you may not have in-house. Organizations should not hesitate to consult with legal experts or compliance consultants. These professionals can provide valuable insights into potential compliance risks and offer advice on mitigating them.

They can also help interpret complex regulations, ensuring that your compliance strategies align with the latest legal requirements.

If maintaining regulatory compliance is among your organization's top priorities, exploring what MetricStream has to offer in this domain is a step in the right direction. MetricStream Compliance Management helps organizations navigate compliance challenges effectively and protect their operations. It enables efficient management of a wide range of regulatory requirements through an integrated approach. Organizations gain better visibility into the effectiveness of their control environment and are better equipped to address and remediate issues and gaps in a proactive manner.

To learn how the MetricStream Compliance Management software solution can help you stay ahead of the curve, request a personalized demo today.

How important is compliance risk?

Compliance risk is paramount for organizations as it encompasses the potential threats arising from violations of laws, regulations, and industry standards. Effectively managing compliance risk ensures legal adherence, maintains business integrity, and safeguards an organization's reputation.

What are the repercussions of not complying?

Not complying with regulations and standards can lead to severe repercussions such as hefty fines, legal sanctions, loss of business licenses, reputational harm, decreased customer trust, and potential litigation.

How can compliance risk management contribute to business success?

Effective compliance risk management contributes to business success by enhancing operational efficiency, reducing the likelihood of legal and financial setbacks, bolstering stakeholder confidence, and fostering a positive organizational culture.

What is meant by compliance risk?

Compliance risk refers to the potential for legal penalties, financial loss, or reputational damage an organization faces when it fails to follow laws, regulations, or internal policies.

How to identify compliance risk?

Compliance risks can be identified by conducting internal audits, reviewing regulatory requirements, analyzing past incidents, and monitoring changes in laws and industry standards.